Analyst Targets Suggest Upside Potential for Top ETFs

The analysis from ETF Channel highlights promising upside for the BlackRock U.S. Carbon Transition Readiness ETF (Symbol: LCTU) based on its underlying holdings.

According to our calculations, the weighted average implied analyst target price for LCTU is $72.15 per unit. Currently, LCTU is trading at approximately $65.87 per unit, indicating a potential upside of 9.53% based on analyst projections for the holdings in this ETF.

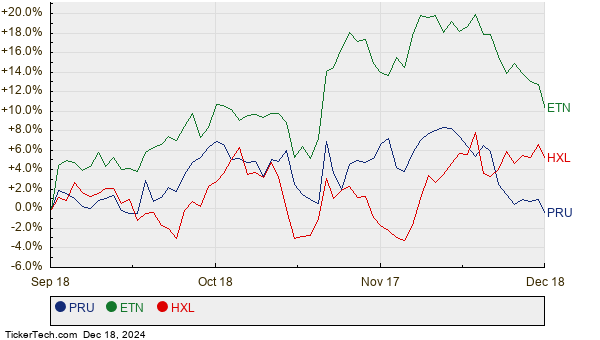

Three notable holdings within LCTU that could drive this upside are Prudential Financial Inc (Symbol: PRU), Eaton Corp plc (Symbol: ETN), and Hexcel Corp. (Symbol: HXL). Specifically, PRU, which is priced at $118.89 per share, has an average analyst target of $130.47, translating to a 9.74% upside. ETN’s recent price of $347.08 means a 9.69% potential upside if it reaches the target price of $380.72. Meanwhile, HXL, currently at $63.60 per share, is expected by analysts to hit $69.71, representing a 9.61% gain.

Here’s a summary of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| BlackRock U.S. Carbon Transition Readiness ETF | LCTU | $65.87 | $72.15 | 9.53% |

| Prudential Financial Inc | PRU | $118.89 | $130.47 | 9.74% |

| Eaton Corp plc | ETN | $347.08 | $380.72 | 9.69% |

| Hexcel Corp. | HXL | $63.60 | $69.71 | 9.61% |

Investors may wonder whether these analyst targets are realistic or if they stem from overly optimistic assessments. It is critical to evaluate whether target prices accurately reflect current market conditions and company developments. High targets relative to stock prices can indicate confidence in future growth but may also foreshadow potential downgrades if expectations are misplaced.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

● Mesa Air Group Past Earnings

● WLDN Historical Stock Prices

● Institutional Holders of EWY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.