“`html

U.S. Retail Sales Surge: A Positive Shift in Consumer Spending

The U.S. retail sector has displayed remarkable resilience despite challenges from rising prices and increased borrowing costs that have affected overall sales. Encouragingly, the sector has experienced steady growth in sales recently as inflation rates begin to drop and the Federal Reserve’s rate cuts alleviate some financial pressures.

In November, retail sales surpassed expectations, rising by more than predicted as consumers spent freely on a wide array of products. This trend indicates that the economy remains robust. As the retail landscape rebounds and the Federal Reserve signals potential cuts in interest rates for 2025, it may be an opportune time to invest in retail stocks.

Here are five retail stocks recommended for investors: Amazon.com, Inc., AMZN, The Gap, Inc., GPS, Williams-Sonoma, Inc., WSM, Tapestry, Inc., TPR, and Urban Outfitters, URBN. These stocks have all seen upgrades in earnings estimates over the past 60 days, hold Zacks Rank #1 (Strong Buy) or #2 (Buy), and are poised for growth. You can view the full list of today’s Zacks #1 Rank stocks here.

Retail Sales Rise in November

According to the Commerce Department, retail sales increased by 0.7% in November, following a 0.5% rise in October, and exceeding economists’ predictions of 0.5%. Compared to the previous year, retail sales are up by 3.8%.

A significant 2.4% rise in motor vehicle sales, alongside a 1.8% increase in online shopping, propelled overall retail sales in November. This solid performance signals a strong beginning to the holiday shopping season.

The boost in retail sales points to a healthy consumer sector, which makes up a large portion of the nation’s economic activity. With easing price pressures, consumers are starting to spend more freely.

The Federal Reserve began reducing rates with a 50 basis point cut in September, followed by a 25 basis point reduction in November. Analysts are optimistic regarding another 25 basis point cut during the Fed’s upcoming two-day policy meeting in December. Additionally, officials have indicated that more rate cuts may occur in 2025, believing inflation, despite slight increases in November, remains on track to meet the 2% target.

Top 5 Retail Stocks with Growth Potential

Amazon.com, Inc.

Amazon.com, Inc. is a leading e-commerce provider with a massive presence in North America and expanding globally. The company thrives on its Prime program supported by an extensive distribution network. Its acquisition of Whole Foods Market also allowed Amazon to establish itself in the grocery sector. Furthermore, Amazon Web Services solidifies its leadership in the cloud-computing industry.

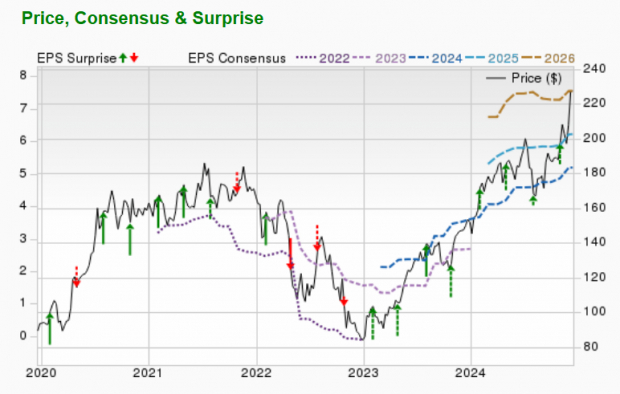

Amazon’s expected earnings growth rate for next year is 19.9%. Over the last 60 days, the Zacks Consensus Estimate for current-year earnings has risen by 9.3%. Presently, AMZN has a Zacks Rank #2.

Image Source: Zacks Investment Research

The Gap, Inc.

The Gap, Inc. is a prominent specialty retailer known for its wide array of clothing, accessories, and personal care products. The company operates various brands, including Old Navy, Gap, Banana Republic, Athleta, Intermix, and Hill City.

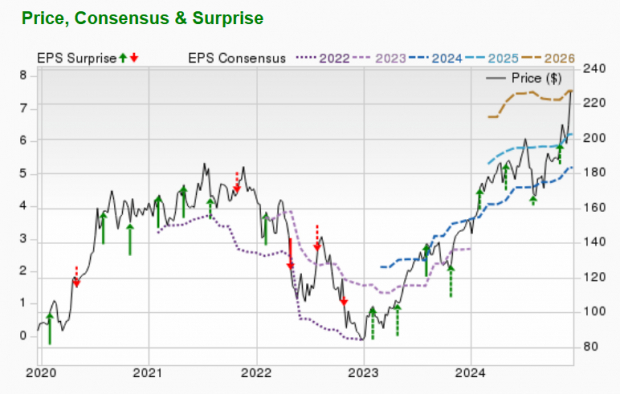

The Gap’s anticipated earnings growth rate for next year stands at 6.9%. The Zacks Consensus Estimate for current-year earnings has increased by 7.4% in the past 60 days. GPS currently holds a Zacks Rank #2.

Image Source: Zacks Investment Research

Williams-Sonoma

Williams-Sonoma, Inc. specializes in premium-quality home products and has been a key player in the retail market since its inception in 1973, featuring five brands, each serving as an operational segment.

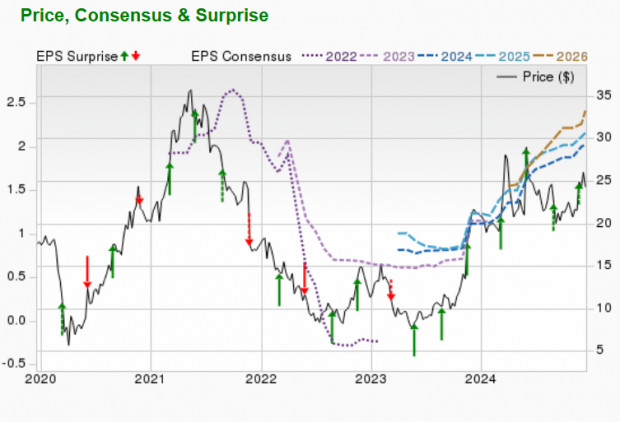

Williams-Sonoma’s expected earnings growth rate for next year is 2.5%. The Zacks Consensus Estimate for current-year earnings has improved by 4.1% over the last 60 days. WSM currently has a Zacks Rank #2.

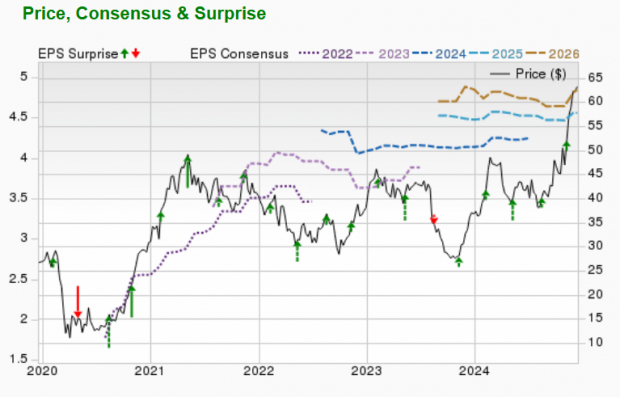

Image Source: Zacks Investment Research

Tapestry, Inc.

Tapestry, Inc. designs and markets fine accessories and gifts for both women and men in the U.S. and around the world. TPR offers a diverse range of lifestyle products including handbags, footwear, jewelry, and seasonal apparel collections.

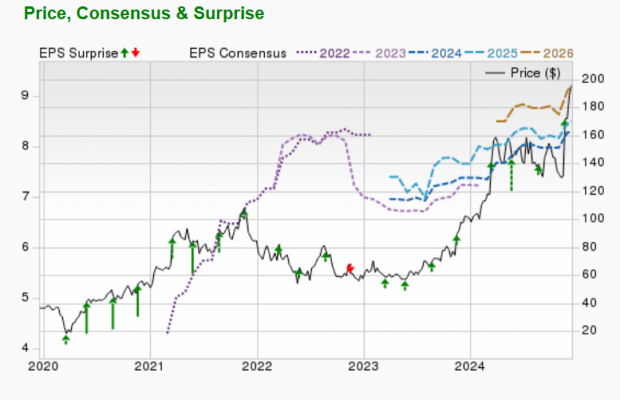

Tapestry anticipates an earnings growth rate of 6.1% for the upcoming year. The Zacks Consensus Estimate for current-year earnings has risen by 2% over the last 60 days. TPR holds a Zacks Rank #2.

Image Source: Zacks Investment Research

Urban Outfitters

Urban Outfitters is a lifestyle retailer offering fashion apparel, accessories, home decor, and gifts, primarily sold through stores, catalogs, call centers, and online platforms. The company operates in the U.S., Canada, and Europe.

Urban Outfitters’ expected earnings growth rate for next year is 8%. Over the last 60 days, the Zacks Consensus Estimate for current-year earnings has improved by 7.2%. URBN currently holds a Zacks Rank #1.

Image Source: Zacks Investment Research

Discover Zacks’ Top 10 Stock Picks for 2025

Interested in getting a heads-up on our 10 best stock choices for 2025?

History indicates their performance could be outstanding.

From 2012, under the direction of Sheraz Mian, the Zacks Top 10 Stocks have grown by +2,112.6%, significantly outperforming the S&P 500, which gained +475.6%. Now, Sheraz is meticulously reviewing potential stock selections.

“`

Top 10 Stocks to Watch for 2025: Expert Picks Unveiled January 2

Over 4,400 companies have been analyzed to select a prime set of ten tickers for 2025. This is an opportunity you won’t want to miss as these stocks will be announced on January 2.

Be First to New Top 10 Stocks >>

If you’re interested in the latest investment suggestions from Zacks Investment Research, you can download a report titled “5 Stocks Set to Double” available for free today. Click to access this report.

Download 5 Stocks Set to Double.

Here are some companies worth following:

- Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

- Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

- The Gap, Inc. (GAP) : Free Stock Analysis Report

- Williams-Sonoma, Inc. (WSM) : Free Stock Analysis Report

- Tapestry, Inc. (TPR) : Free Stock Analysis Report

For further insights, you can access the full article on Zacks.com by clicking here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.