Analysts Predict Growth for JPMorgan Market Expansion Enhanced Equity ETF

Recent analysis of the JPMorgan Market Expansion Enhanced Equity ETF (Symbol: JMEE) highlights promising price targets from financial analysts.

Based on the underlying holdings of the ETF, the average implied analyst target price sits at $71.04 per unit. Currently, JMEE trades around $63.32, which suggests a potential upside of 12.19% if these targets are met. Three standout holdings within JMEE show significant promise: NCR Atleos Corp (Symbol: NATL), StoneX Group Inc (Symbol: SNEX), and Brookline Bancorp Inc (Symbol: BRKL).

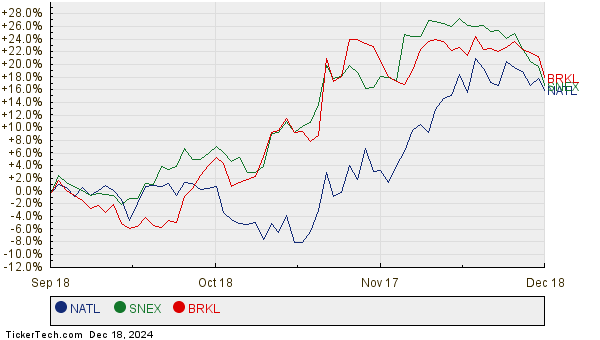

NATL is currently priced at $33.00 per share, but analysts set an average target of $38.25, indicating a potential increase of 15.91%. Similarly, SNEX, trading at $95.92, has a target of $111.00, showing a possible gain of 15.72%. Lastly, BRKL, with a recent price of $12.12, is expected to rise to $13.83, reflecting an upside of 14.13%. Here is a twelve-month price history chart comparing the performance of these stocks:

A table summarizing the key analyst target prices is as follows:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan Market Expansion Enhanced Equity ETF | JMEE | $63.32 | $71.04 | 12.19% |

| NCR Atleos Corp | NATL | $33.00 | $38.25 | 15.91% |

| StoneX Group Inc | SNEX | $95.92 | $111.00 | 15.72% |

| Brookline Bancorp Inc | BRKL | $12.12 | $13.83 | 14.13% |

Investors may ponder whether these forecasts are reasonable or overly ambitious for the stocks in question. The disparity between current trading prices and analyst targets may indicate optimism, but it can also suggest potential future revisions of these forecasts. Investors should consider recent market trends and company-specific factors before concluding.

![]() Find out more about the top ETFs with upside potential »

Find out more about the top ETFs with upside potential »

Related Topics:

High-Yield Preferred Stocks

DIAX Average Annual Returns

TOL Stock Forecasts

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.