Nvidia Stock Climbs Amid Positive Market Trends

Nvidia (NASDAQ: NVDA) shares are on the rise during today’s trading. By 3:15 p.m. ET, the stock was up 1.3%, having peaked at a 4.8% increase earlier in the day. In contrast, the S&P 500 (SNPINDEX: ^GSPC) fell by 1.5%, and the Nasdaq Composite (NASDAQINDEX: ^IXIC) decreased by 1.9%. These declines were influenced by Federal Reserve chairman Jerome Powell’s hawkish remarks related to an interest rate cut.

Key Drivers Behind Nvidia’s Surge

Nvidia’s stock is benefitting from several positive developments today. TrendForce has released a report forecasting a strong production outlook for the company’s next-generation Blackwell processors. The firm predicts that production of Nvidia’s GB200 processors will rapidly increase, reaching peak output in the second and third quarters of next year. So far, production has met expectations, which is favorable for both Nvidia and its shareholders.

Nvidia may also see a boost from a The Financial Times report stating that Microsoft has purchased over double the amount of AI processing chips from Nvidia compared to its second-largest customer, Meta Platforms. This suggests that large tech companies, including Meta, are still investing significantly in AI infrastructure. Moreover, Nvidia has introduced the Jetson Orin Nano Super Developer Kit, aimed at hobbyists and students, priced at $249.

Should You Buy Nvidia Stock?

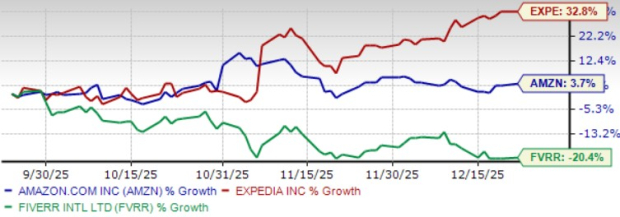

This year has been exceptionally strong for Nvidia, with stock prices increasing roughly 167%. While the stock has dipped about 11% from its all-time high, it remains a high-risk, high-reward opportunity due to its growth-dependent valuation.

NVDA PE Ratio (Forward) data by YCharts

Currently, Nvidia’s valuation stands at approximately 45 times this year’s anticipated earnings, suggesting that robust future performance is already reflected in the stock price. However, the company has been achieving strong sales and earnings growth, indicating that this momentum may continue.

The stock holds a forward price-to-earnings-growth (PEG) ratio of about 0.3. Generally, a PEG ratio below 1 indicates that a stock might be undervalued relative to its earnings growth rate.

Given Nvidia’s strong market position in processors for advanced AI applications, the stock appears to remain a sensible buy for investors willing to take on risks. Although there will be fluctuations in demand influencing sales and earnings, significant investment in AI infrastructure seems to be in its early stages of growth.

Seize a Second Chance for Investment

Have you ever felt you missed out on investing in top-performing stocks? If so, this is news you’ll want to consider.

Occasionally, our expert analysis team identifies a “Double Down” stock recommendation for companies they anticipate will see significant gains. If you believe you’ve missed your chance, now could be an optimal time to invest before prices elevate. The potential returns illustrate this:

- Nvidia: an investment of $1,000 in 2009 would now be worth $338,103!*

- Apple: if you invested $1,000 in 2008, it would have grown to $48,005!*

- Netflix: a $1,000 investment in 2004 would be valued at $495,679!*

Currently, our analysts are issuing “Double Down” alerts for three companies poised for remarkable growth, and this may be a pivotal moment for investment.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.