The Trade Desk: A Strong Performer with Future Growth Potential

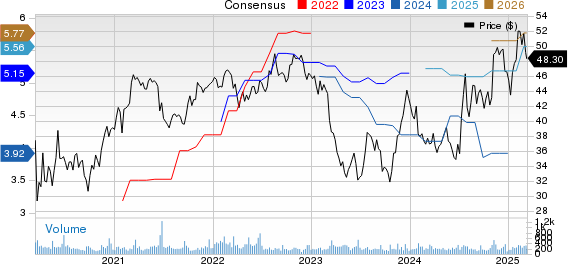

This year has been exceptional for The Trade Desk (NASDAQ: TTD), boasting a remarkable 77% increase in stock prices year to date, and continuing to outperform the market since the start of 2023.

But if you haven’t yet invested, is now the right time to consider purchasing shares of this tech company?

Where should you invest $1,000 today? Our expert team has identified the 10 best stocks to consider buying now. See the 10 stocks »

Image source: Getty Images.

A History of Growth for The Trade Desk

The Trade Desk has stood out in the tech industry by consistently delivering impressive growth over nearly a decade. Since 2015, its revenues have soared from $114 million to $1.9 billion by 2023, achieving a strong double-digit growth rate each year. The company has maintained profitability since 2013.

This success stems from the significant value it offers to its clients. The Trade Desk’s innovative data-driven platform enhances advertisers’ ability to maximize their budgets, effectively placing ads across diverse channels like connected TV, online video, mobile, audio, and display.

Additionally, advertisers utilize a range of tools such as monitoring and automation within The Trade Desk’s platform, streamlining their marketing efforts. This combination of effectiveness, efficiency, and cost savings makes The Trade Desk a viable alternative to major competitors like Alphabet and Meta Platforms.

Looking ahead, the adtech firm shows no signs of slowing down, reporting a 27% revenue growth in the first nine months of 2024, totaling $1.7 billion. Moreover, net income more than doubled from $82 million to $211 million during this time.

Momentum for Future Expansion

With its rapid expansion, The Trade Desk is on track to exceed $2 billion in revenue for 2024. However, this is just the beginning of its potential. In 2023, it accounted for less than 2% of global ad spending, which is estimated to reach $830 billion. The company could significantly increase its market share, with ample opportunity for future growth.

Advertisers are recognizing the benefits of programmatic advertising, which emphasizes transparency, accountability, and cost-effectiveness. This shift away from traditional advertising continues to gain momentum, positioning The Trade Desk as a favored partner for both current and prospective advertisers.

Another key driver of growth is the transition to connected TV. Many consumers prefer ad-supported content over subscription-based services, which bodes well for The Trade Desk’s connected TV segment in the coming years.

Additionally, the integration of artificial intelligence (AI) into its Kokai platform may unveil new opportunities for the firm. By leveraging its data alongside AI advancements, The Trade Desk can enhance its decision-making tools, ultimately benefiting advertisers even further.

In essence, The Trade Desk appears poised for substantial future growth.

Concerns about Valuation

Despite its growth potential, one significant concern looms over The Trade Desk’s stock: its high valuation. Currently, the company has a price-to-earnings (P/E) ratio of 217 times, while Alphabet’s P/E ratio stands at 26 times.

Investing in a strong growth company at a low valuation is rare. Over the past three years, The Trade Desk’s stock has typically traded at a P/E well above 100. While this elevated valuation hasn’t deterred stock price appreciation, any failure to meet expectations could lead to sharp declines.

Investor Considerations

The Trade Desk presents multiple attractive features for investors, including a strong business model and a long runway for growth.

Nevertheless, a high valuation may limit investment options, leaving little room for error. Consequently, conservative investors might find it wise to exercise caution before committing their funds to The Trade Desk at this valuation.

Is $1,000 in The Trade Desk Worth It?

If you’re considering investing in The Trade Desk, you might want to weigh your options carefully.

The Motley Fool Stock Advisor team has compiled a list of what they believe are the 10 best stocks for immediate investment… and The Trade Desk is not included. The selected stocks could present substantial returns in the coming years.

For perspective: when Nvidia was featured on this list on April 15, 2005, a $1,000 investment would now be worth $799,099!

Stock Advisor offers an accessible plan for success, featuring portfolio-building advice, analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Lawrence Nga has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Netflix, The Trade Desk, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.