Analysts Predict Upside Potential for WisdomTree ETF and Key Holdings

Our analysis at ETF Channel highlights the upside potential of the WisdomTree U.S. Efficient Core Fund ETF (Symbol: NTSX). By examining the underlying holdings, we determined that the weighted average implied analyst target price for NTSX stands at $52.78 per unit.

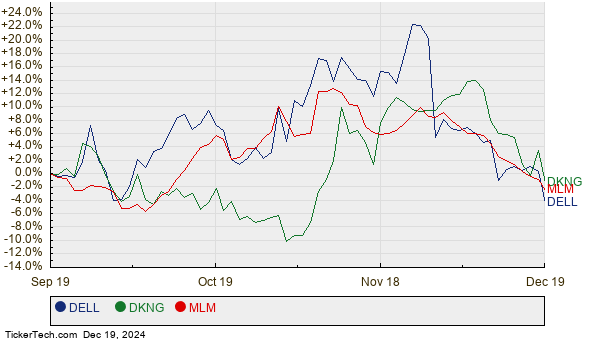

Currently trading around $47.03 per unit, analysts see a 12.22% upside for NTSX, based on the average targets for its holdings. Notably, three stocks within NTSX display significant growth potential: Dell Technologies Inc (Symbol: DELL), DraftKings Inc (Symbol: DKNG), and Martin Marietta Materials, Inc. (Symbol: MLM). As of now, DELL is priced at $112.67 per share, while analysts expect it to reach a target of $149.42 per share, representing a 32.62% upside. Likewise, DKNG has a recent share price of $38.75 and an average target price of $51.11, indicating a potential 31.89% rise. Finally, MLM’s current price of $535.64 suggests a 24.43% upside, with an average target of $666.50 per share. Below is a twelve-month price performance chart for DELL, DKNG, and MLM:

Here’s a summary table showcasing current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. Efficient Core Fund ETF | NTSX | $47.03 | $52.78 | 12.22% |

| Dell Technologies Inc | DELL | $112.67 | $149.42 | 32.62% |

| DraftKings Inc | DKNG | $38.75 | $51.11 | 31.89% |

| Martin Marietta Materials, Inc. | MLM | $535.64 | $666.50 | 24.43% |

The question now is whether analysts are justified in their optimistic targets, or if they may be overly ambitious. As stock prices fluctuate, it’s vital for investors to consider whether these targets still hold relevance in light of recent company developments and industry trends. High price targets compared to current trading prices can signify optimism but may also lead to future downgrades if projections prove out of touch with market realities. Further research and caution are necessary for investors navigating these opportunities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• Institutional Holders of AMDL

• IGTE Options Chain

• Institutional Holders of UXJ

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.