“`html

Cathie Wood’s Bold Bets: Disruptive Tech Stocks Thrive in 2023

Cathie Wood is known for her focus on disruptive tech stocks in her exchange-traded funds (ETF). Her bold investments have attracted a devoted following among investors eager to understand her insights. While she takes risks on emerging companies and new trends, this has led to impressive performances at times.

For instance, her internet-centric ETF, Ark Next Generation Internet (NYSEMKT: ARKW), is significantly outperforming the market in 2023, boasting a gain of 59% compared to 29% for the S&P 500 index. Can investors expect this momentum to continue into 2025?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The AI Influence on Growth Stocks

Wood’s ETFs are filled with high-growth stocks that present enormous opportunities. For example, she took a chance on Tesla long before many investors caught on. She has built a reputation for spotting trends early.

Her firm, Ark Invest, manages multiple ETFs, each targeting different sectors, with a keen focus on disruptive technology. The Next Generation Internet ETF includes stocks that pertain to a wide array of Internet-related products and services, encompassing hardware, payments, infrastructure, cloud computing, and social media.

Image source: Getty Images.

Though this ETF wasn’t specifically launched to capitalize on artificial intelligence (AI), several sectors within it are rapidly adapting to AI advancements, particularly cloud giants Microsoft and Amazon. Notable smaller holdings include Nvidia. Top positions also feature notable companies like Tesla, Roku, and Coinbase Global, providing a diverse tech-focused portfolio despite its significant exposure to cryptocurrency.

Interestingly, the ETF most linked to AI initiatives is the Autonomous Technology & Robotics ETF, which aims to leverage developments in automation and AI. This ETF has also outperformed the market, though its 41% increase this year lags behind the internet ETF, possibly due to its inclusion of various sectors like energy and transportation, beyond the traditional tech categories seen in the internet ETF.

Evaluating Risk and Reward

Generally, growth stocks tend to outperform when the market is doing well. In strong bull markets, it’s often these growth stocks that fuel market gains, while value stocks can have the opposite effect, pulling down indexed benchmarks like the S&P 500.

Wood’s approach to growth stocks ventures into riskier and more disruptive territory. In prosperous times, these stocks can soar; however, their volatility can lead to significant downturns during tough periods.

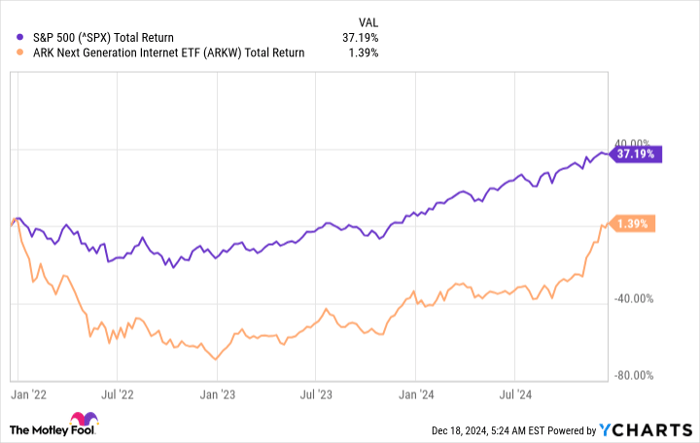

Although the internet ETF has doubled the broader market’s returns this year, it has not kept pace with the S&P 500 over the past three years.

^SPX data by YCharts

The last three years have included a bear market, a period when growth-oriented ETFs often face significant hurdles. Yet, across its lifetime, the internet ETF has notably surpassed the market’s performance with gains of 638% compared to 270% for the broader market.

Cathie Wood is a firm believer in the transformative power of technology. While her long-term success with the internet ETF lends support to her methods, not all of her ETFs have consistently outperformed the market over time. This variance indicates a level of risk. Investors considering this ETF should be prepared for potential fluctuations and should only invest if they have confidence in both cryptocurrency markets and the resilience of the ETF during market corrections.

Is Now the Right Time to Invest $1,000 in Ark ETF Trust – Ark Next Generation Internet ETF?

Before making any investment in Ark ETF Trust – Ark Next Generation Internet ETF, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy right now, and notably, Ark ETF Trust – Ark Next Generation Internet ETF was not among them. The selected stocks could potentially yield significant returns in the coming years.

For instance, when Nvidia made the list on April 15, 2005, an investment of $1,000 at that time would be worth $790,028!*

Stock Advisor offers a straightforward strategy for investing success, with guidance on portfolio building, analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Jennifer Saibil does not hold any positions in the stocks mentioned. The Motley Fool has investments in and recommends Amazon, Coinbase Global, Microsoft, Nvidia, Roku, and Tesla. The Motley Fool also recommends selling options on Microsoft. A disclosure policy is maintained by The Motley Fool.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`