Disney’s Strategic Path: A Bright Future Ahead

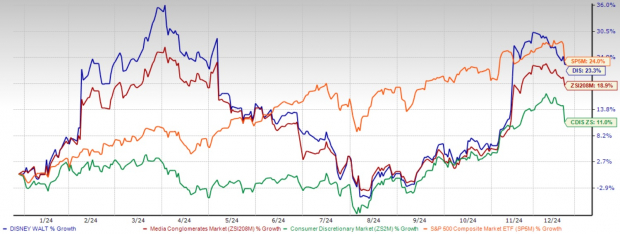

As Disney (DIS) prepares for 2025, it is leveraging its strong content ecosystem, successful streaming service, and expanding parks division to set the stage for significant growth. The fourth-quarter fiscal 2024 results highlight solid performance across all segments, along with a well-defined strategic roadmap. These factors make Disney a strong investment choice. The stock has risen 23.3% year to date, surpassing the Zacks Consumer Discretionary sector’s growth of 11%, indicating robust investor confidence. With projected revenues of $94.94 billion for fiscal 2025, reflecting a 3.91% year-over-year growth, here are three compelling reasons for investors to consider Disney stock.

Notable Year-to-Date Stock Performance

Image Source: Zacks Investment Research

Transforming Entertainment Landscape

Disney is undergoing a remarkable transformation, positioning itself for growth as it heads toward 2025. In its fourth-quarter fiscal 2024 report, the company announced adjusted earnings of $1.14 per share, exceeding the Zacks Consensus Estimate by 4.59% and marking a significant 39% year-over-year increase. The earnings forecast for fiscal 2025 has improved by 0.6% to $5.41 per share over the past month, indicating increasing analyst confidence in Disney’s ability to execute its strategy effectively.

Image Source: Zacks Investment Research

Check the latest earnings estimates and surprises on Zacks Earnings Calendar.

Significantly, the streaming division has turned profitable, achieving a $253 million operating profit compared to the prior year’s loss. While subscriber growth for Disney+ Core is expected to be modest in fiscal 2025 due to competition from Netflix (NFLX), Amazon (AMZN), and Apple (AAPL), the company’s focus on profitability and high-quality content strengthens its position within the streaming market. With Disney+ reaching 122.7 million paid subscriptions and a 14% surge in ad revenues, its digital strategy appears successful.

Expertise in IP Monetization

Disney’s exceptional ability to monetize its intellectual property across various platforms sets it apart from its rivals. For instance, the Bluey franchise has soared as 2024’s most-watched show on Disney+, with plans for a theatrical release in 2027, plus incorporation into parks and cruises beginning in 2025. This approach exemplifies Disney’s ability to maximize the value of its IP.

The Entertainment sector’s operating income increased to $1.1 billion in the fiscal fourth quarter, fueled by successful releases like Inside Out 2 and Deadpool & Wolverine. Although Linear Networks revenues dipped by 6.4% year over year, totaling $2.46 billion in the fourth quarter, the company’s strategic shift towards streaming and experiential entertainment helps mitigate the challenges posed by traditional media.

Parks and Experiences: A Growth Driver

The Parks, Experiences and Products division stands as a major contributor to growth for 2025 and beyond. Despite facing some challenges overseas in the fourth quarter of 2024, domestic operations displayed resilience, with a 4.8% increase in operating income. Disney’s ambitious plans for new attractions and experiences promise strong growth prospects.

The incorporation of popular IP like Bluey into parks and cruises, in addition to existing franchises, enhances guest experiences while generating multiple revenue streams. Management’s guidance suggests 6-8% growth in operating income for fiscal 2025, reflecting confidence in this division’s potential, despite some near-term obstacles, including weather impacts and pre-launch costs.

Investment Outlook

As 2025 approaches, Disney offers a compelling investment opportunity, although certain financial details warrant attention. The company’s price-to-sales ratio stands at 2.21X, notably higher than the Zacks Media Conglomerates industry’s 1.12X. This premium valuation signals confidence in Disney’s strong market presence and growth potential.

3-Year Price-to-Sales TTM Ratio for DIS

Image Source: Zacks Investment Research

While the company carries a debt of $45.81 billion against a cash position of $6 billion, strong cash flow generation and strategic initiatives instill confidence in its financial health. Expectations of high-single-digit adjusted EPS growth for fiscal 2025, along with a $3 billion stock repurchase program, highlight management’s commitment to enhancing shareholder value. The Entertainment segment anticipates double-digit growth in operating income, while the streaming sector aims for an $875 million increase in operating income.

The convergence of successful streaming operations, strong IP monetization, and parks expansion lays a solid foundation for growth. Disney’s continued strategic investments across all sectors, coupled with efficiency measures, suggest promising potential returns for shareholders. Furthermore, the forecast of double-digit adjusted EPS growth through fiscal 2027 supports a favorable long-term investment perspective.

Conclusion

For investors aiming to benefit from the dynamic entertainment industry, Disney provides a valuable opportunity. The company is effectively navigating digital changes, leveraging its extensive IP portfolio and physical assets for growth. With its strong year-to-date performance and compelling forward-looking metrics, Disney stock remains an appealing investment choice as it approaches 2025, despite some immediate challenges in specific segments. Currently, Disney holds a Zacks Rank #2 (Buy), pointing to its strong investment potential.

Zacks Identifies Top Semiconductor Stock

Our top semiconductor stock is significantly smaller than NVIDIA, which has surged more than +800% since its recommendation. While NVIDIA remains strong, this new stock has greater room to grow.

With robust earnings growth and a growing customer base, it is poised to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is set to expand from $452 billion in 2021 to $803 billion by 2028.

Want the latest recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.