Market Bounces Back After Turbulent Week, Nvidia and Banks Lead the Charge

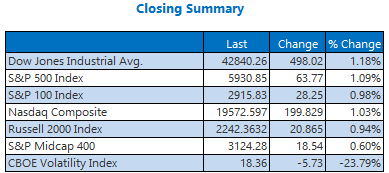

Stocks ended a challenging week positively, buoyed by reassuring inflation data that softened the harsh tone from the Federal Reserve earlier in the week. The Dow jumped nearly 500 points today, driven largely by Nvidia (NVDA) and bank stocks. While the S&P 500 and Nasdaq also recovered some losses, all three major indexes concluded the week down. As Wall Street anticipates a low volume holiday-shortened week, the Cboe Volatility Index (VIX), known as Wall Street’s “fear gauge,” fell back below 20 after a brief increase over two days.

Discover more about today’s market actions, including:

- Pharmaceutical stock declines due to disappointing drug trial outcomes.

- Which software stock entered a favorable seasonal trend.

- Additionally, Buffett increases his stake in OXY; FedEx announces a spinoff; and insights into the Dow’s significant drop.

Key Market Takeaways for Today

- Bitcoin (BTC) quietly dipped below $100,000 this week. (CNBC)

- This natural gas exporter is poised for a potentially significant initial public offering (IPO). (Bloomberg)

- Warren Buffett increases his investment in a prominent petroleum stock.

- FDX surges on news of a spinoff.

- Exploring the context behind the Dow’s significant losses this week.

Commodities Experience Weekly Losses Amid Fed Concerns

Oil prices remained steady today but reported a loss over the week. February-dated West Texas Intermediate (WTI) crude inched up by eight cents, or 0.1%, closing at $69.46 per barrel. Overall, oil prices fell by 1.9% for the week.

This week’s positive inflation data caused a drop in the U.S. dollar while benefiting gold. Gold for December delivery climbed 1.6% to settle at $2,647.90 an ounce. However, for the week, the precious metal experienced a 1% decline as fatigue around the Federal Reserve lingers into 2025.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.