Are you looking for a straightforward way to invest and earn dividends without complicating your portfolio? The Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) may be just what you need. Let’s explore its benefits.

Considering where to invest $1,000? Our analysts have revealed the 10 best stocks worth buying right now. Discover the 10 stocks »

Understanding the Vanguard Dividend Appreciation ETF

Exchange-traded funds (ETFs) allow investors to easily diversify their portfolios by holding a group of stocks. These funds are traded like regular stocks and can contain dozens to hundreds of individual equities. The value of an ETF changes based on the combined value of its holdings.

The Vanguard Dividend Appreciation ETF aims to include dividend-paying stocks expected to not just maintain but increase their payouts over time. This fund tracks the S&P U.S. Dividend Growers Index, which consists of companies that have raised their dividends for at least 10 consecutive years.

Currently, 338 stocks qualify for the S&P U.S. Dividend Growers Index, and many can sustain growth well beyond that milestone.

The ETF’s trailing dividend yield is 1.6%, slightly above the S&P 500 yield of around 1.2%, which includes many stocks that pay no dividends.

However, there’s much more to consider.

Viewing the Bigger Picture

One common error among new investors is to chase stocks with high dividend yields. Although you may see immediate returns, these investments may lead to disappointment over the long term.

Stocks with unusually high yields often prompt market skepticism regarding their dividend sustainability. Take Kraft Heinz, for example, which boasts a forward yield of 5.1%. However, its dividend has remained unchanged since it was cut in 2019, and future increases seem unlikely.

This explains why investors sometimes prefer stocks with lower initial yields; they expect solid and consistent growth in dividends over time.

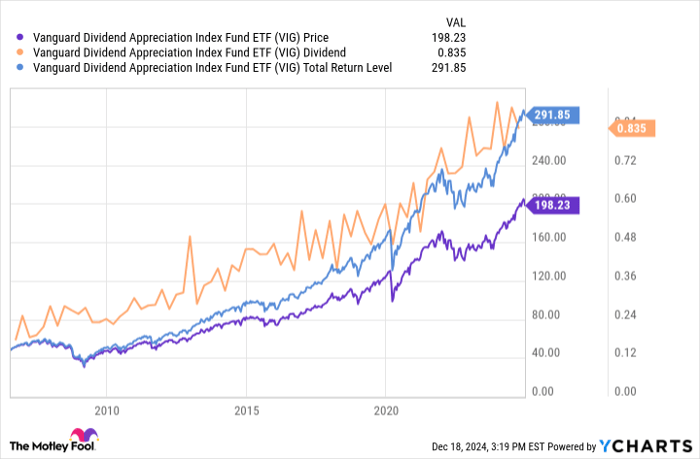

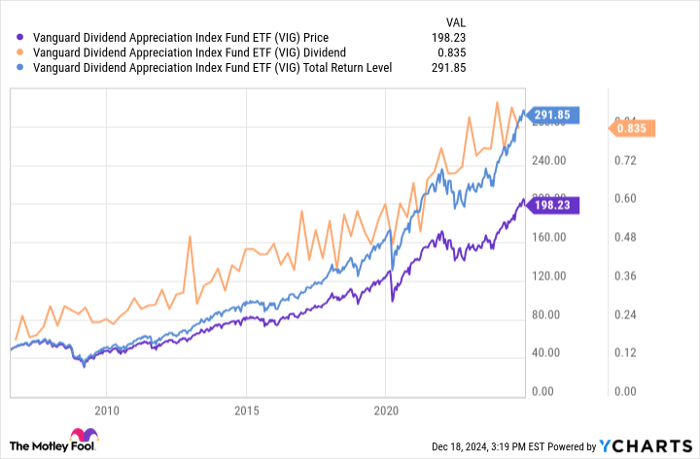

The Vanguard Dividend Appreciation ETF exemplifies this approach, having increased its quarterly dividend payment from $0.555 five years ago to $0.835 today. That’s an impressive rise of about 50%, significantly outpacing inflation.

VIG data by YCharts.

Interestingly, income-focused investors may still enjoy capital appreciation along with dividends. According to data from Hartford, stocks with consistent dividend growth have averaged annual returns exceeding 10% since 1973, far outpacing the over 4% annual returns of non-dividend payers.

Additionally, there’s a 70% chance that a strong dividend-paying stock will outperform the S&P 500 in any given year. In contrast, the chances are less than 50% for less reliable dividend stocks. Reliable dividend growth often signals a well-managed company.

Indeed, historical performance often provides insight into future results.

Simplicity is Key

The Vanguard Dividend Appreciation ETF isn’t your only choice for dividend investments. Individual stocks and other dividend ETFs are also options. Ultimately, it’s your money and your portfolio.

If your goal is to find a hands-off investment for steady passive income over decades, the Vanguard Dividend Appreciation ETF stands out as a strong choice. You won’t need to frequently buy or sell stocks; Vanguard updates the fund automatically as they adjust their underlying index.

All that’s left for you is to decide whether to reinvest the dividends.

Is now the time to invest $1,000 in Vanguard Dividend Appreciation ETF?

Before making a decision, consider the following:

The Motley Fool Stock Advisor team has recently identified the 10 best stocks to buy, and Vanguard Dividend Appreciation ETF was not among them. These selected stocks are expected to yield substantial returns.

For context, when Nvidia appeared on this list on April 15, 2005, a $1,000 investment would now be worth $825,513!*

Stock Advisor provides a straightforward plan for success, including portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.

Explore the 10 stocks »

*Stock Advisor returns as of December 16, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Dividend Appreciation ETF. The Motley Fool also recommends Kraft Heinz. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.