Amazon: The Stock That Shined Brightest in 2024

Finding a top-performing stock often feels like searching for a diamond in the rough. However, one standout has claimed the spotlight this year. With 2025 on the horizon, is it time to consider this stock for your portfolio?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Leading the Pack: Amazon for 2024

No suspense here—my top choice for 2024 was Amazon (NASDAQ: AMZN). As the year wraps up, Amazon’s shares have surged by about 47%, outpacing the S&P 500 index by nearly double.

So why did I choose Amazon? Its business model, seen as reliable, played a big role. Amazon is the dominant player in e-commerce and holds a strong position in cloud services, establishing a significant protective barrier against competitors.

At the beginning of 2024, I anticipated significant growth from Amazon Web Services (AWS) as businesses increasingly shifted their IT budgets to the cloud. The rise of artificial intelligence (AI) was expected to further boost AWS’s growth.

Additionally, I noticed Amazon’s commitment to improving profitability. The company’s latest quarterly report showed that its earnings had more than tripled from the previous year. I noted, “I expect these efforts to show up in Amazon’s quarterly results this year and provide nice catalysts that further boost its share price.”

Amazon’s Impressive Performance This Year

It wasn’t prophetic foresight to predict Amazon’s success. It has built a globally recognized brand. A quick look at its operations would reveal solid investment potential.

That said, many other companies with market caps exceeding $10 billion have seen even higher gains than Amazon this year, some of which are in my own portfolio. Perhaps one of those should have taken the top spot on my list.

Still, Amazon has maintained an impressive trajectory in 2024 for exactly the reasons I expected. Its e-commerce segment thrived, highlighted by record sales during Prime Day. Meanwhile, AWS continued to grow through new AI services for clients.

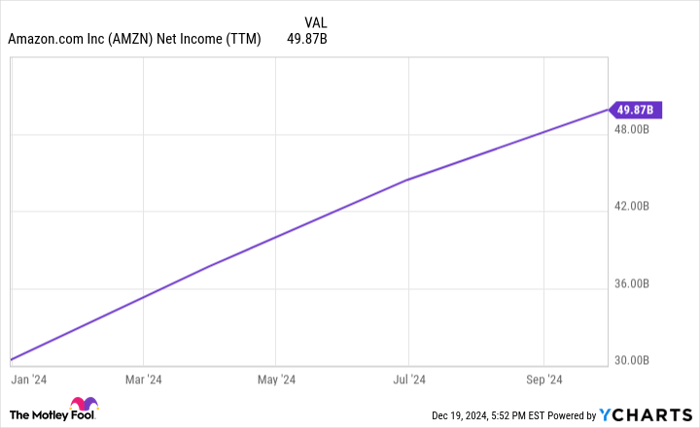

Perhaps most importantly, Amazon’s strategy for profitability has yielded results, as illustrated in the chart below depicting the company’s trailing-12-month net income growth over the last year.

AMZN Net Income (TTM) data by YCharts

The connection between earnings and share prices is well-established, particularly over time. I would have been surprised if Amazon’s stock had not risen significantly in light of its improved financial performance.

Looking Ahead: Is Amazon a Smart Investment for 2025?

While I’m thankful for Amazon’s success this year, the question remains: Is it a wise choice for 2025? I believe it is.

The solid investment rationale I presented at the beginning of 2024 still holds. Amazon maintains a strong competitive advantage and promising growth potential, especially with AWS. CEO Andy Jassy continues to assert that the current landscape—85% of IT spending on-premises and 15% on cloud—will flip over the next decade or so. AI remains a powerful driving force behind AWS. Furthermore, I expect Amazon’s profitability to rise in the coming year.

When considering all factors, Amazon will continue to rank among my top investment picks as we move into 2025. However, whether it will stay at the very top of my list is still a question I am pondering.

Should You Consider Investing in Amazon Now?

Before you invest in Amazon, keep this in mind:

The Motley Fool Stock Advisor analyst team recently identified their top 10 best stocks for investors right now—and Amazon isn’t included. The stocks they chose could potentially bring impressive returns in the future.

For example, when Nvidia made this list on April 15, 2005, an investment of $1,000 at the time would now be worth $825,513!*

Stock Advisor provides a straightforward investment strategy, featuring guidance on building a portfolio, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

See the 10 stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on The Motley Fool’s board of directors. Keith Speights is an investor in Amazon. The Motley Fool holds and recommends shares in Amazon and has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.