Best Buy’s Struggles: Stock Declines Amidst Rising Competition

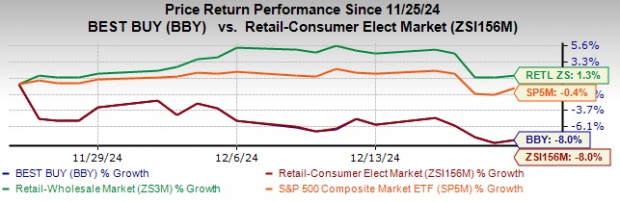

Best Buy‘s BBY stock has lost 8% over the past month, matching the performance of the Zacks Retail – Consumer Electronics industry. In contrast, the Retail-Wholesale sector has risen 1.3%, while the S&P 500 Index has fallen by 0.4%. As of December 20, Best Buy’s shares closed at $85.55, trading 17.5% below its 52-week high of $103.71, achieved on August 29, 2024.

BBY Stock Performance Over the Last Month

Image Source: Zacks Investment Research

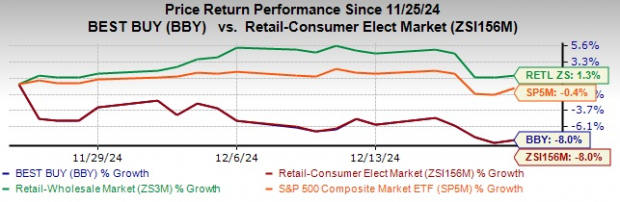

Best Buy’s stock has dipped below some critical technical points, including its 50-day moving average of $89.69. This average serves as an important measure for assessing market trends and momentum. Falling below this level raises concerns among investors regarding the stock’s short-term outlook and indicates the possibility of further declines unless these levels are regained.

BBY’s Position Relative to 50-Day Moving Averages

Image Source: Zacks Investment Research

Challenges Facing Best Buy

Best Buy is grappling with various challenges that may hinder its attractiveness as an investment. Increased competition from major retailers such as Amazon AMZN, Walmart WMT, and Target TGT is putting additional pressure on the company.

In the third quarter of fiscal 2025, BBY experienced a concerning 2.9% decline in enterprise revenues. Domestic revenues, which represent the majority of its overall income, dropped 3.3%, indicating weak consumer demand in key product areas like appliances, home theater systems, and gaming. The company’s international operations also faced difficulties, with revenues decreasing by 1.6%. The ongoing slump in comparable sales highlights Best Buy’s struggle to stabilize its revenue amid persistent competition and cautious consumer spending.

Inflation, political distractions, and general consumer reluctance have led to erratic demand, particularly in non-essential goods. Best Buy’s dependence on promotional sales strategies adds further volatility. While these promotions have increased store visits, they have often hurt profit margins. Management anticipates that product margins will face pressure in the fourth quarter of fiscal 2025.

Underperformance in high-margin areas such as gaming, home theater products, and appliances points to deeper problems within these key revenue streams. These segments have failed to gain momentum, even during promotional events, complicating recovery efforts.

Furthermore, Best Buy’s cautious projections fuel concern. Management now predicts comparable sales in the fiscal fourth quarter will remain flat or decrease by up to 3%. The annual sales forecast has been adjusted downward to a range of $41.1-$41.5 billion from the previous estimate of $41.3-$41.9 billion, highlighting expectations of ongoing volatility in consumer purchasing behavior.

Possibilities for Best Buy’s Stock Recovery

Despite these challenges, Best Buy’s potential recovery relies on several positive factors rooted in its solid core strengths. The company reported significant performance in its computing and tablet categories, achieving a 5.2% growth in comparable sales during the third quarter of fiscal 2025. A notable driver was a 7% increase in laptop sales, the highest growth since April 2021, spurred by consumer interest in AI-enabled devices and technology upgrades.

Moreover, Best Buy’s membership program has proven essential for profitability, contributing to a 60 basis points increase in gross margin for the fiscal third quarter. Improved membership tiers and enhanced services have led to higher renewal rates and increased spending by members, promoting long-term customer loyalty.

The company’s omnichannel strategy has also consolidated its market leadership. Online sales accounted for 31% of domestic revenues, complemented by efficient fulfillment options and a cohesive digital and in-store shopping experience. New features like the AI-driven “Gift Finder” app have boosted consumer engagement and optimized operations.

Additionally, Best Buy’s initiatives to refresh in-store experiences have improved customer engagement and category performance. Updates to sections such as mobile devices and smart home technologies, along with tailored store designs, have enhanced the shopping experience. The company has also ventured into smaller-format locations tailored to specific market demands, like its recent opening of a 15,000-square-foot store in Bozeman, MT.

Internationally, the partnership with Bell Canada through Best Buy Express has broadened its reach, gaining entry into 61 markets in Canada. Early feedback has been promising, suggesting the potential for additional revenue based on Best Buy’s expertise in electronics and services.

Estimate Trends for Best Buy

Recent adjustments in expectations reflect a more cautious outlook for Best Buy. The Zacks Consensus Estimate for earnings per share has been revised downward over the last month, dropping by 10 cents and 22 cents to $6.18 and $6.66 per share for the current and next fiscal years, respectively.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Assessing Best Buy’s Valuation

Currently, Best Buy’s price-to-earnings (P/E) ratio reflects a premium relative to its industry and sector peers. The stock has a forward 12-month P/E ratio of 12.95, compared to the 11.69 for the industry. Given this elevated valuation, investors may need to scrutinize whether Best Buy’s growth prospects warrant such a premium, especially amid existing challenges.

Image Source: Zacks Investment Research

Should You Consider Investing in BBY Stock?

Given the significant hurdles confronting Best Buy, investors are advised to approach this stock with caution. The company is facing ongoing revenue declines, challenges in high-margin categories, and a reliance on promotional strategies raise red flags. Furthermore, the breach of essential technical levels and revised guidance add to the list of challenges.

While certain initiatives show promise, they currently seem insufficient to counterbalance these headwinds. At present, BBY holds a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Announces Top 10 Picks for 2025

Are you looking for exclusive insights on our ten top stock picks for 2025?

History indicates these stocks could perform exceptionally.

From 2012 (when our Director of Research Sheraz Mian took over the portfolio) through November 2024, the Zacks Top 10 Stocks achieved a remarkable +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Currently, Sheraz is reviewing 4,400 companies to select the best 10 stocks to invest in for 2025. Mark your calendar for January 2 to catch these top choices.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.