Jensen Huang to Kick Off 2025 CES: What it Means for Nvidia Investors

Nvidia (NASDAQ: NVDA) CEO Jensen Huang will deliver the opening keynote speech at the 2025 Consumer Electronics Show (CES), taking place from Monday, Jan. 6 through Friday, Jan. 10 in Las Vegas. Huang’s keynote is scheduled for Monday, Jan. 6 at 9:30 p.m. ET and will likely last about an hour.

The Significance of Huang’s Keynote

Huang’s presence at CES is significant. This annual event is touted as “The Most Powerful Tech Event in the World,” and Nvidia ranks among the most influential tech companies globally. Nvidia’s graphics processing units (GPUs) and related technologies lead in the rapidly evolving artificial intelligence (AI) sector. Notably, Nvidia is the second most valuable company in the world by market cap, just behind Apple, and its stock has surged 172% this year as of Friday, Dec. 20.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Exciting Updates Expected at CES 2025

At CES, major tech companies and startups unveil innovative products and showcase concepts that may enter the market in the future. While CES is a trade-only event, the Consumer Technology Association (CTA), which runs CES, offers live streams of parts of the conference for free public viewing.

Typically, Nvidia shares groundbreaking new products at CES, but it often saves its key announcements for its annual GPU Technology Conference (GTC). However, with Huang serving as the opening speaker this year, there’s a strong chance he will present more thrilling updates than usual. His address will draw a vast audience, as the 2024 CES attracted over 138,000 visitors, with about 40% from outside the U.S., and hosted more than 4,300 exhibitors.

Will Nvidia Stock Experience Another Surge?

Nvidia’s stock, which has had an impressive 172% increase in 2024, saw its gains concentrated in the year’s first half. As of Friday, Dec. 20, the stock closed at $134.70, down from its peak closing price of $148.87 on Nov. 7, and just above the June 18 closing price of $135.56.

Last year’s CES positively impacted Nvidia’s stock price. From the start of the event to the first trading day after its conclusion, Nvidia’s stock saw substantial movement. If a similar trend emerges in 2025, investors may see price increases from Jan. 6, when Huang opens CES, through Jan. 13, the first trading day following the event. However, past performance does not guarantee future results.

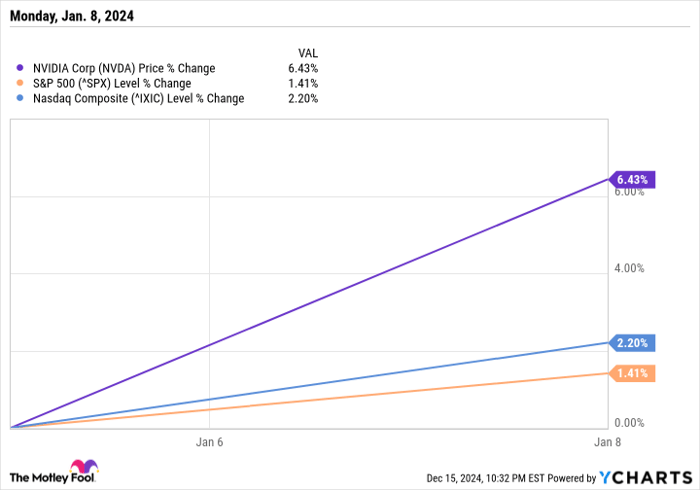

The following chart shows how Nvidia stock and the S&P 500 and Nasdaq Composite indexes performed during the CES 2024.

Data by YCharts.

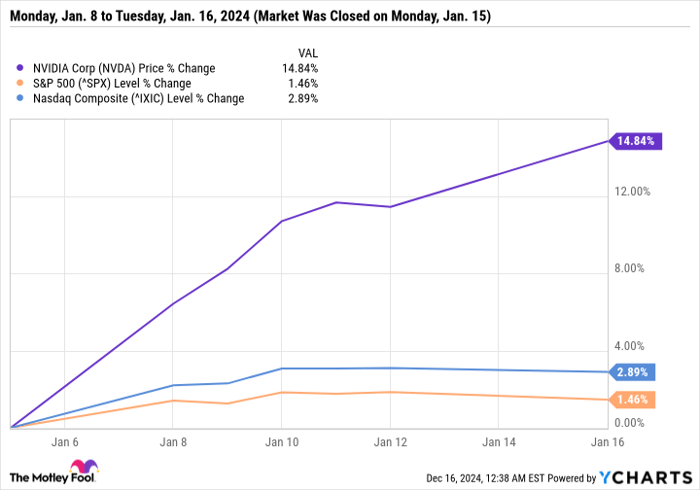

The chart below illustrates Nvidia’s stock performance from the beginning of CES 2024 to the first trading day after its conclusion.

Data by YCharts.

Additionally, Nvidia could benefit from a potential “Santa Claus rally.” This term refers to the trend where the stock market tends to rise during the last five trading days of December and the first two trading days of January. For this year, those dates are from Tuesday, Dec. 24 to Friday, Jan. 3, excluding the market closure on Christmas and New Year’s Day.

Long-Term Potential for Investors

While a stock price breakout for Nvidia would be ideal, it’s not vital for long-term investors. Nvidia is positioned to remain a strong player in the AI sector, which is still in its infancy. The company’s importance and innovations suggest it will continue to thrive regardless of short-term fluctuations.

If there’s no breakout in January, February holds promise too, as Nvidia is set to report its fourth-quarter fiscal 2025 results after the close of trading on Wednesday, Feb. 26.

Seize This Potential Opportunity

Feel like you may have missed out on investing in successful stocks? There might still be chances ahead.

Occasionally, our team of analysts issues a strong recommendation for a “Double Down” stock, indicating they believe these companies are on the verge of significant gains. If you’re concerned about missing your opportunity to invest, now might be the right time to act. The success rates are noteworthy:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.