“`html

Dow Stocks to Consider for 2025: Quality Over Quantity

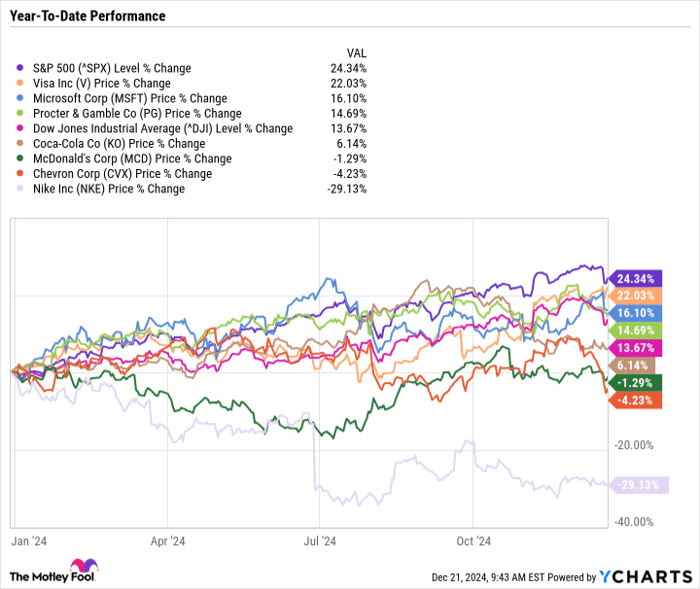

The Dow Jones Industrial Average is home to many well-known blue-chip stocks, often offering dividends. However, during periods of rapid growth, the Dow typically lags behind the S&P 500 as investors flock to companies with promising potential.

For those seeking reliable companies with a history of earnings growth, Visa (NYSE: V), Microsoft (NASDAQ: MSFT), Procter & Gamble (NYSE: PG), Coca-Cola (NYSE: KO), McDonald’s (NYSE: MCD), Chemron (NYSE: CVX), and Nike (NYSE: NKE) represent seven Dow stocks that have underperformed the S&P 500 in 2024 but are promising candidates for investment in 2025.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

Understanding the Current Market Rally

As of now, only 10 of the 30 Dow stocks are outperforming the S&P 500. Notably, two of these, Nvidia and Amazon, were added to the Dow this year.

This year has proven tough for many renowned stocks, including Microsoft, which had a strong showing in 2023. Currently, just 144 components of the S&P 500, or roughly 29%, are beating the index.

^SPX data by YCharts

Growth stocks are currently seeing big gains, pushing the market’s valuation higher. The S&P 500 is now trading at over 22 times forward earnings for the third time since 1985, marking historically high valuations.

The forward price-to-earnings (P/E) ratio reflects consensus estimates for the next 12 months of earnings. With the current P/E ratio at 30.3, a strong growth forecast is built in for the upcoming year.

Balancing Value, Income, and Growth in Investments

Investing in volatile times, regardless of whether the market is pricey or not, is an effective strategy for building wealth. As Ken Fisher of Fisher Investments wisely states, “You don’t need perfect timing to achieve marvelous returns. Time in the market beats timing the market — almost always.”

When market prices are high, focusing on companies that can validate their valuations is crucial. Visa, Microsoft, Procter & Gamble, Coca-Cola, McDonald’s, Chevron, and Nike all maintain reasonable valuations and have a history of consistent dividend increases.

|

Company |

Forward P/E Ratio |

Dividend Yield |

Consecutive Years of Dividend Increases |

|---|---|---|---|

|

Chemron |

13.7 |

4.6% |

37 |

|

Coca-Cola |

21.9 |

3.1% |

62 |

|

Procter & Gamble |

24.2 |

2.4% |

68 |

|

McDonald’s |

24.8 |

2.3% |

48 |

|

Visa |

28.3 |

0.7% |

15 |

|

Microsoft |

33.5 |

0.7% |

15 |

|

Nike |

34.8 |

2% |

23 |

Data sources: YCharts, Chevron, Coca-Cola, Procter & Gamble, McDonald’s, Visa, Microsoft, Nike.

Chemron stands as a major player in oil and gas, boasting a strong balance sheet and a low-cost production model that allows it to remain profitable even amid fluctuating oil prices. The company is also diversifying into low-carbon energy solutions.

Coca-Cola and Procter & Gamble are termed Dividend Kings for their remarkable achievement of raising dividends for over 50 consecutive years. While not the fastest growers, these companies thrive in economic downturns. When consumer budgets shrink, people tend to spend less on non-essentials like entertainment, while still purchasing beverages and home goods. These stable options are ideal for conservative investors seeking less volatility and consistent income.

Recently, McDonald’s raised its dividend for the 48th year, positioning it to become a Dividend King by 2026. Its franchise model effectively manages both costs and volatility, with only 5% of stores being company-owned. McDonald’s success is rooted in its franchises’ alignment with the brand’s vision, enabling strategic growth.

Visa is recognized for its robust business model, achieving high operating margins and benefiting from its extensive network. As Visa continues to expand internationally and enhance services for its card users, it remains a strong prospect despite its lower yield compared to others in the sector.

Visa’s current stock may not yield significant dividends, but its strategy focuses largely on stock buybacks. Historically, this approach has proven successful, as Visa has outperformed the S&P 500 over time. Even at near-all-time highs, Visa presents a compelling investment opportunity for 2025.

On the other hand, Microsoft differentiates itself as a balanced technology behemoth, consistently hitting record sales and reaching notable operating margins.

“`

Microsoft and Nike: Contrasting Paths in the Market

Microsoft’s Strong Position and Future Growth

Microsoft maintains a strong balance sheet and operates without debt. The company continues to repurchase its stock and increase dividends at significant rates. With potential changes to its agreement with OpenAI, Microsoft is poised to accelerate growth in the upcoming year. Access to more advanced AI technologies could further enhance its profitability. The investment case for Microsoft appears robust, justifying its premium stock valuation.

Nike Faces Challenges, Yet Holds Dividend Potential

Nike stock is struggling and ranks just behind Boeing for poor performance in the Dow for 2024. Its forward price-to-earnings (P/E) ratio appears unattractive as the company experiences a slowdown. Sales and margins are on the decline, primarily due to difficulties balancing an expanding direct-to-consumer platform while repairing wholesaler relationships. Although earnings reported on December 19 showed some positive signs, revitalizing Nike’s extensive product development pipeline will take time.

Despite recent challenges, Nike has an impressive history of increasing dividends for 23 consecutive years. This long-standing track record, combined with a recent sell-off, has pushed its yield up to 2%. Investors confident in a potential turnaround might consider purchasing shares now, but it’s important to note that improvements may take longer than anticipated.

Strong Investment Options: Proven Winners to Consider

Brands like Visa, Microsoft, Procter & Gamble, Coca-Cola, McDonald’s, Chevron, and Nike stand out due to their well-understood business models and historical performance. These companies are positioned to meet investor expectations over time. The best choice among them depends on individual investment goals.

For those focused on income, Procter & Gamble, Coca-Cola, McDonald’s, and Chevron may be more appealing. Conversely, investors seeking growth could consider Visa and Microsoft. As for Nike, while it has a legendary brand, it has faced numerous challenges recently and may require significant time for recovery. If successful in its turnaround efforts, the stock could be viewed as a bargain at current prices.

In summary, these Dow stocks represent a balanced mix of risk and reward, making them attractive long-term investments for 2025.

Seize This Unique Opportunity

Have you ever felt you missed a chance to invest in successful stocks? Now is the time to pay attention.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are ready to surge. If you’re worried about having missed your opportunity, this moment serves as an ideal time to invest before it’s too late. The impressive numbers support this claim:

- Nvidia: Investing $1,000 when we doubled down in 2009 would have turned into $362,166!*

- Apple: Investing $1,000 when we doubled down in 2008 would have grown to $48,344!*

- Netflix: Investing $1,000 when we doubled down in 2004 would result in $491,537!*

Currently, we are issuing “Double Down” alerts for three promising companies, and this opportunity may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Daniel Foelber holds positions in Nike and is the owner of long January 2025 $70 calls on Nike. The Motley Fool has investments in and recommends Amazon, Chevron, Microsoft, Nike, Nvidia, and Visa. The Motley Fool also recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For more information, please visit The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.