Maximizing Returns: Exploring Covered Calls with Nike

Enhanced Income Potential for Nike Shareholders

Shareholders of Nike (Symbol: NKE) seeking to increase their income beyond the stock’s annualized dividend yield of 2.1% should consider selling the January 2027 covered call at the $95 strike price. By doing this, they can collect a premium at an $8.70 bid, resulting in an additional annualized return of 5.5%. This strategy leads to a total projected rate of return of 7.6%, assuming the stock does not reach the call price. However, any price increase beyond $95 would mean losing the upside, which requires NKE to rise 23.8% from its current level. In such a case, shareholders would still enjoy a total return of 35.1%, factoring in dividends received before the stock is called.

Dividends can be unpredictable and typically reflect a company’s profitability fluctuations. Analyzing Nike’s dividend history chart below is useful for assessing the likelihood that the most recent dividend will continue, and whether the 2.1% yield is reasonable.

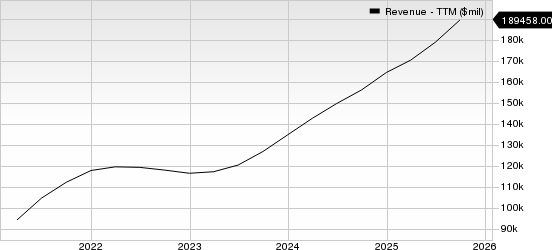

Historical Trading Insights for NKE

The chart below illustrates NKE’s trailing twelve-month trading history, with the $95 strike price indicated in red:

The above chart, together with an examination of the stock’s historical volatility, can be beneficial when analyzing whether selling the January 2027 covered call at the $95 strike price offers a suitable risk-reward ratio. After evaluating the last 251 trading days and the current price of $76.76, we find Nike’s trailing twelve-month volatility to be 34%. For more covered call options strategies for different expirations, visit the NKE Stock Options page on StockOptionsChannel.com.

Current Market Activity Trends

In afternoon trading on Tuesday, the put volume across S&P 500 stocks reached 903,272 contracts, while call volume hit 1.98 million, yielding a put-call ratio of 0.46. This figure compares to a long-term median put-call ratio of 0.65, indicating a significantly higher volume of calls relative to puts. Essentially, this trend suggests that buyers are favoring call options today.

Find out which 15 call and put options traders are discussing today.

![]() Top YieldBoost Calls of the Dow »

Top YieldBoost Calls of the Dow »

For Further Exploration:

- SPGI Historical Stock Prices

- ARTNA Split History

- TDE Videos

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.