Warren Buffett’s Wisdom: A Closer Look at Biohaven Ltd’s Oversold Status

Understanding the Risks and Opportunities of BHVN Shares

Legendary investor Warren Buffett famously suggests navigating the stock market by being cautious when others are overly optimistic and opportunistic when others are frightened. One effective way to gauge market sentiment for a specific stock is through the Relative Strength Index (RSI), a technical analysis tool that indicates momentum on a scale ranging from zero to 100. A stock is deemed oversold when its RSI falls below 30.

On Tuesday, Biohaven Ltd (Symbol: BHVN) stocks entered the oversold zone, achieving an RSI of 29.8, with shares trading as low as $35.26. In contrast, the S&P 500 ETF (SPY) currently has an RSI of 52.2. For bullish investors, BHVN’s 29.8 RSI could signal that the heavy selling pressure is starting to wane, creating potential entry points for buyers.

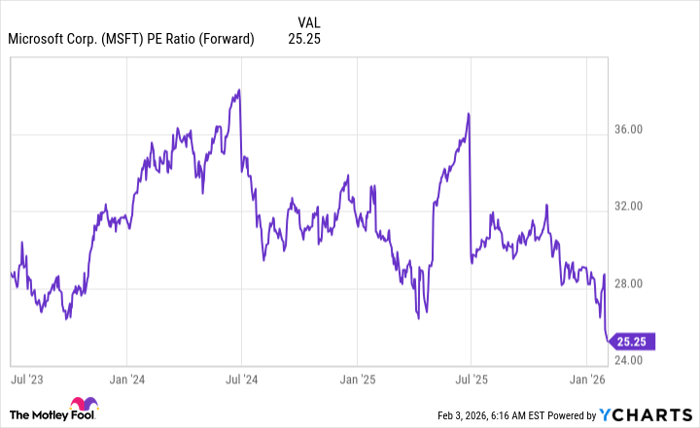

The chart below illustrates BHVN’s performance over the past year:

Examining the chart, BHVN’s 52-week low stands at $26.80 per share, while its 52-week high is $62.21. The last recorded trade was at $35.87.

![]() Discover 9 additional oversold stocks to watch »

Discover 9 additional oversold stocks to watch »

Also see:

- Funds Holding HESG

- Institutional Holders of YCBD

- AMRX shares outstanding history

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.