DigitalOcean Experience Steady Growth Amid Market Challenges

DigitalOcean (DOCN) shares saw a rise of 10.6% over the last six months, outperforming the Zacks Computer & Technology sector which rose 6%. However, it lagged behind the Zacks Internet – Software industry’s growth of 13.5% during the same period. Notably, DOCN has outperformed major competitors like Google (GOOGL), whose shares grew only 5.8%, and Microsoft (MSFT), which saw a decline of 3.5%.

The success of DOCN can largely be attributed to its innovative solutions and a growing network of partners. These factors have significantly boosted its adoption in rapidly expanding sectors such as AI/ML, cybersecurity, and data analytics.

Steady Earnings Expectations for DOCN

For the fourth quarter of 2024, DOCN anticipates revenues between $199 million and $201 million, marking an estimated growth of about 11% at the midpoint. Non-GAAP diluted earnings are expected to be between 27 cents and 32 cents per share.

Looking ahead to the full year 2024, DOCN expects revenues of $775 million to $777 million, reflecting a year-over-year growth of around 12% at the midpoint. Meanwhile, non-GAAP diluted earnings are projected to range from $1.70 to $1.75 per share.

The Zacks Consensus Estimate for DOCN’s fourth-quarter revenues stands at $200.22 million, which suggests a 10.7% increase compared to the previous year. The consensus for earnings is 35 cents per share, indicating a 20.45% decline year-over-year, and has not changed in the last month.

For 2024, the Zacks Consensus Estimate for DOCN’s revenues is approximately $775.91 million, hinting at an 11.98% increase year-over-year. The earnings estimate for 2024 remains at $1.76 per share, signifying a 10.69% growth compared to last year.

Remarkably, DOCN has surpassed the Zacks Consensus Estimate for earnings in each of the past four quarters, with an average surprise rate of 21.29%.

DigitalOcean Holdings, Inc. Price and Consensus

DigitalOcean Holdings, Inc. price-consensus-chart | DigitalOcean Holdings, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Growing Product Offerings and Partnerships Strengthen DOCN

DigitalOcean’s innovative product suite has fueled its revenue growth. Recent advancements such as enhanced droplet configurations, GPU-accelerated infrastructure, and improved backup options enable DOCN to serve demanding workloads across sectors like cybersecurity, data analytics, and AI/ML, which require robust scalability and security.

The company’s expanding network of partners includes prominent names like NVIDIA (NVDA), Hugging Face, Netlify, and MongoDB. Through its collaboration with NVIDIA, DOCN provides GPU droplets powered by NVIDIA H100 Tensor Core GPUs, facilitating smoother deployment with advanced tools.

Similarly, a partnership with Hugging Face allows DOCN to support seamless deployment of AI/ML models through one-click options on GPU droplets, streamlining the model inferencing process.

Additionally, the partnership with Netlify simplifies integration of Netlify applications with DOCN-managed MongoDB, enhancing the overall developer experience.

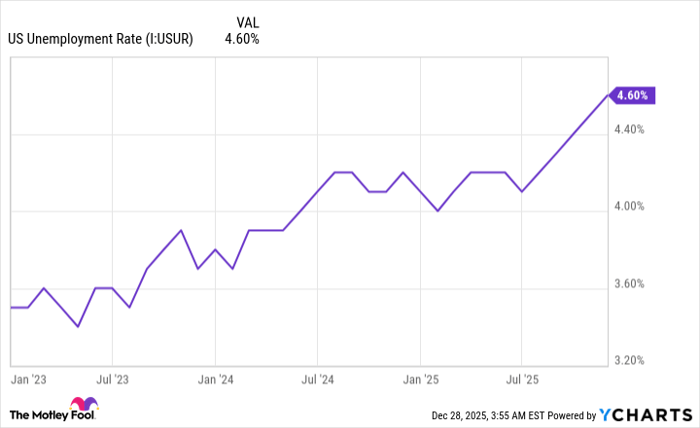

However, DOCN must navigate ongoing macroeconomic challenges and fierce competition from larger players like Amazon Web Services, Google Cloud, and Microsoft Azure, which boast more substantial resources and established ecosystems. Also, DOCN’s heavy dependence on sectors like cybersecurity and data analytics exposes it to potential sector-specific risks.

Investor Insights on DOCN Stock

Despite Benefiting from a strong product portfolio and partnerships, DOCN faces significant macroeconomic and competitive challenges.

Currently, DOCN holds a Zacks Rank #3 (Hold), suggesting that it may be prudent for investors to wait for a healthier buying opportunity. You can find the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks with Potential for High Returns

These stocks were chosen by Zacks experts as being the top candidates to potentially double in 2024. Not every pick may succeed, but past recommendations have achieved gains as high as +143.0%, +175.9%, +498.3%, and +673.0%.

Most of these stocks are currently flying under Wall Street’s radar, presenting a prime opportunity for early investment.

Today, Discover These 5 Potential High-Growth Stocks >>

Want the latest recommendations from Zacks Investment Research? You can download the report on 5 Stocks Set to Double for free today.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

DigitalOcean Holdings, Inc. (DOCN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author and do not reflect the opinions of Nasdaq, Inc.