“`html

Tech Titans Thrive as Vanguard ETF Hits Higher Returns

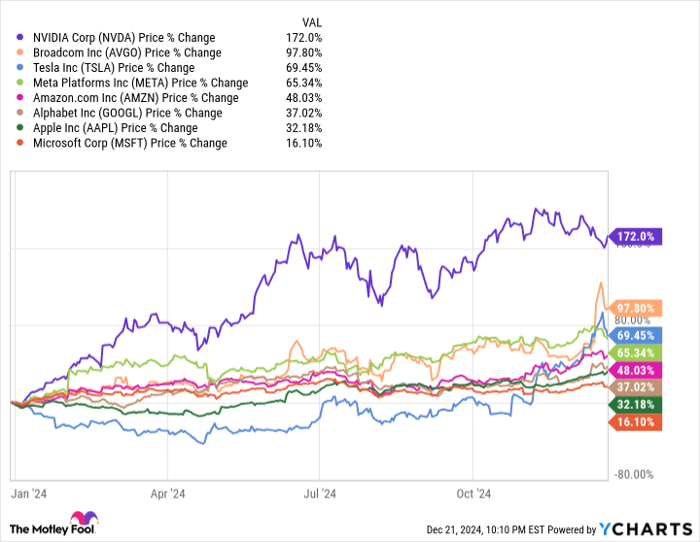

This chart shows the eight American technology companies valued at $1 trillion or more and their returns in 2024. Averaging around 67%, these returns far exceed the S&P 500, which is up only 26%. Understanding this difference is crucial for investors.

Start Your Mornings Smarter! Subscribe to Breakfast news for daily market updates. Sign Up For Free »

NVDA data by YCharts

Combined, these tech giants represent 35.9% of the S&P 500. Thus, investors who don’t hold these stocks are likely underperforming. As trends like artificial intelligence (AI) evolve, similar outcomes may occur in 2025.

Investing in an exchange-traded fund (ETF) that includes these leaders could be a more straightforward option than purchasing stocks individually. The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) is one such fund; over a third of its holdings are in just three of the stocks listed.

Here’s why this ETF could be a notable investment for all types of investors.

Image source: Getty Images.

Leading the Charge in Tech and AI

The Vanguard Mega Cap Growth ETF consists of 71 stocks, with 60% of its portfolio in the technology sector. This is not surprising since its top three holdings—Apple, Nvidia, and Microsoft—make up 37.6% of the portfolio. Each of these companies plays a vital role in AI innovation.

Apple is poised to be a major distributor of AI to consumers through its Apple Intelligence software. Nvidia leads in supplying data center chips essential for AI development. Microsoft offers cloud-based AI services and created Copilot, an AI assistant that enhances business productivity.

Moreover, other influential AI stocks within the Vanguard ETF’s top 10 holdings include:

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

1. Apple |

13.21% |

|

2. Nvidia |

12.28% |

|

3. Microsoft |

12.12% |

|

4. Amazon |

7.16% |

|

5. Meta Platforms |

4.69% |

|

6. Tesla |

4.00% |

|

7. Eli Lilly |

2.88% |

|

8. Alphabet Class A |

2.61% |

|

9. Visa |

2.27% |

|

10. Alphabet Class C |

2.13% |

Data source: Vanguard. Portfolio weightings are accurate as of Nov. 30, 2024, and are subject to change.

Amazon leads e-commerce and applies AI for efficiency in its fulfillment centers. It also created Rufus, an AI shopping assistant, and runs Amazon Web Services, a top cloud platform focused on AI capabilities.

Meta Platforms developed the popular Llama open-source AI model, which has gained over 600 million downloads. CEO Mark Zuckerberg believes its upcoming Llama 4 will be the most advanced AI model upon its 2025 launch, enhancing features across Facebook, Instagram, and WhatsApp.

Tesla stands to gain significantly from its self-driving technology, which could reshape its financial outlook. Alphabet’s family of AI models, Gemini, is transforming Google Search, demonstrating the broad applications of AI.

Other noteworthy AI stocks outside the top 10 in the Vanguard ETF include Broadcom, Salesforce, Advanced Micro Devices, and Palo Alto Networks.

Interestingly, the ETF also includes strong performers from beyond tech, such as Eli Lilly and Visa, providing some diversification along with other well-known companies like Costco Wholesale, McDonald’s, and Walt Disney.

Enhancing Investment Performance with the Vanguard ETF

Since launching in 2007, the Vanguard Mega Cap Growth ETF has achieved a compound annual return of 13.3%, outperforming the S&P 500’s average annual return of 10.2% during the same period.

The 3.1-point differential may seem modest, but its impact becomes evident over time due to compounding:

|

Starting Balance in 2007 |

Compound Annual Return |

Balance in 2024 |

|---|---|---|

|

$50,000 |

13.3% (Vanguard ETF) |

$417,713 |

|

$50,000 |

10.2% (S&P 500) |

$260,649 |

Calculations by author.

Additionally, over the past decade, the ETF has accelerated to a 16.3% annual average return due to the rise in smartphones, cloud computing, enterprise software, and AI advancements fueling growth in major tech firms.

MGK data by YCharts

In closing, AI is predicted to be a game-changer. Morgan Stanley projects Microsoft, Amazon, Alphabet, and Meta will spend a combined $300 billion on AI development in 2025. If successful, this could lead to substantial revenue growth, especially for hardware providers like Nvidia and Broadcom. However, if AI doesn’t meet expectations, these companies risk losing significant value.

“`

A Cautious Take on the Vanguard ETF Amid Rising AI Stocks

The recent surge in AI-related stocks poses a challenge for the S&P 500, where these high-weighted members might lead to a downturn. It’s vital for investors to consider how an investment in the Vanguard ETF could potentially underperform.

Invest Wisely: Diversification is Key

Thinking about diving into the hottest stocks? It’s essential to balance your investments. Experts suggest that investors should hold the Vanguard ETF only as part of a diverse portfolio that doesn’t overly lean into AI stocks.

Have you ever felt like you missed out on some of the best stock opportunities? If that’s the case, there’s an opportunity you might want to explore.

Sometimes, our team of analysts identifies what they call a “Double Down” stock—a company they believe is poised for significant growth. If you think the best times to invest have passed, now could be your moment to act before these stocks take off again. The potential returns are impressive:

- Nvidia: Investing $1,000 when we made our recommendation in 2009 would yield $362,166 today!*

- Apple: A $1,000 investment during our recommendation in 2008 would now be worth $48,344!*

- Netflix: If you had invested $1,000 in 2004, it could have grown to $491,537!*

Currently, we’re excited to share three stocks on our “Double Down” list, presenting a unique chance for savvy investors.

Discover the 3 “Double Down” stocks now »

*Stock Advisor returns as of December 23, 2024

John Mackey, the former CEO of Whole Foods Market, now part of Amazon, is on The Motley Fool’s board. Suzanne Frey, a top executive at Alphabet, also holds a board position. Randi Zuckerberg, who previously worked with Facebook and is related to its CEO Mark Zuckerberg, is another board member. Meanwhile, Anthony Di Pizio has no investments in any stocks mentioned. The Motley Fool recommends and holds positions in firms like Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, Salesforce, Tesla, Visa, and Walt Disney. Additionally, they recommend Broadcom and Palo Alto Networks and have specific options strategies involving Microsoft. Please refer to The Motley Fool’s disclosure policy for further details.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.