Understanding Analyst Ratings: What They Mean for Nvidia Investors

When investors are deciding whether to buy, sell, or hold a stock, they often consult analyst recommendations. Changes in these ratings can sway a stock’s price significantly, but how useful are they really?

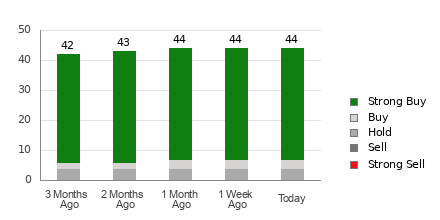

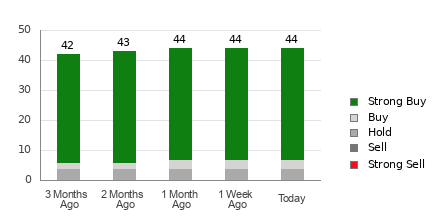

To gauge the sentiment surrounding Nvidia (NVDA), let’s take a look at what analysts are saying.

Nvidia has an average brokerage recommendation (ABR) of 1.25, based on the ratings from 44 brokerage firms. This score falls between the classifications of Strong Buy and Buy on a scale from 1 (Strong Buy) to 5 (Strong Sell).

Breaking down the recommendations, 37 of the 44 suggest Strong Buy, while three indicate Buy. In total, Strong Buy and Buy ratings represent 84.1% and 6.8% of all recommendations, respectively.

Current Trends in Nvidia’s Analyst Recommendations

For more on Nvidia’s price targets and stock forecasts, click here>>>

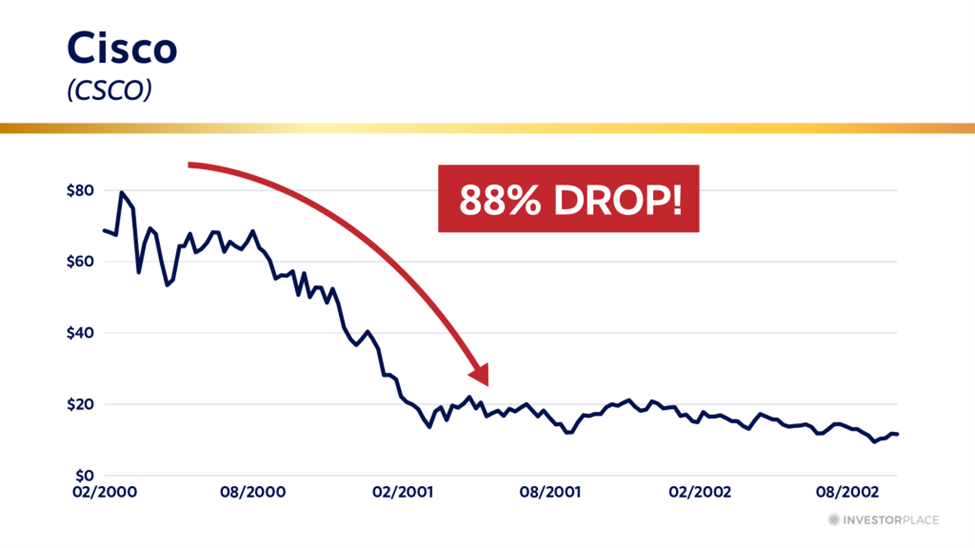

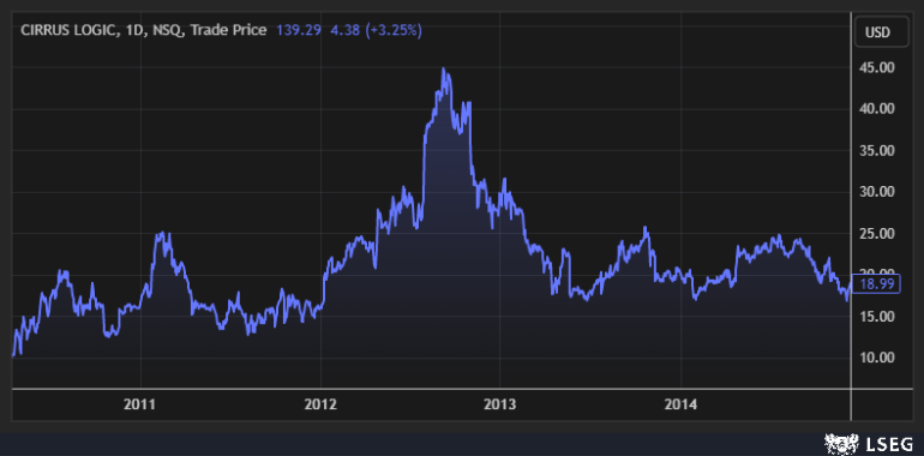

While a strong ABR indicates buying Nvidia, it’s not wise to make investment decisions based only on this data. Research shows that brokerage recommendations often fail to guide investors towards stocks with the best growth potential.

This skepticism stems from the potential conflicts of interest within brokerage firms. Analysts often exhibit a notable bias toward positive ratings. On average, five Strong Buy recommendations are issued for every one Strong Sell recommendation, which raises questions about the validity of these ratings, particularly for retail investors.

Thus, using analyst ratings as a supplement to your own research or as a signal alongside more reliable indicators is the recommended approach.

The Zacks Rank, a prestigious stock rating tool with an established track record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model, grounded in earnings estimate revisions, provides a more dependable forecast of a stock’s near-term price movement. Pairing the Zacks Rank with brokerage recommendations can enhance your investment strategy.

Distinguishing Between Zacks Rank and ABR

Even though both Zacks Rank and ABR use a 1-5 scale, they measure different aspects.

The ABR is derived solely from analyst recommendations, often displayed as decimals (e.g., 1.28). In contrast, the Zacks Rank relies on a quantitative model that emphasizes earnings estimate revisions, represented as whole numbers from 1 to 5.

Historically, brokerage analysts tend to skew optimistic in their ratings due to the interests of their firms, which can confuse investors. Meanwhile, the Zacks Rank focuses on actual earnings revisions, a key factor that correlates more strongly with stock price movements.

The Zacks Rank evaluates all stocks based on earnings estimates across various analysts, ensuring a balance among its classifications.

The timeliness of ratings differs as well. ABR scores may lag behind real-time changes in market sentiment. In contrast, Zacks Rank updates reflect the latest earnings revisions promptly, providing a clearer picture of future price movements.

Is NVDA a Smart Investment?

For Nvidia, the Zacks Consensus Estimate for earnings in the current year has risen by 0.4% to $2.94 over the past month.

This increase in earnings estimates suggests that analysts are increasingly optimistic about Nvidia’s performance, which could lead to a price surge in the near future.

Combined with other factors related to earnings estimates, this change has earned Nvidia a Zacks Rank #2 (Buy). For a list of Zacks Rank #1 (Strong Buy) stocks, click here >>>>

Therefore, while the Buy-equivalent ABR for Nvidia is informative, it should complement your analysis rather than act as the sole decision-making factor.

Zacks Identifying Top 10 Stocks for 2025

Are you looking for insights on Zacks’ top 10 stock picks for the upcoming year?

History suggests these selections could perform exceptionally well. From 2012, when our Director of Research Sheraz Mian took over this portfolio, through November 2024, the Zacks Top 10 Stocks recorded gains of +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Now, as Sheraz reviews 4,400 companies, he is set to find the best 10 stocks for 2025. Don’t miss the chance to learn more when they are announced on January 2.

Stay tuned for new Top 10 Stocks >>

For the latest recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double” by clicking here for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.