“`html

Technology Stocks Set for Continued Success: Will Nasdaq Composite Keep Rising?

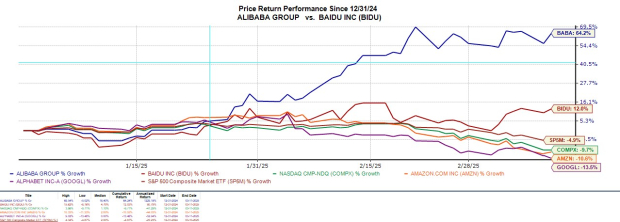

The technology sector has seen significant growth in recent years, highlighted by an impressive 86% surge in the Nasdaq Composite index. With the current landscape, there’s optimism that this upward trend will persist into 2025.

Historically, when the Nasdaq Composite sees gains of over 20%, it averages around 17% growth in the following year. Additionally, after a 30% leap, it typically sees an average gain of about 19%. As of now, the Nasdaq Composite is up over 32% in 2024.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

While past performance cannot guarantee future success, current trends suggest continued growth for the Nasdaq in 2025. Factors such as strong U.S. economic growth, high consumer spending, and advancements in technology—including artificial intelligence (AI)—could drive tech stocks even higher.

1. Nvidia: Leading the Charge with AI Chips

Shares of Nvidia (NASDAQ: NVDA) have soared 185% in 2024, largely due to the rising demand for its AI hardware and consistent financial performance. Despite this remarkable gain, the stock is valued at a reasonable 33 times its expected earnings, compared to the tech-heavy Nasdaq-100 index’s forward earnings multiple of 27.

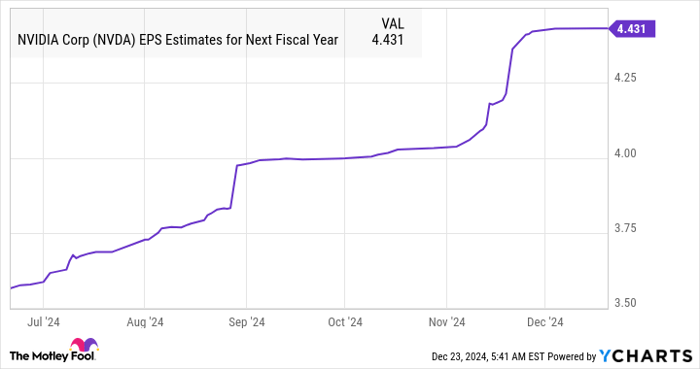

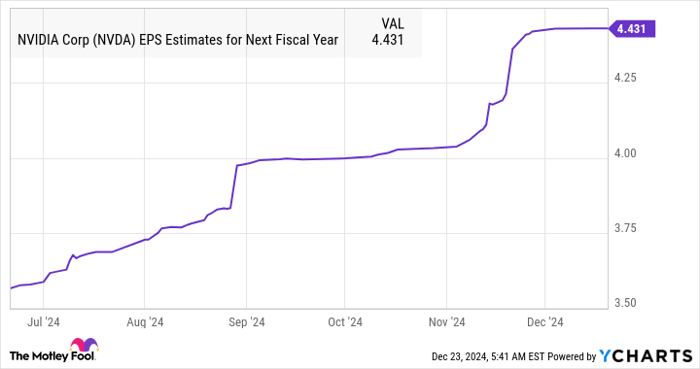

According to Yahoo! Finance, Nvidia’s earnings per share is expected to increase by 128% to $2.95 this fiscal year, followed by a 50% gain to $4.43 next fiscal year. Analysts have even raised their earnings forecasts for Nvidia in recent months, suggesting strong future performance.

Data by YCharts.

Looking ahead, Nvidia’s production of its new Blackwell processors is expected to significantly ramp up, with estimates of 250,000 to 300,000 units in Q4 2024, potentially generating $5 billion to $10 billion in revenue. The following quarter could see production rise to 750,000 to 800,000 units, shifting focus from the older Hopper chips.

These new chips are set at a premium price, but their anticipated performance gains make them worthwhile investments for customers. If Nvidia achieves the projected $4.43 earnings per share and maintains a 41 times earnings ratio, its stock could rise to $182, reflecting a potential 35% increase from current values.

2. Palantir: Exceptional Growth on the Horizon

Palantir Technologies (NASDAQ: PLTR) has gained over 389% in 2024, making it a potentially risky but exciting option for investors. The stock currently trades at an exorbitant 422 times trailing earnings, but its forward earnings multiple of 222 suggests strong growth ahead.

Palantir is a frontrunner in the expanding market for AI software platforms. According to Forrester, Palantir is emerging as a leading provider in this sector, with potential growth aided by an anticipated revenue generation of $153 billion in the AI segment by 2025.

Growth is already evident as both commercial and government entities increasingly adopt Palantir’s software for AI integration. A notable example is the U.S. Army’s recent contract extension with Palantir worth $400.7 million, which could grow up to $619 million.

By the end of Q3 2024, Palantir noted a remaining deal value of $4.5 billion, up 22% year-over-year, indicating strong future revenue potential. Analysts predict a revenue increase of 25% to $2.79 billion in 2025, supported by this growing pipeline of contracts.

“`

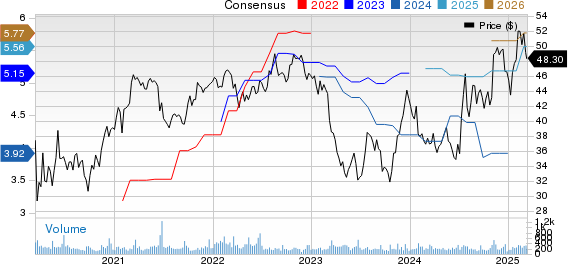

Palantir Projects 52% Earnings Surge This Year

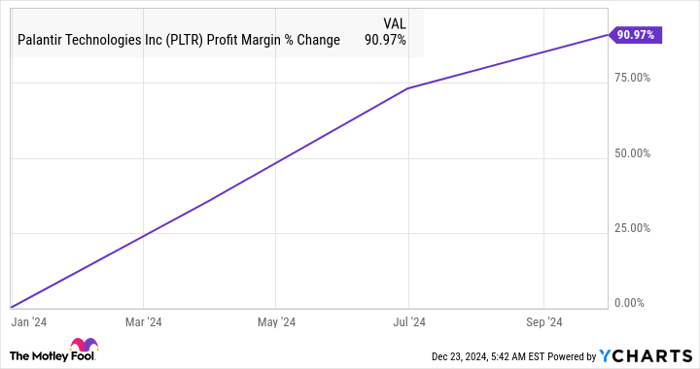

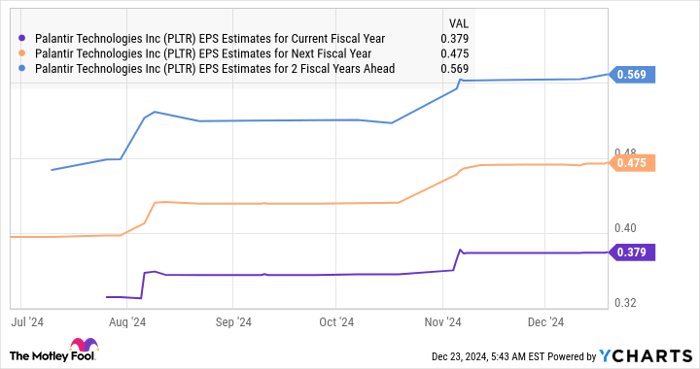

Palantir Technologies expects its earnings to rise significantly this year, with projections reaching $0.38 per share, marking a 52% increase. The company has been improving its profit margins by securing additional business from existing customers, which enhances its unit economics.

PLTR Profit Margin data by YCharts

The strong unit economics combined with a promising revenue pipeline are the driving forces behind the increasing earnings-per-share expectations for Palantir this year.

PLTR EPS Estimates for Current Fiscal Year data by YCharts

This upward trend could persist into 2025 and beyond as Palantir taps into a significant growth opportunity within the AI software platform market. With this potential for expansion, the stock may continue to rise in value, indicating that growth-oriented investors might still consider purchasing even after the robust gains seen in 2024.

Should You Invest in Nvidia Right Now?

Before making a decision on Nvidia stock, take this into account:

The Motley Fool Stock Advisor analyst team recently pinpointed what they regard as the 10 best stocks to buy now — and Nvidia did not make the list. The stocks that were chosen have the potential to deliver impressive returns in the coming years.

Reflecting back on when Nvidia was included in the list on April 15, 2005… if you had invested $1,000 at that time, your investment would be worth $859,342!*

Stock Advisor offers investors a straightforward roadmap to success, featuring portfolio-building strategies, continuous analyst updates, and two new stock picks each month. This service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.