Exploring Income Opportunities with U.S. Physical Therapy, Inc. (USPH)

Shareholders can enhance their earnings with covered call strategies.

Investors in U.S. Physical Therapy, Inc. (Symbol: USPH) who want to increase their income beyond the stock’s current 1.9% annualized dividend yield might consider selling a covered call. The June 2025 call option at the $110 strike price offers a premium of $3.50, which would translate to an additional 8% return on top of the dividend yield. This strategy could yield a total annualized return of 10% if the stock price remains below $110. If the stock exceeds this strike price, the shareholder might miss out on that future gain. However, the stock would need to rise by 21.1% to reach $110, meaning a called stock would still result in a 25% total return when combining capital gains with any dividends received prior to the option’s expiration.

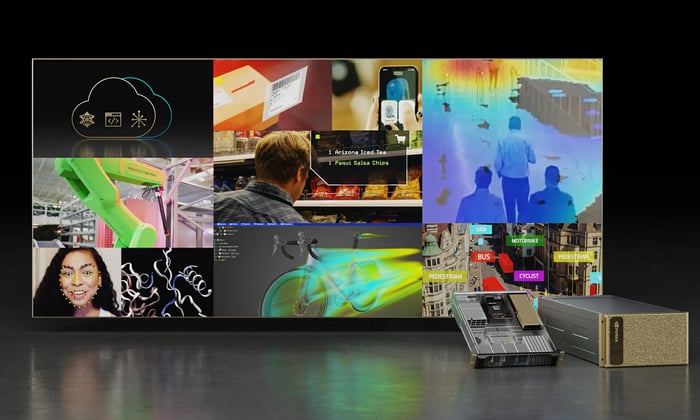

Dividends can be unpredictable as they often rely on a company’s profitability. For U.S. Physical Therapy, Inc., examining its dividend history may provide insight into the sustainability of the current yield. The chart below presents the company’s dividend trends, assisting in determining if the 1.9% rate is a viable expectation.

The following chart displays the trailing twelve-month trading history for USPH, emphasizing the $110 strike level in red:

This chart, combined with the stock’s historical volatility, helps assess whether selling the June 2025 covered call at the $110 strike is a sound strategy. U.S. Physical Therapy, Inc. has a trailing twelve-month volatility of 32%, calculated using the last 251 trading days and the current price of $90.20. For more options strategies at different expiration dates, you can visit the USPH Stock Options page on StockOptionsChannel.com.

During mid-afternoon trading on Friday, the put volume among S&P 500 stocks reached 1.24 million contracts, while call volume stood at 2.13 million, resulting in a put:call ratio of 0.58. This figure indicates a preference for call options in today’s trading, as it is lower than the long-term median put:call ratio of 0.65.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

- Top Ten Hedge Funds Holding DXC

- WGBS Split History

- PER Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.