Three Stocks to Watch for Your 2025 Growth Portfolio

As you plan your investment strategies for 2025 and beyond, consider these three compelling companies that show great potential for growth.

1. Axon Enterprise: A Leader in Law Enforcement Technology

Axon Enterprise (NASDAQ: AXON) may remind you of its dominance in the law enforcement tech sector, notably with tasers and body cameras. This was particularly evident about 20 years ago when these products gained traction among police forces, making Axon a household name in this niche.

Despite a natural ebb in investor excitement over time, demand for non-lethal policing tools has surged. Axon’s revenue jumped from $24 million in its early days to over $2 billion currently. Correspondingly, its stock price skyrocketed from $6.86 per share in 2003 to around $590 today, earning Axon a spot in the NASDAQ 100 index.

This inclusion could attract even more investor interest rather than signal a peak in growth. Current projections from Mordor Intelligence indicate that the global body camera market could expand at an annual rate of 16% through 2030, with the connected-energy gun market also slated for significant growth. Growing concerns over police interactions and legal proceedings bolster this outlook.

Axon also recently ventured into the drone market, introducing aerial technology that can provide real-time information to emergency responders. While the stock saw a high in December 2023, current trends suggest that the demand for its products remains strong.

2. Celsius Holdings: An Energy Drink Investment Opportunity

In stark contrast to Axon’s success, Celsius Holdings (NASDAQ: CELH) faced a tumultuous 2024. Following a booming 2023, the energy drink company’s shares plummeted over 70% from their March highs.

This downturn, primarily due to profit-taking, opens a window for savvy investors. Celsius competes with giants like Red Bull and Monster Beverage, capturing a market share of around 10% to 20% in the U.S. Despite this, it has made significant strides in expanding its presence.

Celsius distinguishes itself by using healthier, natural ingredients in its drinks, such as ginger and green tea, and steering clear of sugar and artificial additives. This aligns with growing consumer preferences for healthier options. Additionally, Celsius drinks are recognized for boosting metabolism, appealing primarily to fitness enthusiasts.

The factors behind last year’s sell-off relate to the timing and rapid stock appreciation during the pandemic. Analysts believe the price drop was an overcorrection, paving the way for a potential rebound this year. Currently, most analysts rate Celsius as a strong buy, with a 12-month price target of $41.00, representing a potential 50% uplift from its present valuation.

3. Shopify: An E-Commerce Powerhouse

Lastly, consider Shopify (NYSE: SHOP), which facilitates e-commerce for businesses of all sizes. By enabling direct sales, Shopify allows merchants to foster direct customer relationships, contrasting with third-party platforms like eBay and Amazon.

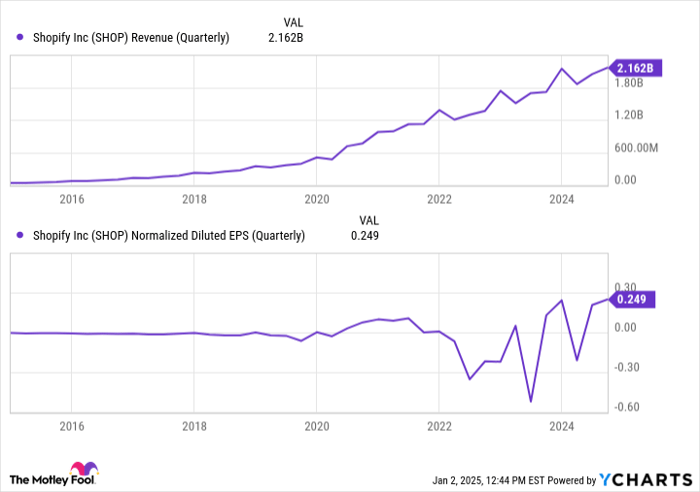

Shopify has been profitable, generating nearly $2.2 billion in revenue for the quarter ending in September, with an annual total approaching $8.9 billion. The U.S. retail market indicates that only 16% of sales occur online, highlighting substantial room for growth. Mordor Intelligence forecasts nearly 16% annual growth in the global e-commerce sector through 2030, with Shopify poised to capture a significant share.

Despite its stock currently trading at more than 50 times next year’s forecast earnings of $1.94, investor enthusiasm remains high due to its growth prospects. Shopify’s stagnant stock price since November represents a potential buying opportunity that won’t last long.

Investment Considerations for Axon Enterprise

Before diving into an investment in Axon Enterprise, it’s worth noting the insights from the Motley Fool Stock Advisor team, which has identified ten stocks deemed more promising for current investors.

Nvidia serves as a striking historical example; for those who invested $1,000 following its recommendation back in April 2005, that investment would now be worth an impressive $885,388.

With guidance on portfolio building and regular stock picks, Stock Advisor has notably outperformed the S&P 500 since its inception.

John Mackey, the former CEO of Whole Foods Market, is a member of The Motley Fool’s board of directors. James Brumley does not hold positions in any mentioned stocks. The Motley Fool recommends Amazon, Axon Enterprise, Celsius, Monster Beverage, and Shopify, among others.

These views and opinions are those of the author, not necessarily reflecting those of Nasdaq, Inc.