AMD Unveils New AI Processors While Facing Stock Challenges

Advanced Micro Devices (AMD) recently held a press conference ahead of CES 2025, where it introduced a range of AI-driven PC processors aimed at both consumers and businesses. The new Ryzen AI Max Series promises top-notch performance for premium laptops, while the AI 300 Series, built on the innovative “Zen 5” architecture, offers advanced computing capabilities. The AI 200 Series targets everyday productivity needs.

For business users, AMD showcased the Ryzen PRO versions, which come equipped with enterprise-level security and management tools. This move solidifies AMD’s position in the AI PC market, catering to modern computing and business environments.

Gaming Innovations on the Horizon

In the gaming sector, AMD revealed new products designed to enhance the gaming experience on desktop, mobile, and handheld platforms. The Ryzen 9950X3D and 9900X3D desktop processors feature 16 “Zen 5” CPU cores, AMD RDNA 2 graphics, and 2nd Gen 3D V-Cache technology. These processors are expected to be released in the first quarter of 2025.

Additionally, AMD introduced the Ryzen Z2 handheld gaming processor, which is capable of running AAA games seamlessly. The new Ryzen 9000 mobile processors are also set to elevate the performance of gaming laptops, offering higher clock speeds and cooler operation for an exceptional gaming experience.

Notably, AMD announced a collaboration with Dell Technologies to power its DELL Pro commercial notebooks, desktops, and workstations with Ryzen AI PRO processors. This partnership represents the first complete range of Dell commercial PCs utilizing AMD’s latest technology.

AMD’s Stock Struggles Compared to Sector Peers

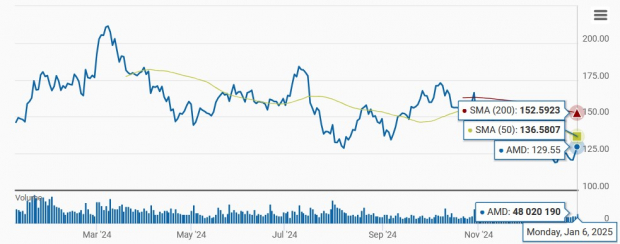

Despite these promising announcements, AMD shares have fallen 11.4% over the past year, significantly lagging behind the Zacks Computer and Technology sector, which returned 38.1%, and the Zacks Computer – Integrated Systems industry, which returned 11.8%.

This decline can be attributed to weaknesses in the Embedded segment, which is experiencing decreased demand, along with stiff competition from NVIDIA (NVDA) impacting AMD’s market share.

AMD Stock Performance Over One Year

Image Source: Zacks Investment Research

Can Recent Acquisitions Propel AMD’s AI Ambitions?

AMD is aggressively pursuing acquisitions to bolster its AI ecosystem and close the technological gap with NVIDIA. The company recently acquired ZT Systems, which provides AI infrastructure to large-scale computing companies. This acquisition is critical as it will allow AMD to design and validate its next-generation AI silicon efficiently, paving the way for quicker deployment of data center accelerators that are essential for AI progress.

Moreover, the acquisition of Silo AI, based in Helsinki, further boosts AMD’s AI development capabilities, along with other recent acquisitions like Nod.ai and Mipsology.

Strong Partnerships Support AMD’s Growth

AMD’s robust partner network features companies like Microsoft, Oracle, DELL, Hewlett Packard (HPE), Lenovo, and Supermicro, all of which are utilizing AMD’s Instinct platforms in their operations.

The company powers the El Capitan supercomputer with its Instinct MI300A APUs. Located at the Lawrence Livermore National Laboratory and developed by HPE, El Capitan has earned the title of the fastest supercomputer on the Top 500 list, achieving a remarkable 1.742 exaflop High-Performance Linpack score.

In addition, AMD has partnered with IBM to provide AMD Instinct MI300X accelerators on the IBM Cloud, further enhancing high-performance computing (HPC) and AI capabilities.

2025 Earnings Estimates Show Decline

The Zacks Consensus Estimate for AMD’s earnings in 2025 is currently set at $4.88 per share, marking a decline of 0.61% over the past month. This figure suggests an impressive year-over-year growth of 47.58%.

Projected revenues for 2025 stand at $32.27 billion, which translates to a 25.77% increase compared to the previous year. AMD has managed to beat the Zacks Consensus Estimate in three of the last four quarters, with an average surprise of 1.86% in results.

AMD Price and Consensus Overview

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

Stay updated on the latest EPS estimates and surprises through Zacks Earnings Calendar.

Is AMD Stock Currently Overvalued?

At present, AMD’s stock appears to be overvalued, reflected by a Value Score of D. This suggests that the stock is trading at a stretched valuation.

It currently trades at a forward 12-month Price/Sales ratio of 6.49X, compared to the industry average of 3.34X, indicating significant premium pricing.

Forward Price/Sales Ratio

Image Source: Zacks Investment Research

Investment Outlook for AMD

While AMD’s growing portfolio and strategic acquisitions may boost its revenue growth, the company’s short-term outlook remains bleak due to Embedded segment weaknesses and heightened competition from NVIDIA.

The current overvaluation is a concern for potential investors.

Notably, AMD is trading below both the 50-day and 200-day moving averages, suggesting a bearish trend in the market.

AMD Stock Trading Below Key Moving Averages

Image Source: Zacks Investment Research

With a Zacks Rank #3 (Hold), it may be prudent for investors to exercise patience and wait for a more opportune moment to buy the stock. You can find the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks with Potential for Major Gains

Each stock was carefully selected by a Zacks expert as a top contender to gain +100% or more in 2024. While past picks have delivered impressive returns of +143.0%, +175.9%, +498.3%, and +673.0%, not every selection guarantees success.

Many of these promising stocks remain under the radar on Wall Street, presenting an excellent opportunity for early investment.

Today, check out these five potential home runs >>

Looking for the latest stock recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.