“`html

Investment Showdown: Nike vs. Adidas as 2025 Begins

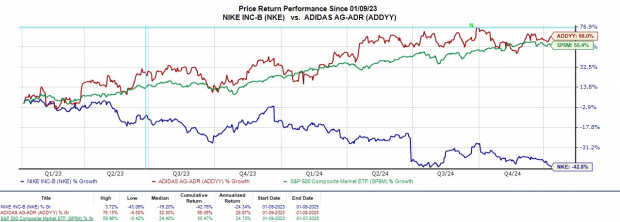

As 2025 kicks off, Nike NKE shares are lingering near 52-week lows, while Adidas ADDYY stock approaches its highs. Investors are left to ponder: will Nike experience a rebound, or can Adidas continue to soar?

This prompts an important discussion on which of these two iconic brands represents the better investment choice right now.

Image Source: Zacks Investment Research

The Factors Behind NKE’s Decline and ADDYY’s Rise

Nike’s challenges stem from a pressing need to refresh its product lineup in response to intense competition beyond Adidas, including brands like Under Armour UAA and New Balance. Coupled with slower sales growth and inventory setbacks, investor confidence has dipped.

Conversely, Adidas has successfully taken advantage of Nike’s struggles by expanding its product range, resulting in improved financial results and stronger market sentiment.

Comparing Outlooks & Earnings Estimates

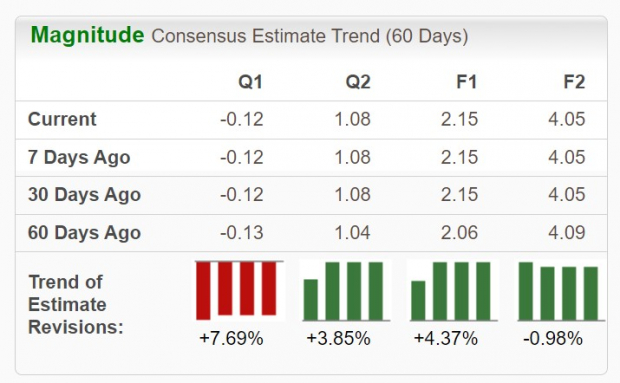

According to Zacks estimates, Nike’s total sales are expected to fall by 10% in fiscal 2025, reaching $46.34 billion, down from $51.36 billion last year. Projections for fiscal 2026 suggest a modest stabilization, with sales increasing by 1% to $47.11 billion.

Nike’s annual earnings are anticipated to drop 47% this year to $2.10 per share, compared to $3.95 in 2024. However, earnings per share (EPS) for fiscal 2026 is expected to recover, climbing 12% to $2.36, though estimates have been lowered in the past quarter.

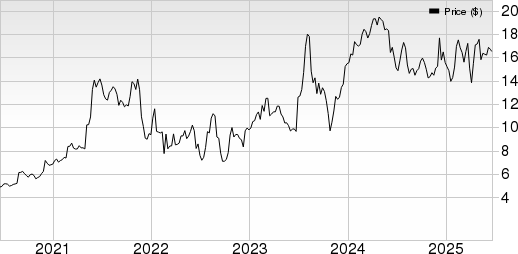

Image Source: Zacks Investment Research

In contrast, Adidas is projected to see its top line grow by 6%, with total sales expected to rise 10% in fiscal 2025 to $27.3 billion. Earnings forecasts for Adidas also look promising, with EPS expected to increase from a loss of -$0.36 in fiscal 2023 to $2.15 in fiscal 2024. Moreover, fiscal 2025 EPS is predicted to surge by 88% to $4.05.

It’s worth noting that Adidas’s FY24 EPS estimates have increased by 4% over the last 60 days, while FY25 estimates have seen a slight decline.

Image Source: Zacks Investment Research

Valuation Insights

Currently, NKE shares trade at $71, reflecting a forward earnings multiple of 34.3X. Adidas’s stock trades at $125, but with a lower multiple of 30.9X. Both companies are above the S&P 500 average of 22.1X, as well as their industry average of 14.4X.

Adidas also offers a more appealing price-to-sales ratio at less than 2X, whereas Nike stands at 2.3X.

Image Source: Zacks Investment Research

Dividend Insight

Nike clearly leads in terms of dividends, boasting a 2.22% annual yield, significantly higher than Adidas’s meager 0.19% and the industry average of 1.92%.

Image Source: Zacks Investment Research

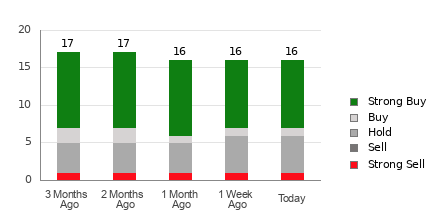

Conclusion

Currently, Adidas holds a Zacks Rank #3 (Hold), while Nike is classified with a Zacks Rank #5 (Strong Sell). While Nike appeals more to income-focused investors, the recent drop in earnings estimates indicates potential downside risk. In contrast, those involved with Adidas could see rewards thanks to the company’s promising growth outlook.

7 Best Stocks for the Next 30 Days

Just released: Experts identify 7 elite stocks from a current list of 220 Zacks Rank #1 Strong Buys. These tickers are deemed “Most Likely for Early Price Pops.”

Since 1988, this list has outperformed the market over 2X, averaging a +24.1% annual gain. Be sure to give these 7 stocks your immediate attention.

NIKE, Inc. (NKE): Free Stock Analysis Report

Adidas AG (ADDYY): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`