AI Stocks Shine: Stellar Returns Highlight Growth Opportunities

Many artificial intelligence (AI) stocks have seen impressive gains over the past few years. Even last year, investors who entered the market could have benefited significantly by choosing top-performing AI companies.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

For example, Palantir Technologies (NASDAQ: PLTR), SoundHound AI (NASDAQ: SOUN), and Nvidia (NASDAQ: NVDA) emerged as standout investments in 2024. If you had invested $7,000 in each of these stocks at the beginning of last year, your portfolio would be valued at over $120,000 by the end of 2024, marking a remarkable near five-fold increase in pre-tax wealth. Below, we delve into how each company performed and evaluate whether investing now is a wise choice.

Palantir Technologies: A Leader in Data Analytics

Palantir Technologies, known for its data analytics capabilities, has been harnessing AI to improve its offerings. The company is well-regarded in the fields of counterterrorism and intelligence, serving government clients globally. Recently, it has also focused on commercial growth, creating solutions that enable diverse businesses to make informed decisions.

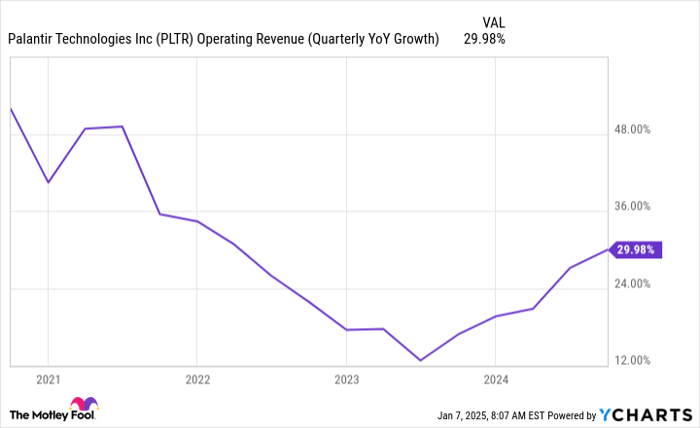

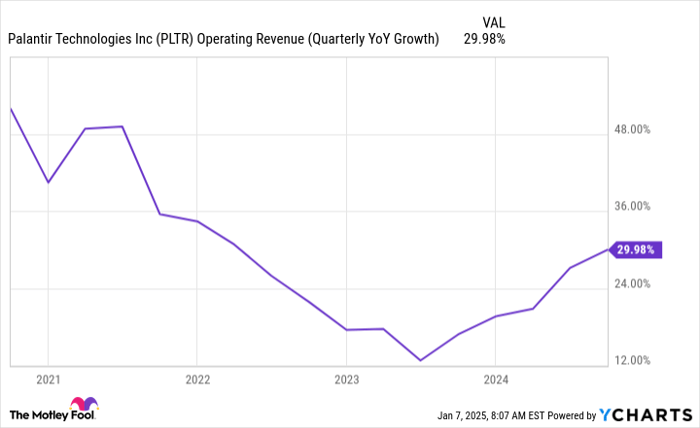

Through numerous boot camps, Palantir has introduced potential customers to the Palantir Artificial Intelligence Platform (AIP), showcasing various use cases for its software. The outcomes have been outstanding, with CEO Alex Karp noting a “relentless” demand for AIP and accelerating sales. While growth had been slowing in prior years, a resurgence occurred in 2024.

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts.

Now consistently profitable and a new member of the S&P 500, investor interest in Palantir remains high. An investment of $7,000 in Palantir a year ago would now exceed $33,000.

However, caution is advised for potential investors. The company’s stock is priced at about 118 times the expected profits for the following year, signaling a large premium. Unless you have strong confidence in a future surge, consider cashing in your gains instead, as a repeat performance in 2025 may be unlikely.

SoundHound AI: Emerging Voice Technology

The smallest firm on this list, SoundHound AI, specializes in voice AI and has a market cap of roughly $5.5 billion. Its stock surged late last year after reporting strong quarterly results and announcing partnerships with various restaurant chains.

In early December, the company revealed that Torchy’s Tacos had adopted its AI Smart Ordering service at all 130 locations. Shortly thereafter, Church’s Texas Chicken disclosed that it would implement SoundHound’s technology at drive-thrus to streamline the ordering experience.

Since SoundHound’s business is still developing and highly competitive, news about new client partnerships can greatly impact its reputation and market confidence. While not profitable yet, SoundHound experienced an 89% revenue increase in the third quarter, reaching $25.1 million. Its net loss expanded by 8% to $21.8 million, but investors appear willing to be patient, given the company’s robust growth prospects in both the fast-food and automotive sectors.

With the strong uptick in SoundHound’s stock late last year, a $7,000 investment a year ago would have approached $70,000 by the end of 2024. Yet like Palantir, SoundHound’s stock may be overpriced right now, creating uncertainty about future performance. The start of 2025 has seen stock volatility, and it remains too early to predict the next steps. Presently, the stock is priced at 68 times its trailing twelve-month revenue.

Nvidia: The GPU Giant

Nvidia’s inclusion in the list of top AI stocks for 2024 is unsurprising. The chip manufacturer has been critical in providing the processing power behind numerous AI initiatives using its leading graphics processing units (GPUs). Boasting a market cap exceeding $3 trillion, Nvidia stands as one of the world’s most valuable companies and has demonstrated substantial growth over recent years.

Nvidia’s performance is notable, with significant increases in both revenue and profit. For the nine-month period ending on October 27, it reported $91.2 billion in revenue—a staggering 135% rise from the previous year. This growth was achieved while maintaining an impressive profit margin of 56%, with net income jumping from $17.5 billion to $50.8 billion.

Achieving high revenue growth is commendable, but Nvidia’s profit acceleration further enhances its attractiveness. Among these three investments, it appears to be the most fairly valued, suggesting potential for further short-term growth. It is currently trading at 35 times next year’s estimated earnings, with a price-to-earnings growth ratio close to 1, indicating favorable long-term investment potential.

If you had invested $7,000 in Nvidia last year, your investment would exceed $19,000 now. Overall, combining all three stocks, a $21,000 total investment would have resulted in a portfolio valued around $122,000 at the year’s start.

Should you invest $1,000 in Palantir Technologies right now?

Before investing in Palantir Technologies, consider the following:

The Motley Fool Stock Advisor analyst team recently highlighted their choice of the 10 best stocks to buy now, and Palantir Technologies did not make the list. The selected companies could yield impressive returns moving forward.

For context, when Nvidia was recommended on April 15, 2005, a $1,000 investment at that time would have grown to $858,852!*

Stock Advisor provides a practical guide for investors, including portfolio building advice, regular analyst updates, and two new stock picks each month. The service has notably more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

David Jagielski has no position in any stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.