AMD Stock Struggles Amid Analyst Downgrades and Market Concerns

December Sell-Off and Year-End Decline

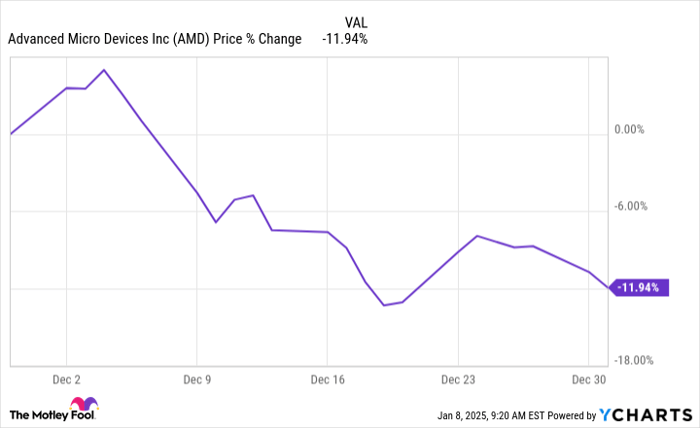

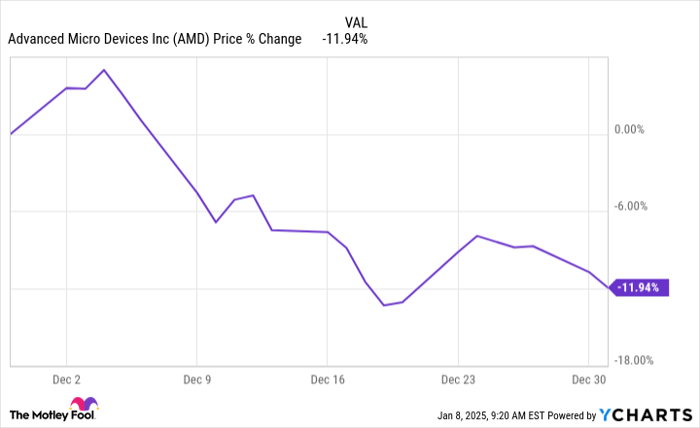

Advanced Micro Devices (NASDAQ: AMD) stock experienced significant sell-offs in December’s trading. The semiconductor company’s share price ended the month down by 11.9%, as reported by S&P Global Market Intelligence.

AMD data by YCharts.

At the close of December trading, AMD’s stock fell approximately 18% for 2024. Analysts became cautious, issuing lower projections for share prices and revenue as the year ended.

Analysts Shift Outlook on AMD

On Dec. 9, Bank of America downgraded AMD from a “buy” to “neutral” and reduced its 12-month price target from $180 to $155. Following this, Truist issued a similar downgrade on Dec. 16, maintaining a hold rating while also cutting its target from $180 to $155.

Wolfe Research weighed in the next day, forecasting AMD’s 2025 revenue to be around $3 billion lower than Wall Street’s average. Their report indicated that AMD’s advancements in artificial intelligence (AI) were weaker than market expectations, projecting only $7 billion in AI revenue this year. This assessment raised concerns about the company’s upcoming quarterly report.

Moreover, on Dec. 20, Morgan Stanley reiterated its equal-weight rating, reducing its price target from $169 to $158. Analysts pointed to mounting competition from Nvidia as a factor that could stifle AMD’s growth in the AI sector.

AMD’s 2025 Outlook: A Mixed Bag

Despite experiencing substantial sell-offs in December, AMD shares began 2025 with slight recovery, showing a roughly 4% increase before the market opened on Jan. 8. However, subsequent bearish analyst coverage and investor concerns about macroeconomic conditions erased these early gains, leaving AMD stock relatively flat for the year so far.

In a notable move, before today’s market opened, HSBC issued a rare double downgrade of AMD, reducing its rating from “buy” to “reduce” and slashing its price target from $200 to $110. This change was largely attributed to AMD’s perceived competitive disadvantage against Nvidia.

As AMD heads into 2025, expectations are notably lowered. Nvidia holds a strong position in the advanced processor market, and some analysts are concerned that AI may not drive the anticipated growth for AMD in the near term. Nevertheless, it may be premature to dismiss AMD completely, as the challenges they face could pave the way for a significant recovery down the line.

Where to Invest $1,000 Right Now

When our team of analysts has a stock recommendation, it can be wise to take notice. For context, Stock Advisor’s average return is 891%, outperforming the S&P 500’s 172%.*

They recently identified the 10 best stocks for investors to consider right now — and Advanced Micro Devices is among them, alongside nine other potentially lucrative opportunities.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

HSBC Holdings is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Bank of America, Nvidia, and Truist Financial. The Motley Fool recommends HSBC Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.