As Bitcoin BTC/USD ETFs near their first anniversary on U.S. exchanges, their journey reflects the extreme ups and downs of the cryptocurrency market.

The funds have had an eventful ride, from a strong start in January 2024 to a series of unpredictable market swings.

Bitcoin ETFs: A Year of Highs and Lows

A Glorious Start for Bitcoin ETFs

On January 11, 2024, the Grayscale Bitcoin Trust GBTC and the iShares Bitcoin Trust IBIT made their debut as some of the first Bitcoin ETFs available in the U.S. That day, trading volumes surged into the billions as millions of shares changed hands.

Despite this initial excitement, both funds illustrated Bitcoin’s well-known volatility. While GBTC ended its first day up 0.5%, IBIT faced a 4% drop after an initial rally.

Read Also: Bitcoin, Ethereum, Dogecoin Lower ‘Corrections Are Typically Short-Lived,’ Trader Prefers Not Going To $89,000 To $90,000

One Year Later: Uneven Results

Fast forward to today, and the performance of both ETFs tells a surprising story. GBTC has soared by 90.97%, and IBIT has surged by 100.30%. However, their short-term activity paints a different picture.

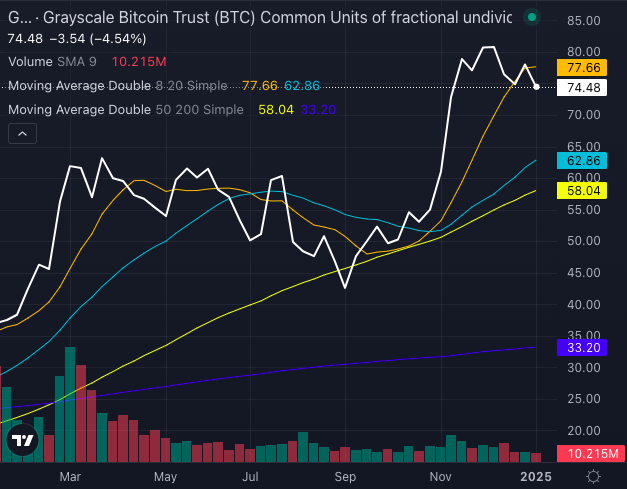

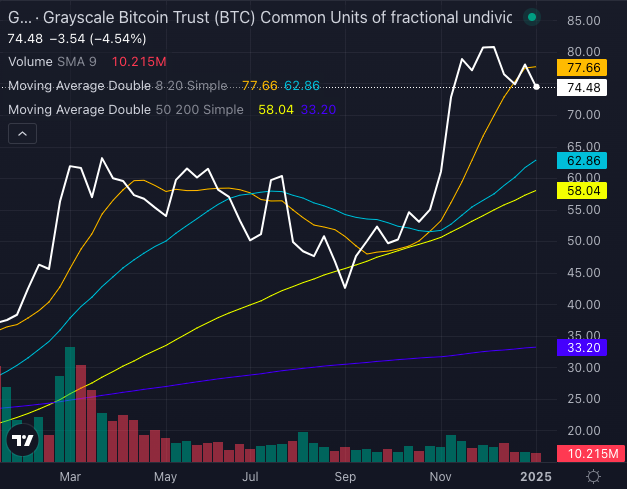

Chart created using Benzinga Pro

- Grayscale Bitcoin Trust (GBTC): Currently trading at $74.48, GBTC is below its eight-day simple moving average, indicating a bearish sentiment in the short term. However, longer-term indicators, like the 20-day, 50-day, and 200-day SMAs, suggest that bullish momentum is building.

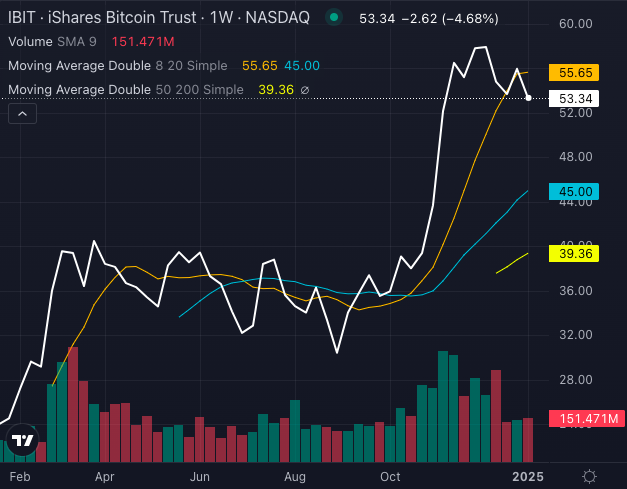

- iShares Bitcoin Trust (IBIT): IBIT trades at $53.34 and shows a similar pattern—short-term bearish signals contrast with a bullish outlook from longer-term averages.

Chart created using Benzinga Pro

Overall, both ETFs are experiencing “moderately bearish” trends, indicating slight selling pressure and uncertainty within the wider crypto market.

Navigating Bitcoin’s Uncertainty

The performance of these ETFs is closely linked to Bitcoin itself, which has faced a recent decline following a significant rally in 2024. Insights from James Toledano, COO of Unity Wallet, shed light on the situation:

“Bitcoin’s sharp pullback is likely driven by a mix of macroeconomic challenges and pressures specific to the market. Speculators are particularly concerned about slower-than-expected rate cuts from the Fed and strong economic data from the U.S.,” Toledano noted in an email.

He also mentioned that investors might be locking in profits after the impressive gains seen in 2024, largely motivated by hopes surrounding Donald Trump‘s pro-crypto policies.

“Now, we wait for Trump’s inauguration on January 20. Many believe that crypto will rally again following this event, suggesting we are experiencing a calm period before another surge,” Toledano added.

Looking Ahead

As Bitcoin ETFs start their second year, investors will likely pay close attention to potential policy changes and the economic landscape under Trump’s administration. With Bitcoin’s volatility expected to persist, these ETFs remain a risky yet intriguing option for traders who can tolerate the unpredictability.

From their lively initial launch to the mixed signals of today, Bitcoin ETFs stand firm in their reputation for unpredictability.

What will 2025 hold—more upward momentum, or is it merely the calm before another storm in the crypto world? Time will soon reveal the answer.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs