eBay’s Stock Climbs Amid New Partnership with Meta

eBay Inc. (EBAY) experienced a notable jump of 9.86% in its stock price during the recent trading session, hitting an intraday high of $71.52. This rise marks a new 52-week record for the company. The surge in stock price followed Meta Platforms (META) announcing plans to showcase select eBay listings on Facebook Marketplace.

This development raises an important question: Should investors take advantage of this momentum? Before we dive into potential investment strategies, let’s thoroughly examine the details surrounding this announcement.

META’s New Strategy to Feature eBay Listings

Meta has rolled out a pilot project that will feature eBay listings on Facebook Marketplace in Germany, France, and the United States, allowing transactions to be completed through eBay. This initiative follows the European Commission’s ruling last November, which determined that Facebook Marketplace had disrupted competition among online marketplaces in Europe.

Is This a Turning Point for eBay?

As eBay grapples with stagnation in its business growth, integrating its listings into Facebook Marketplace could be the boost it needs. Reviewing the third-quarter 2024 earnings, we can see the company is facing challenges in maintaining growth. eBay recorded 133 million active buyers, reflecting only a 1% increase from the previous year. Moreover, its gross merchandise volume (GMV) reached $18.3 billion, marking a modest 2% increase, the second consecutive quarter of growth but still indicating limited expansion.

Further analysis shows that while eBay has seen near 5% growth in luxury fashion and collectibles, other segments remained flat. This indicates that despite promising results in specific categories, the company has struggled to create broader growth across its marketplace.

Should Investors Consider eBay?

By placing select listings on Facebook Marketplace, eBay can tap into Facebook’s extensive user base, significantly boosting visibility and reach. Such increased exposure may facilitate higher sales for sellers on the platform, enhancing eBay’s brand presence across another popular channel. Consequently, this partnership aims to direct more traffic and sales back to eBay, benefiting both sellers and the company.

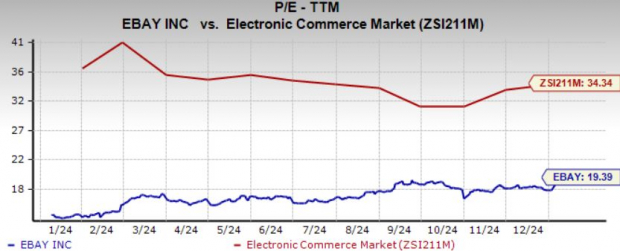

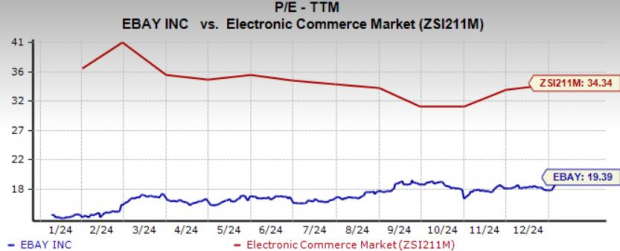

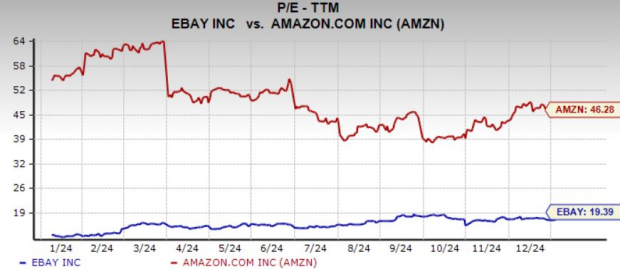

However, investors should be cautious. eBay currently holds a Zacks Rank of #3 (Hold). The recent 10% spike in stock price could be linked to excitement over the new partnership, which remains in the testing phase and may not deliver immediate benefits. Currently, eBay’s stock trades at a trailing 12-month price-to-earnings (P/E) ratio of 19.39x, notably lower than the industry average of 34.34x and the P/E of competitor Amazon.com Inc (AMZN) at 46.28x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Expert Picks for Investors

Among thousands of stocks, five Zacks experts have selected their top picks expected to soar by 100% or more in the coming months. From this group, Director of Research Sheraz Mian has identified one with the most potential upside.

This company targets millennial and Gen Z audiences and reported nearly $1 billion in revenue last quarter. A recent dip positions it as an attractive opportunity. Although not all recommended stocks achieve their targets, this one holds promise, reminiscent of past Zacks picks like Nano-X Imaging, which surged by +129.6% in just nine months.

For those interested in Zacks’ recommendations, you can access the “7 Best Stocks for the Next 30 Days” report for free now.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.