ERO Copper Corp. (ERO) is a copper producer focusing on large-scale production expansion to meet rising market demand.

Since late September, ERO stock has experienced a decline, driven by a diminishing earnings outlook and challenges in the Basic Materials sector.

Understanding ERO Copper

Copper serves as a vital conductor of electricity, making it crucial for electrical wiring, power generation, electronics, and telecom infrastructure.

With the shift towards renewable energy and the rapid growth of data centers and artificial intelligence, the copper market is expected to thrive in the long term.

Due to its extensive applications, copper is often regarded as an economic indicator.

Image Source: Zacks Investment Research

Headquartered in Vancouver, B.C., Ero Copper operates mines across Brazil and has recently diversified into gold mining, benefiting from soaring gold prices.

Recent years have been fruitful for Ero Copper, and its future growth potential looks promising.

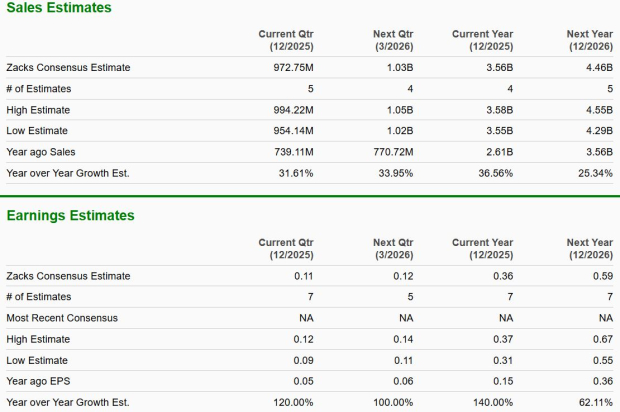

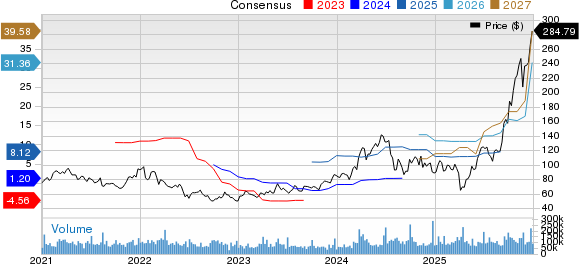

Ero Copper plans to increase its annual copper output by 2025, supported by a new mining project. Revenue is projected to climb by 23% in 2024 and an impressive 82% in FY25, reaching $959 million.

Image Source: Zacks Investment Research

Earnings are anticipated to increase by 26% in FY24 and soar by 194% in FY25, rising from $0.87 in FY23 to $3.23 per share this year.

However, the earnings forecast for Ero Copper has dimmed since the third quarter, with the FY25 consensus EPS dropping by 13% in recent months.

Should Investors Avoid ERO Stock?

Additionally, Ero Copper’s most recent EPS estimate was 35% lower than its already lowered consensus, resulting in a Zacks Rank #5 (Strong Sell). The company has also undergone management changes as part of a succession plan initiated by its board in January 2023.

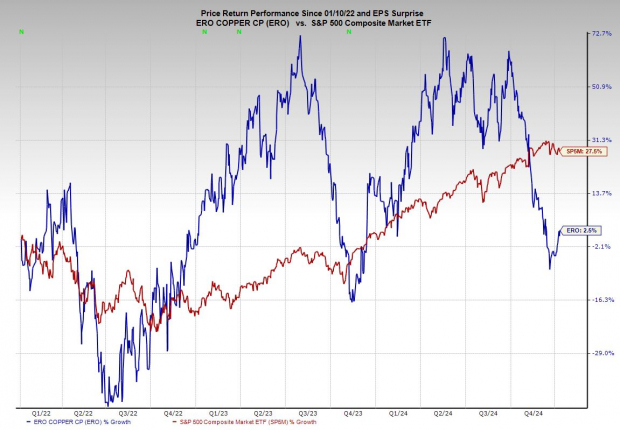

In the last year, ERO shares have fallen by 8%, reflecting trends in the Basic Materials sector. Over the past three years, the stock’s performance has been volatile, increasing by just 3% compared to a 28% rise in the S&P 500.

Investors considering ERO stock may want to wait for the forthcoming earnings report before making any decisions.

Only $1 to See All Zacks’ Buys and Sells

This is real.

A few years ago, we surprised our members by offering a 30-day access to all our stock picks for just $1. This comes with no further obligations.

Thousands have seized this opportunity while others hesitated, thinking there might be a catch. Indeed, there’s a purpose behind it—we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which secured 228 positions with double- and triple-digit gains in 2023 alone.

Ero Copper Corp. (ERO): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.