CCM Global Equity ETF Analysts Predict 10.33% Upside

Recent analysis of the CCM Global Equity ETF (Symbol: CCMG) shows a promising outlook based on its underlying holdings. The implied analyst target price for the ETF is $30.11 per unit, which signals potential gains for investors.

Current Trading Price and Potential Growth

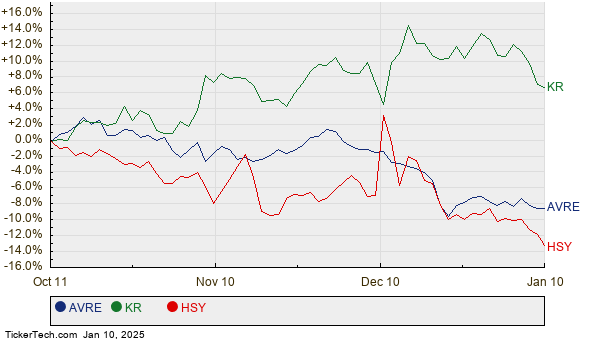

Currently, CCMG trades around $27.29, indicating analysts’ expectations of a 10.33% upside. This optimistic forecast primarily stems from three key holdings poised for growth: the Avantis Real Estate ETF (Symbol: AVRE), Kroger Co (Symbol: KR), and Hershey Company (Symbol: HSY).

Highlights of Underlying Holdings

AVRE currently trades at $41.44 per share, yet analysts project a target price 12.44% higher, showing robust potential. Similarly, KR’s recent price is $58.90, with a projected target of $65.67, suggesting an 11.49% upside. HSY also stands out, trading at $162.22, while analysts anticipate a target of $180.18, representing an 11.07% increase.

Below is a chart depicting the price history of AVRE, KR, and HSY over the past twelve months:

Key Data Summary

The combined weight of AVRE, KR, and HSY within CCMG is 5.67%. Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| CCM Global Equity ETF | CCMG | $27.29 | $30.11 | 10.33% |

| Avantis Real Estate ETF | AVRE | $41.44 | $0.00 | 12.44% |

| Kroger Co | KR | $58.90 | $65.67 | 11.49% |

| Hershey Company | HSY | $162.22 | $180.18 | 11.07% |

Analyst Insights and Considerations

Investors should consider whether the analysts’ targets are justified or overly optimistic, particularly in the context of recent developments in the industry. A high price target can indicate optimism but may lead to potential downgrades if expectations are misaligned with market realities. Investors would benefit from conducting further research in this regard.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Large Caps By Top Market Capitalization

• Institutional Holders of EVHC

• Top Ten Hedge Funds Holding TI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.