Top Oversold Stocks in the Materials Sector: Opportunities for Investors

Investors looking to capitalize on undervalued companies may find promising opportunities among the most oversold stocks in the materials sector.

The Relative Strength Index (RSI) serves as a momentum indicator, assessing a stock’s performance on days of price increases compared to those of declines. Typically, a stock is considered oversold when its RSI drops below 30, suggesting it may be undervalued, according to Benzinga Pro.

Below is the latest compilation of significant oversold stocks in this sector, each with an RSI near or below the 30 mark.

MP Materials Corp MP

- On December 9, MP Materials reported that it had exchanged part of its 0.25% green convertible senior notes due 2026, resulting in a reduction of $25 million in outstanding debt. Over the last month, the company’s stock has declined about 1%, hitting a 52-week low of $10.02.

- RSI Value: 29.9

- MP Price Action: On Wednesday, MP shares closed at $19.38.

- Benzinga Pro’s real-time newsfeed highlighted the latest updates related to MP.

Aptargroup Inc ATR

- On January 7, analyst Matt Roberts from Raymond James began coverage of AptarGroup with an Outperform rating and set a price target of $200. The company’s stock has seen a drop of approximately 10% over the past month, with a 52-week low of $124.94.

- RSI Value: 28.6

- ATR Price Action: Shares of Aptargroup ended at $154.15 on Wednesday.

- Benzinga Pro’s charting tool identified trends in ATR’s stock movement.

Westlake Corp WLK

- On January 7, analyst Charles Neivert from Piper Sandler maintained an Overweight rating on Westlake while lowering the price target from $155 to $135. The stock has fallen around 10% over the past month, reaching a 52-week low of $108.95.

- RSI Value: 19.8

- WLK Price Action: Westlake shares dropped 0.1% to close at $110.54 on Wednesday.

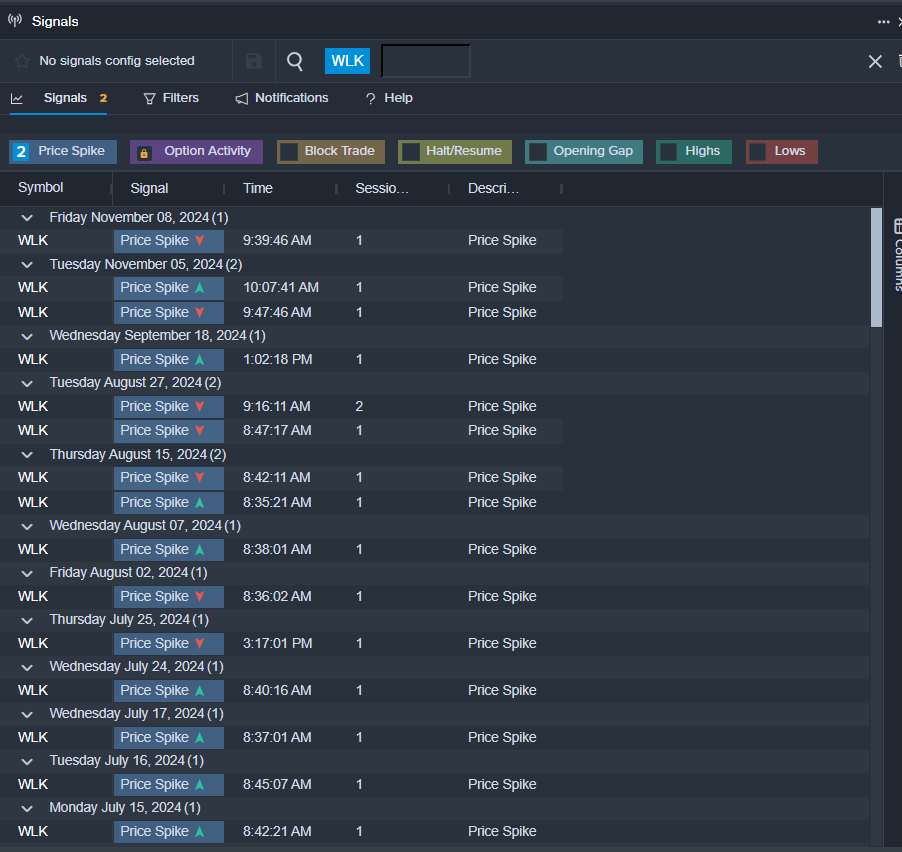

- Benzinga Pro’s signals feature indicated a possible breakout for WLK shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs