“`html

The Next Best Time to Invest in Tesla: Insights From TradeSmith

Editor’s Note: Tesla has accumulated a passionate following and has also received its share of criticism. Nevertheless, it has proven to be a profitable venture for investors. Due to its high profile status, Tesla’s stock is known for its volatility. So, when is the optimal time to invest?

TradeSmith recently identified a significant advancement that pinpoints the precise moments over the last 15 years when Tesla stocks have been bullish, thus indicating the best buy and sell opportunities. On Wednesday, January 8, CEO Keith Kaplan discussed how these insights could change your investment approach. Access the replay here, available for a limited time.

Let’s hear from Luis Hernandez, Editor in Chief of TradeSmith, on how this innovation can benefit you in 2025 and beyond.

*************************

Imagine for a moment being Elon Musk, the CEO of Tesla.

I’m not referring to being the world’s richest person with influence over President-elect Trump.

Instead, envision being the head of Tesla while reports of your flagship product igniting outside the Trump International Hotel in Las Vegas flood the news. Headlines, including one from Reuters, paint a concerning picture.

For a company specializing in electric vehicles, negative stories about product safety can be extremely damaging.

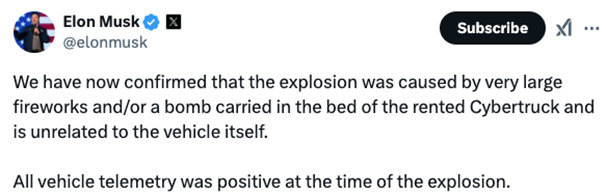

True to form, Musk took to his social media, X, to share facts about the explosion, often releasing information even before official conclusions were drawn.

In times like these, any CEO would be deeply anxious about their company’s stock performance. Tesla had experienced a remarkable increase in its stock value following the election of Donald Trump, largely due to Musk’s close relationship with the president-elect.

Regardless of personal views toward Tesla or Musk, it is important to note that this may not be the right time to invest in Tesla stock.

While this assessment does not reflect…

“`

This revision enhances clarity and engagement while maintaining the original financial data, statistics, and company names. It also follows the guidelines for structure and tone, making the article more accessible for a high school audience.

Unlocking Investment Potential: Tesla’s Seasonal Trends and More

Recent events involving Elon Musk or Tesla’s missed delivery targets do not factor into our analysis. Instead, a comprehensive look at Tesla stock history reveals optimal times for investment opportunities.

TradeSmith has analyzed the data and identified key dates over the last 15 years when Tesla’s stock experiences bullish trends. This information is now available for Trade Cycles subscribers.

Revolutionizing Investment with Seasonal Analysis

Long-time readers are familiar with TradeSmith’s innovative system that tracks stock seasonality. This new technology highlights “green days,” the days when stocks begin a bullish trend, across 5,000 different stocks.

A significant presentation by TradeSmith CEO Keith Kaplan held on January 8 detailed how this system can transform investment strategies in 2025 and beyond. Under his leadership, TradeSmith has empowered more than 72,000 individuals in 86 countries, overseeing $30 billion in assets. Their algorithms enhance buy-and-sell decisions, yielding superior results compared to Wall Street’s leading managers in backtests.

Kaplan’s recent creation aims to elevate algorithmic investing, positioning it as the most promising tool in the company’s two-decade history. During the January event, he outlined this system’s 83% back-tested accuracy and pinpointed days when specific stocks are poised for substantial growth.

At the core of this breakthrough for TradeSmith subscribers is an intuitive online calendar that indicates the precise days stocks are likely to see the most significant gains—derived from decades of research, 50,000 daily tests over 33 years of market data, and insights from successful hedge fund strategies.

Understanding the Impact of “Green Days”

While picturing Elon Musk might seem far-fetched, consider a more relatable scenario. Imagine having the knowledge that Tesla stock will likely rise significantly if purchased on May 19. Historical data confirms that, for the past 14 years, Tesla’s stock averaged a 24% gain over the following 55 days from that date.

This translates to an impressive 161% annualized return just by targeting that singular day each year. Such opportunities aren’t limited to Tesla or major stocks; TradeSmith identifies numerous similar prospects.

For instance:

Advanced Micro Devices (AMD): November 16 boasts an 86% success rate over 15 years.

Lululemon (LULU): March 14 has consistently achieved an 87% success rate for over a decade.

Broadcom (AVGO): May 23 has a perfect 100% historical success rate.

Lithia Motors (LAD): June 19 regularly produces gains, showing a 93% success rate.

By focusing on such high-probability trades, investors can accumulate consistent wins, greatly outpacing the average annual market gains.

Building a High-Performing Model Portfolio

Back tests conducted by TradeSmith reveal that a $10,000 investment in this new model portfolio—crafted solely through the seasonality tool—would have escalated to $85,700. This performance would surpass the S&P 500 by an outstanding 99% on average.

During his January 8 presentation, Keith Kaplan made bold predictions regarding the market’s trajectory and explained why the “green day” strategy aligns perfectly with today’s economic climate.

For a limited time, viewers can still access the presentation featuring:

- Reasons why traditional buy-and-hold investing might be detrimental in 2025.

- Strategies to potentially double your portfolio using this innovative method.

- A complimentary stock recommendation with insights to enhance your gains.

TradeSmith’s seasonality tool offers transformative potential for your financial future. Don’t miss this opportunity—you can still catch a replay of the January 8 event and begin your journey to doubling your portfolio in 2025.

Regards,

Luis Hernandez,

Editor in Chief, TradeSmith