Lucid Group’s Promising Growth Marred by Stock Performance

Investors watch as Lucid Group (NASDAQ: LCID) showcases significant sales growth but struggles with stock value.

Currently valued at less than $10 billion, Lucid Group stands in stark contrast to industry leader Tesla, which boasts a market cap exceeding $1 trillion. Despite substantial vehicle delivery increases—71% compared to last year and a 90% rise in the previous quarter—Lucid has a long way to go to rival Tesla’s dominance. This growth could position Lucid as a well-known brand in the future, but the critical question is: are investors seeing benefits from this potential?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Unexpected Outcomes for Lucid Group Investors

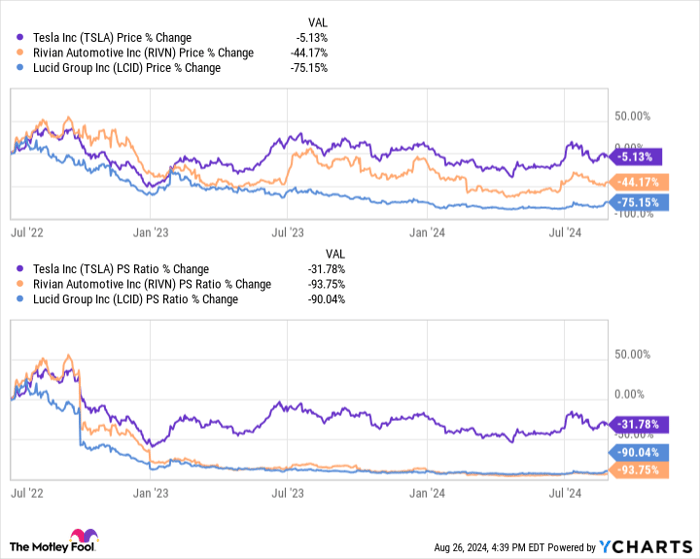

In 2021, numerous electric car companies celebrated IPOs, bagging billions at high valuations. Although these businesses have reported rising sales since then, this has not translated into investor profits.

LCID PS Ratio data by YCharts

Lucid saw a staggering 16,300% increase in sales since 2021. Despite this impressive growth, long-term investors have experienced an approximate 89% loss on their investments. A $50 investment from that time is now worth around $5.

This disconnect between escalating sales and declining stock prices arises not solely from Lucid’s performance but reflects broader market trends. Since 2021, Lucid’s price-to-sales multiple has plummeted by over 99%. Although sales are increasing, they are not doing so quickly enough to satisfy the market’s lowered expectations for Lucid’s future.

While Lucid continues its operational success, it appears the market had already priced in excessive optimism. As noted by Warren Buffett, investment returns hinge on purchase prices. In 2021, stocks like Lucid were overvalued, a common trend among many ecologically focused investments.

With the stock now trading at a significantly lower price compared to previous highs, new investors might find better fortunes. This scenario serves as a reminder of the critical role valuation plays in investment.

Catch This Second Chance for Potential Gains

Have you ever felt like you missed out on investing in top-performing stocks? If so, this news may be of interest.

On rare occasions, our expert team identifies stocks they believe are poised for growth, issuing a “Double Down” stock recommendation. If you’ve worried about missing your chance, now might be an ideal time to invest before opportunities slip away. The following are notable past successes:

- Nvidia: A $1,000 investment back in 2009 would now be worth $363,307!*

- Apple: A $1,000 investment from 2008 would have grown to $45,963!*

- Netflix: If you invested $1,000 in 2004, it would now stand at $471,880!*

Currently, we are offering “Double Down” alerts for three remarkable companies, so don’t miss out on what may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.