Meta Platforms Leads the Charge in Generative AI Development

In 2025, generative artificial intelligence (AI) models are set to become significantly more efficient as various companies advance towards creating agentic AI. This evolution allows AI agents to operate more like humans.

Generative AI is helpful on its own, yet these new agents can function autonomously, offering substantial benefits to users. A frontrunner in this innovation is Meta Platforms (NASDAQ: META), utilizing its Cicero technology for these agents. This could prove transformative for Meta, creating exciting possibilities.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Enhancing Interaction with AI Agents

Meta’s Cicero technology demonstrated its capabilities by participating in a board game called Diplomacy, which blends elements of Risk, poker, and the reality show Survivor. While AI typically excels at technical tasks, negotiating and forming relationships have been its weak points.

Yet, Cicero ranked in the top 10% across 40 games, showcasing that AI can be trained to reason and interact more effectively with humans.

So, what does this mean for Meta?

As a social media giant with platforms like Facebook, Instagram, WhatsApp, Threads, and Messenger, having AI like Cicero that understands human interaction is essential. Meta aims to integrate this technology by creating AI influencers. If users can create these influencers, it may lead to increased engagement, subsequently driving ad revenue growth.

The success of this strategy remains uncertain, but anticipate more AI-generated content populating Meta’s platforms in the coming year.

Moreover, the technology behind Cicero is currently part of Meta’s AI assistant, allowing users to experience its reasoning capabilities. By engaging with this platform, users help train Meta’s Llama large language model (LLM), enhancing its accuracy and complexity.

Nonetheless, these advancements primarily boost Meta’s existing operations rather than introduce entirely new functionalities. This raises the question: Is the stock worth investing in given the current business environment?

Meta’s Stock Remains Attractive Without AI Agents

Meta Platforms has shown strong performance recently. In the third quarter, revenue grew by 19%, with earnings per share (EPS) increasing by 37% year over year. Analysts project a continued upward trend, expecting an average revenue growth of 15% into 2025.

These results are impressive for a company of Meta’s scale, and the stock is selling at a reasonable price.

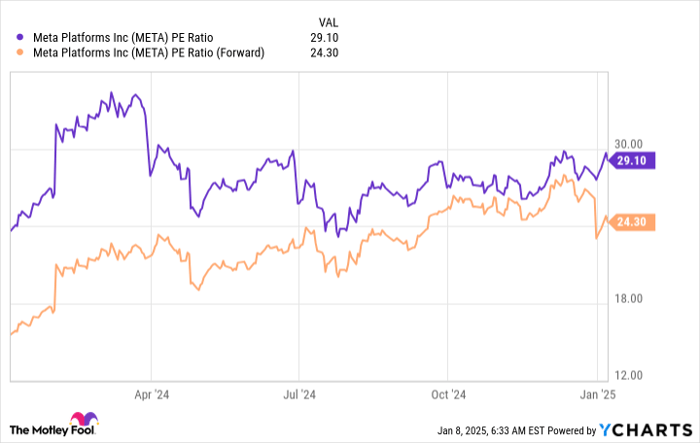

META PE ratio, data by YCharts; PE = price to earnings.

Currently, Meta trades at 29 times trailing earnings and 24 times forward earnings, which is not much higher than the overall market’s valuation. The S&P 500 (SNPINDEX: ^GSPC) trades at around 24.7 times trailing earnings and 21.4 times forward earnings.

Given that other major technology firms, such as Microsoft and Apple, trade at higher premiums despite slower growth, it’s fair to say that Meta’s stock is a good buy at this moment.

Will AI agents significantly impact the company? Alone, they may not, but their successful integration could enhance user engagement and help Meta keep pace with competitors in the social media landscape.

Meta Platforms is still actively engaging in the AI sector, which is crucial for thriving in a future driven by AI. While the stock is worth buying right now, it shouldn’t be viewed solely through the lens of AI agents.

Is Investing $1,000 in Meta Platforms a Good Move Right Now?

Before investing in Meta Platforms, consider the following:

The Motley Fool Stock Advisor team has highlighted what they deem the 10 best stocks to buy at the moment… and Meta Platforms isn’t on the list. These ten stocks are poised for substantial returns in the years to come.

For instance, when Nvidia made this list on April 15, 2005… if you had invested $1,000 then, you’d have $858,668 now!

Stock Advisor offers investors a straightforward guide for building a successful portfolio, with regular updates from analysts and two new stock picks monthly. The Stock Advisor service has more than quadrupled the S&P 500’s returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Randi Zuckerberg, a former market development director and spokesperson for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Keithen Drury does not hold any position in the mentioned stocks. The Motley Fool has positions in and recommends Apple, Meta Platforms, and Microsoft. The Motley Fool recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a full disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.