Nasdaq’s Remarkable Performance: What Could 2025 Hold?

The Nasdaq Composite (NASDAQINDEX: ^IXIC) has experienced impressive growth over the past two years. After a remarkable 43% increase in 2023, it continued with about a 30% gain in 2024, making this one of its best-performing periods ever.

However, a strong performance does not necessarily indicate an impending correction in 2025. Historical trends suggest otherwise. Since 1972, years that achieve 30% returns are typically followed by an average return of 19%. This momentum effect makes it more likely for investors to see continued positive performance in 2025, based on past data.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to purchase at this time. See the 10 stocks »

Given historical patterns, the Nasdaq could continue to rise in 2025. One particular artificial intelligence (AI) stock stands out as a strong buy before this potential surge.

The AI Narrative and What to Consider

The Nasdaq’s growth over the past two years has largely been fueled by the AI surge. Many AI-related stocks, like Nvidia, are now trading at very high earnings multiples. Yet, one stock remains undervalued and is an appealing option for 2025: Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Despite challenges about its market share due to new AI tools like ChatGPT, Alphabet’s core business remains strong. Estimates show that Google Search holds around 90% of the global search engine market share, which has stayed stable for years.

Google is deeply integrated into daily digital activities, serving billions of users. The company is now in a position to enhance its offerings with new AI features like updated search result summaries, the Gemini chatbot, and Google Lens, which allows users to search visually. These innovations are set to create new advertising opportunities and boost revenue.

In the last quarter, Google Search revenue increased by 12%, reaching $49 billion.

Alphabet’s Growth Prospects

Alphabet has several strategies to sustain its revenue and earnings growth. The AI momentum will likely support Google Search; moreover, YouTube continues to expand its market share in video streaming, with a revenue increase of 12% last quarter. Google Cloud is also making significant contributions, reporting a revenue surge of 35% year-over-year. This segment is on track to reach $100 billion in annual revenue in the coming years.

Alphabet is also enhancing its profitability by increasing its operating margin, which rose to 32% last quarter, up from 28% a year earlier. As the company scales, this operating leverage will further enhance its earnings performance over time.

Additionally, Alphabet has been actively buying back stock, reducing the total shares outstanding by 11% over the past five years, which elevates earnings per share (EPS).

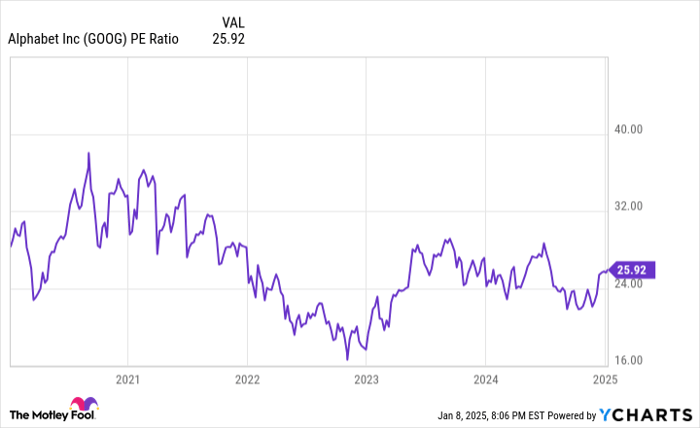

GOOG PE Ratio data by YCharts

Reasons to Consider Buying Alphabet Stock

These five factors position Alphabet for a double-digit EPS growth rate over the next five years and possibly beyond. Currently, the stock is valued at a price-to-earnings ratio (P/E) of 26, which is lower than both the S&P 500 (SNPINDEX: ^GSPC) and the Nasdaq Composite, both of which average over 30.

The AI boom is likely to elevate Alphabet’s EPS above the market average, while its P/E remains below that average. This creates a favorable opportunity to invest in Alphabet stock. Many investors might consider adding this stock to their portfolio and holding on through 2025 and beyond.

Is Alphabet a Good Investment for $1,000?

Before you make a decision to invest in Alphabet, there are a few things to consider:

The Motley Fool Stock Advisor team recently pointed out their list of the 10 best stocks to invest in now, and Alphabet did not make the cut. The selected stocks are believed to hold the potential for substantial returns in the near future.

Reflecting on when Nvidia was recommended on April 15, 2005… a $1,000 investment then would now be worth $832,928!

Stock Advisor provides investors with straightforward guidance, including portfolio-building strategies and regular analyst updates, along with two new stock picks each month. The Stock Advisor program has achieved returns more than four times greater than the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.