2024 Stock Market Report: Top Performers and Investment Opportunities

The stock market had another successful year. The S&P 500 , Nasdaq Composite, and Dow Jones Industrial Average finished the year with impressive gains of 23%, 29%, and 13%, respectively.

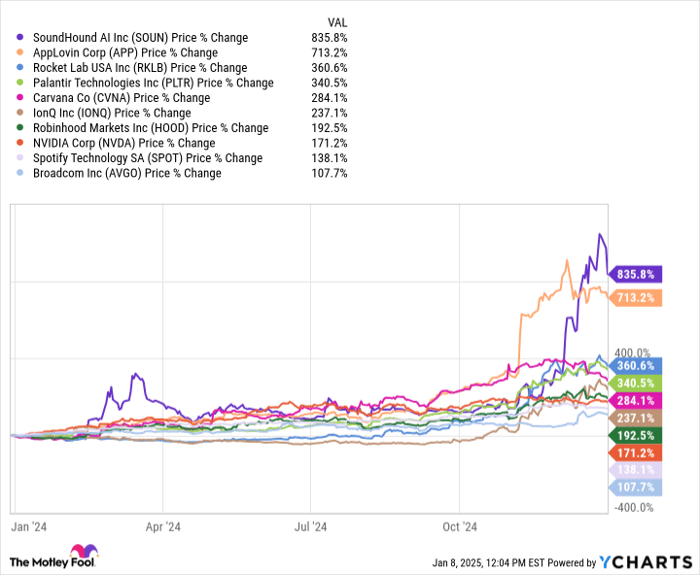

However, some individual stocks performed even better. Let’s take a closer look at 10 of the stock market’s best performers from last year, along with five companies I’m excited to invest in right now.

Wondering where to invest $1,000 today? Our analysts have identified the 10 best stocks to consider. Explore the top stocks »

Image source: Getty Images.

Top 10 Stocks that Doubled in 2024

Here are 10 stocks that more than doubled in value last year, listed from highest to lowest returns:

- SoundHound AI

- AppLovin

- Rocket Lab USA

- Palantir Technologies

- Carvana

- IonQ

- Robinhood

- Nvidia

- Spotify

- Broadcom

SOUN data by YCharts

Many stocks on this list are connected to artificial intelligence (AI). Five companies—SoundHound, AppLovin, Palantir Technologies, Nvidia, and Broadcom—are significantly involved in AI technology.

Other notable stocks come from various sectors, including investment services (Robinhood), automotive (Carvana), aerospace (Rocket Lab USA), streaming (Spotify), and quantum computing (IonQ).

While all these stocks are worth noting, I have identified five that I am particularly eager to consider for investment.

1. Rocket Lab USA

Rocket Lab stands out as a company that specializes in space logistics, providing services like satellite construction and space launches.

In the past year, Rocket Lab successfully launched 15 rockets from locations in New Zealand and Virginia. Their clientele includes both commercial and government sectors, featuring names like NASA and the U.S. Space Force.

With a revenue increase of 55% reported for the quarter ending on September 30, Rocket Lab indicates a promising future in the expanding space economy, which investors should keep an eye on into 2025.

2. Palantir Technologies

Palantir is strategically positioned to benefit from the growing AI landscape. As organizations aim to improve efficiency through AI integration, Palantir offers one of the few platforms capable of helping them achieve these goals.

The company has experienced “unrelenting” demand for its services, reflecting in a remarkable 30% year-over-year revenue growth for the quarter ending September 30.

Though shares of Palantir may seem costly, with a price-to-sales ratio exceeding 60x, it could prove to be a worthwhile investment for long-term holders in a world increasingly influenced by AI.

3. Robinhood

Robinhood saw its share price surge nearly 200% last year as the company excelled in various areas. Its potential for becoming a leading player during a pivotal shift in investment approaches makes it a stock to consider for 2025 and beyond.

Wealth Transfer Fuels Growth for Robinhood and Other Power Players

The Great Wealth Transfer Begins

The Great Wealth Transfer (GWT) is underway. This phenomenon refers to the transfer of over $50 trillion in wealth from baby boomers to younger generations over the coming decades.

Robinhood Capitalizes on a Changing Landscape

As a platform popular among younger investors, Robinhood is positioned to thrive during this transfer. In its latest quarterly report for the three months ending September 30, the company achieved a remarkable 32% revenue growth, propelled by a surge in both crypto and options trading. Additionally, Robinhood’s assets under custody (AUC) jumped 76% to $152 billion.

The GWT is already making its mark, suggesting that Robinhood is a stock to watch closely.

Spotify: A Stock Revival

Next on the list is Spotify.

I’ve been a long-time fan of Spotify, and last year it proved worthwhile, with shares climbing over 138%. Following the stock’s low in 2022, its price has risen more than 400%.

This impressive rally can be attributed to two key factors. First, many tech stocks, especially in streaming, were undervalued during 2022 as investors braced for a recession that never really happened.

Second, Spotify’s management implemented strategic changes that bolstered the company’s overall performance. CEO Daniel Ek made the decision to cut back on unprofitable areas and refocused efforts on music streaming.

Thanks to these adjustments, the company has regularly reported profits.

In investing, simplicity often works best. Find a growing company led by strong management, invest, and allow your shares to appreciate over time. That’s my approach with Spotify.

Nvidia: The AI Powerhouse

Lastly, let’s discuss Nvidia.

Nvidia is at the forefront of the AI revolution. Their graphics processing units (GPUs) are the most sought-after AI chips, known for their superior performance and design.

Some investors worry it may be too late to consider Nvidia stock, but those fears might be overblown. Look at Nvidia’s sales: they skyrocketed from around $26 billion in 2022 to over $113 billion today. Analysts project that by fiscal year 2026, Nvidia could see sales approach $200 billion.

This level of revenue would place Nvidia among the elite, with only 14 American companies, including corporate giants like Apple, Amazon, Microsoft, ExxonMobil, and Walmart, boasting annual revenues above that threshold.

In conclusion, there is still ample opportunity for investors to consider Nvidia. With the AI ecosystem still expanding, Nvidia is poised to be a major player for years to come. I plan to invest as we move into 2025.

Should You Invest $1,000 in Rocket Lab USA Right Now?

Before considering Rocket Lab USA stock, take this into account:

The Motley Fool Stock Advisor team recently identified what they believe are the 10 best stocks for investors to buy now… and Rocket Lab USA was not included in this list. The chosen stocks have the potential to yield significant returns in the future.

For reference, when Nvidia made this list on April 15, 2005, a $1,000 investment would have grown to $832,928!*

Stock Advisor offers a straightforward approach for investors to achieve success, featuring portfolio-building guidance, regular updates from analysts, and two new stock picks every month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since its inception in 2002*.

Discover the 10 stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch holds positions in Amazon, ExxonMobil, Nvidia, Rocket Lab USA, and Spotify Technology. The Motley Fool recommends Amazon, AppLovin, Apple, Microsoft, Nvidia, Palantir Technologies, Spotify Technology, and Walmart. The Motley Fool also advises on Rocket Lab USA, along with certain options on Microsoft. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.