Exploring the Upside Potential of SPDR S&P 400 Mid CapGrowth ETF (MDYG)

At ETF Channel, we’ve analyzed the ETFs in our coverage universe. We specifically examined each holding’s trading price against the average analyst’s 12-month target price, deriving a weighted average target for the ETF itself. For the SPDR S&P 400 Mid CapGrowth ETF (Symbol: MDYG), we found an implied target price of $100.20 per unit.

Analysts Predict Upside for MDYG

Currently, MDYG is trading at approximately $86.63 per unit. This suggests analysts believe there’s a potential upside of 15.66% based on the average targets of its underlying holdings. Some notable holdings contributing to this potential include Cabot Corp. (Symbol: CBT), Voya Financial Inc. (Symbol: VOYA), and KB HOME (Symbol: KBH). For instance, while CBT recently traded at $86.71 per share, its average target price is $115.20, indicating a significant upside of 32.86%. Similarly, VOYA is projected to rise 29.63% from its recent price of $66.40, as analysts anticipate its target price will reach $86.08. Additionally, KBH shows a potential increase of 28.52% from its current price of $63.19, with an expected target of $81.21.

Performance Overview

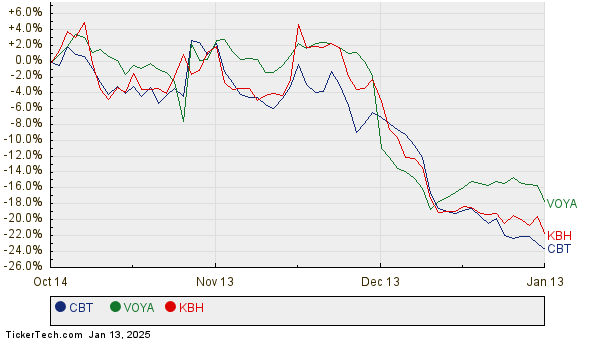

Please refer to the twelve-month price history chart below, which compares the stock performances of CBT, VOYA, and KBH:

Target Price Summary

Below is a summary table highlighting the current analyst target prices for the aforementioned stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 400 Mid CapGrowth ETF | MDYG | $86.63 | $100.20 | 15.66% |

| Cabot Corp. | CBT | $86.71 | $115.20 | 32.86% |

| Voya Financial Inc | VOYA | $66.40 | $86.08 | 29.63% |

| KB HOME | KBH | $63.19 | $81.21 | 28.52% |

Are Analysts’ Targets Realistic?

Investors may wonder if these price targets are justified or perhaps overly optimistic. It’s essential to assess whether analysts’ expectations align with recent developments in these companies and their industries. A high target price can suggest positive sentiment but could also lead to downgrades if market conditions change. Investors are encouraged to conduct thorough research and consider these dynamics before making investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SPIR Insider Buying

• UZA Historical Stock Prices

• CEM Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.