Analysts Predict Strong Upside for TCW Transform 500 ETF and Key Holdings

In a recent analysis by ETF Channel, we examined the underlying stocks of the TCW Transform 500 ETF (Symbol: VOTE). By comparing the trading prices of these stocks to the average 12-month target prices suggested by analysts, we computed an overall implied target price for the ETF itself.

The findings indicate that the implied target price for VOTE is $78.22 per unit. Currently trading at approximately $68.17 per unit, this suggests that analysts anticipate a 14.74% upside for the ETF, based on the performance of its underlying assets.

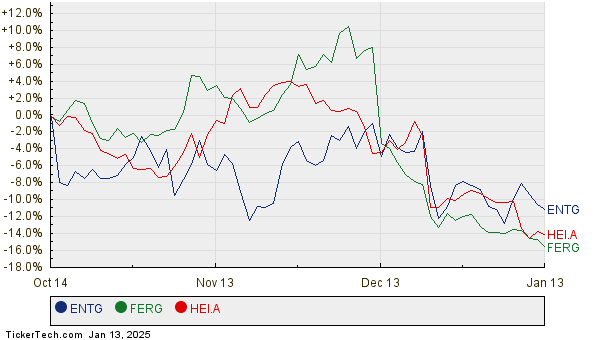

Among VOTE’s holdings, several stand out for their significant potential. Entegris Inc (Symbol: ENTG) shows an impressive upside of 36.05%, with a current trading price of $98.92 and an average target of $134.58. Ferguson Enterprises Inc (Symbol: FERG) looks favorable as well, with a 30.32% upside projected from its recent price of $169.75 to a target of $221.21. Similarly, HEICO CORP-CLASS A (Symbol: HEI.A) is expected to reach $230.00, marking a potential increase of 29.27% from its current price of $177.92. Below is a chart that shows the stock performance of ENTG, FERG, and HEI.A over the past twelve months:

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| TCW Transform 500 ETF | VOTE | $68.17 | $78.22 | 14.74% |

| Entegris Inc | ENTG | $98.92 | $134.58 | 36.05% |

| Ferguson Enterprises Inc | FERG | $169.75 | $221.21 | 30.32% |

| HEICO CORP-CLASS A | HEI.A | $177.92 | $230.00 | 29.27% |

These analyst predictions raise critical questions for investors. Are they justified, or could they be overly optimistic about these stocks’ potential over the next twelve months? Markets can shift quickly, and high analysts’ targets might indicate confidence or could be outdated. Understanding these dynamics will be essential for any informed investment decision.

![]() Discover 10 ETFs With the Most Upside to Analyst Targets »

Discover 10 ETFs With the Most Upside to Analyst Targets »

Also see:

Top Ten Hedge Funds Holding FENI

Top Ten Hedge Funds Holding SMED

ETFs Holding SHLX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.