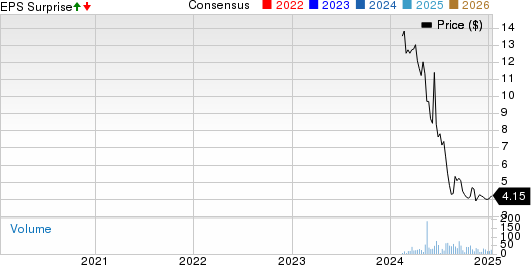

AXIL Brands Posts Mixed Q2 Results Amid Market Turmoil

Shares of AXIL Brands, Inc. (AXIL) saw a slight increase of 0.4% following the company’s earnings announcement for the second quarter of fiscal 2025. This performance is noteworthy compared to the S&P 500 index, which experienced a 1.5% drop during the same period. Over the past month, AXIL shares lost 1.2%, significantly better than the S&P 500’s decline of 6.9%, illustrating relative strength in a challenging market.

Quarterly Revenue and Earnings Breakdown

In its second-quarter fiscal 2025 report, AXIL Brands announced diluted earnings per share of 8 cents, up 60% from 5 cents in the same quarter last year. This increase can be attributed to a higher weighted average share count.

The company reported net sales of $7.73 million, down 8.2% compared to $8.42 million in the prior-year period. Management explained this decline was primarily due to shifts in the timing of post-Thanksgiving sales events, which are now recorded in the third quarter rather than the second quarter as previously established.

Performance by Segment

Hearing Enhancement & Protection: This segment remains the largest for AXIL, generating revenues of $7.45 million, down 9.1% from $8.19 million in the second quarter of fiscal 2024. Gross profit for this segment also decreased by 12.5%, from $6.09 million to $5.32 million, reflecting a decline in margins associated with increased sales of lower-margin products.

Hair & Skin Care: This segment performed better, contributing $284,545 to revenues—a 23.3% increase from $230,741 in the prior-year quarter. Gross profit remained stable, rising slightly to $173,507 from $172,583, mainly due to stronger distributor sales countering a broader dip in direct-to-consumer sales.

Financial Health Overview

AXIL’s overall gross profit fell by 12.1% year over year to $5.5 million, with gross margin decreasing from 74.3% to 71.1% in the same period. Higher costs for sales and increased discounts contributed to this margin erosion.

Operating income dropped 46.8%, from $1.26 million in the second quarter of fiscal 2024 to $0.7 million, resulting in an operating margin decline to 8.7% from 15%. Additionally, the net profit margin fell to 8.2% compared to 12.1% in the prior-year quarter, driven by lower sales and rising costs.

Adjusted EBITDA decreased 28.9% year over year to $1.01 million, with the adjusted EBITDA margin contracting from 17% to 13.1%. This decline indicates issues with absorbing fixed costs due to decreased sales volumes.

Cost Management Efforts

Total operating expenses for the quarter were $4.83 million, a 3.4% decrease from $5 million in the same quarter of fiscal 2024. This reduction was chiefly attributed to a $220,000 decline in advertising costs and a reduction in accounts payable, although expenses for stock-based compensation and consulting related to geographic expansion increased.

Selling, general and administrative expenses saw a decrease of 2.7%, dropping to $3.97 million from $4.08 million, while research and development expenses remained unchanged at $0.86 million.

Cash Position and Debt Management

As of November 30, 2024, AXIL Brands had $5.21 million in cash, a considerable increase from $3.25 million as of May 31, 2024. This improvement is attributed to better management of working capital and reduced advertising expenditure. Total debt stood at $3.81 million, relatively stable compared to $3.80 million six months prior, reflecting prudent balance sheet strategies.

The net cash position witness significant growth, improving to $1.4 million from a net debt of $0.55 million at the end of the second quarter of fiscal 2024, offering enhanced financial flexibility for potential growth initiatives.

Management Insights and Future Outlook

Management reiterated its commitment to expanding both geographically and in product offerings. Approximately $130,000 in consulting fees were spent in the quarter to support these initiatives, although the anticipated benefits have yet to fully materialize.

Efforts are also underway to enhance e-commerce strategies and diversify selling channels through partnerships and retail distribution. The leadership team remains hopeful for long-term growth and expanding market share.

Challenges and Opportunities Ahead

The company’s revenue shortfall primarily stemmed from timing differences in recognizing post-Thanksgiving sales. Additionally, increases in stock-based compensation and costs associated with new products added to margin pressures. Fortunately, reductions in advertising and administrative expenses provided some relief to earnings.

Recent Developments

In a noteworthy move, AXIL transitioned to a new corporate headquarters and warehouse in the second quarter of fiscal 2025, highlighting its ambition for operational efficiency. There were no significant alterations to product warranty or revenue recognition practices. The strategic shift towards high-tech hearing and audio enhancement remains a pivotal growth strategy for the company.

Top Stock Picks for Future Growth

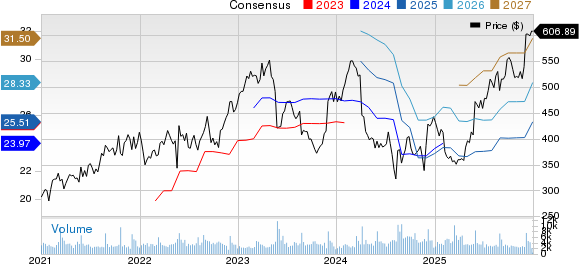

From a selection of thousands of stocks, five Zacks experts have identified their top picks expected to rise by +100% or more in the coming months. Among these, the Director of Research has selected one stock believed to have the most explosive potential.

This company targets millennial and Gen Z demographics, reporting nearly $1 billion in revenue for the last quarter. Recent pullbacks in stock price present an optimal entry point for investors. Like previous successful picks, such as Nano-X Imaging, which surged +129.6% in less than nine months, this recommendation could also prove highly lucrative.

Free: See Our Top Stock And 4 Runners Up

AXIL Brands, Inc. (AXIL): Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.