Key Insights

- Dividends offer a way to earn passive income from stocks, complementing traditional buying and selling strategies.

- Dividend Aristocrats are companies that have raised their dividend payments for at least 25 consecutive years.

- Notable companies providing reliable dividends include Walmart, Kimberly Clark, and Altria.

Investors widely appreciate dividends, which can generate passive income and mitigate losses in other areas of their investment portfolios.

When selecting dividend stocks, those with a reliable history of increasing payouts are often prioritized, showcasing their dedication to rewarding shareholders over time.

For consistent dividend growth, consider the Dividend Aristocrats, including Walmart (WMT), Kimberly Clark (KMB), and Altria (MO). Let’s explore each one further.

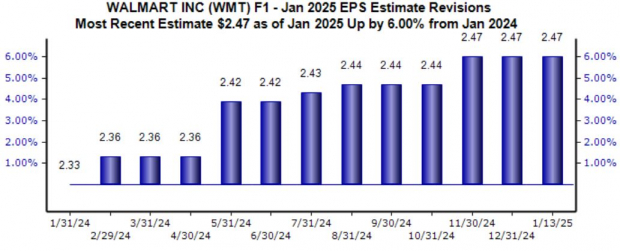

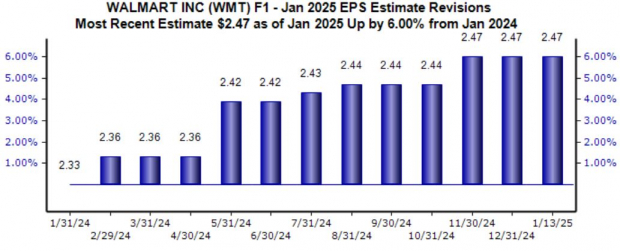

Walmart’s Impressive Performance

Over the past year, Walmart shares have surged by 70%, primarily driven by robust quarterly earnings. The projection for the current fiscal year remains positive, with a consensus estimate of $2.47 per share, indicating a predicted 12% growth compared to last year.

Image Source: Zacks Investment Research

This impressive stock performance has resulted in a lower annual dividend yield. However, Walmart’s 3% annualized dividend growth rate over the past five years illustrates a strong commitment to shareholder returns. The company combines growth with a shareholder-friendly approach effectively.

Below is a chart showing the company’s quarterly dividends, tracked on a trailing twelve-month basis.

Image Source: Zacks Investment Research

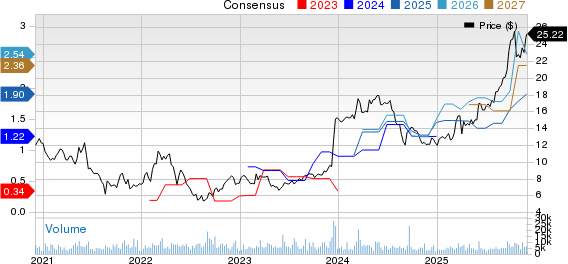

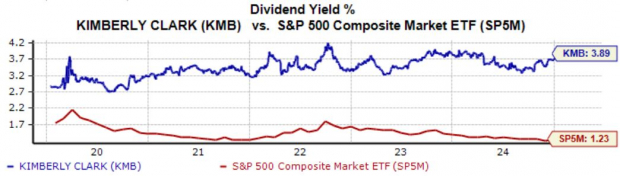

Kimberly Clark Exhibits Stability

Kimberly Clark (KMB) has seen modest growth, with shares increasing by 6% over the last year. Although this lagged behind the S&P 500, the stock maintains its appeal due to its defensive characteristics and consistent dividend payments.

As a company in the consumer staples sector, KMB benefits from steady demand for its products, regardless of economic fluctuations.

The firm has achieved an annual dividend growth rate of 2.9% and has a payout ratio of 67%, which is within a healthy range. Currently, the stock offers a dividend yield of 3.9%, significantly higher than the S&P 500 average.

Image Source: Zacks Investment Research

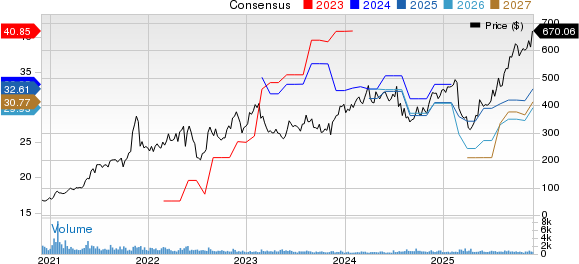

Altria Delivers Substantial Returns

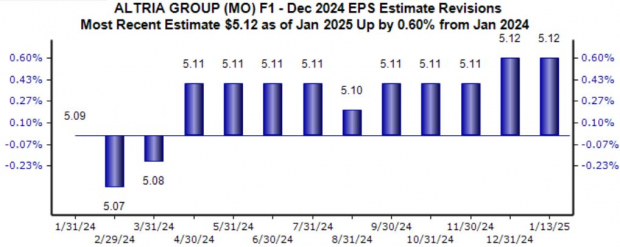

Altria (MO) continues to attract income-focused investors with its significant dividends and a favorable Zacks Rank #2 (Buy). For the current fiscal year, analysts project earnings of $5.12 per share, which indicates a year-over-year growth of 4%.

Image Source: Zacks Investment Research

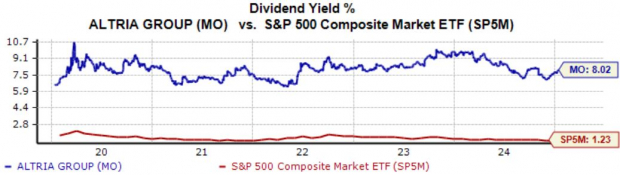

With a current yield of 8% annually, Altria proves to be a high-yield stock. Additionally, it has achieved a 4.3% annualized dividend growth rate over the past five years. The chart below clearly shows how Altria’s yield stands out compared to the S&P 500.

Image Source: Zacks Investment Research

Conclusion

Dividends remain a popular investment choice, allowing investors to benefit from their investments regardless of market conditions. They serve as a vital component for anyone looking for passive income and a safeguard against potential losses.

For those interested in stocks with a strong history of consistent payouts, Altria (MO), Kimberly Clark (KMB), and Walmart (WMT) are worthy of consideration.

Discover: 5 Stocks Set to Benefit from Infrastructure Investments

The U.S. government is allocating trillions of dollars to improve infrastructure, including roads, bridges, and renewable energy projects.

Explore 5 surprising stocks that are poised to capitalize on this wave of spending, which is just beginning.

Download your free guide on how to profit from the trillion-dollar infrastructure opportunity today.

Walmart Inc. (WMT): Free Stock Analysis Report

Altria Group, Inc. (MO): Free Stock Analysis Report

Kimberly-Clark Corporation (KMB): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.