Optimism in the Market: December CPI Shows Signs of Easing Inflation

This morning’s Consumer Price Index (CPI) report exceeded expectations, revealing softer inflation. With this encouraging data, stocks reacted positively, starting a climb upward.

Some analysts may dismiss this rally as a “head fake” or a “dead-cat bounce,” but many believe this trend is likely to continue, with stocks poised for significant gains in the coming weeks.

Inflation has dominated the market narrative ever since the onset of COVID-19 nearly five years ago. The latest CPI findings suggest that inflation may now be moderating, allowing for a more favorable market environment.

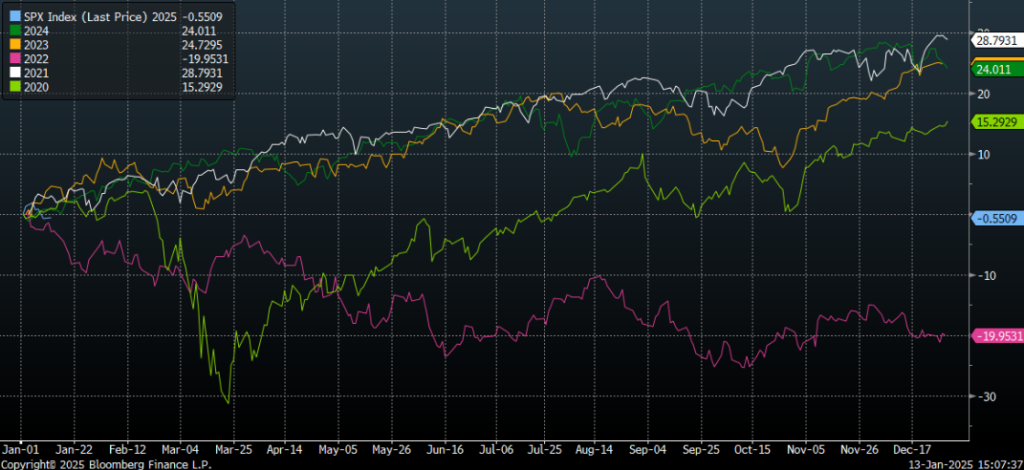

Historically, when inflation remains low—as it did in 2021, 2023, and 2024—the market thrived, with the S&P 500 climbing over 20%. Conversely, in 2022, high inflation drastically hindered the market, resulting in an approximate 20% downturn for the S&P.

To summarize, inflation has been the key factor influencing stock market trends over the past five years—lower inflation generally leads to market growth, while rising inflation tends to drag stocks down.

Insights from December’s CPI Data

Throughout late 2024 and early 2025, negative inflation trends were evident, with the headline CPI rate increasing in October and November without any changes in core CPI.

These trends prompted the market to reduce rate-cut expectations and raised Treasury yields, putting additional pressure on stock prices. However, the latest CPI report suggests that inflation is becoming a favorable factor for markets once again.

In December, the headline CPI rate did go up, but at a slower pace than in preceding months. Notably, core CPI experienced a decline for the first time in several months, with predictions indicating further decreases next month.

This points to a potential turning point in inflation trends that could further stimulate market growth.

The report’s breakdown highlights that most categories are experiencing declining inflation rates. Among the six main sectors included in the CPI report—Food, Energy, All Other Commodities, Shelter, Medical Care Services, and Transportation Services—only one showed a notable rise in December. The others experienced either flat or decreasing rates of inflation.

Despite a notable rise in Energy prices, current trends indicate that they are stabilizing. The slight inflation rise in this sector should be viewed as a return to normal levels rather than concerning.

In conclusion, signs point to inflation shifting in a positive direction again.

Stocks Respond Positively to Inflation Data

Market Reaction to Recent Inflation Figures

After a challenging December and a rocky start to 2025, the stock market is experiencing a notable rally today. This surge appears to be technically significant, marked by the S&P 500 rebounding from the lower end of its 2024 uptrend channel, alongside its 100-day moving average.

This development signals what could be the beginning of a significant upward trend for the market.

In light of these shifts, we are advising our subscribers to invest in the ongoing stock market recovery.

For the initial weeks of the year, investors adopted a wait-and-see approach. However, we now believe the time is right to engage fully in this rally with some fresh recommendations.

To identify promising stocks for this upcoming rally, we are looking to insights from Elon Musk, the world’s wealthiest individual, and his company, xAI.

We believe this startup is poised to become a key player in the next wave of the AI Boom.

Although xAI is not publicly traded yet, we’ve discovered a potential ‘backdoor’ investment opportunity in the firm.

Explore more about xAI and how it could boost your portfolio today.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. Keep updated with Luke’s market analysis in our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.