Nvidia’s Spectacular Rise and Amazon’s Stability: A Contrasting Financial Portrait

Key Takeaways

- Nvidia stock gained more than 140% over the past year thanks to investor interest in AI.

- Some analysts worry there is a growing bubble in AI stocks that may someday burst.

- Are stocks like Amazon a more reliable tech play to include in your portfolio?

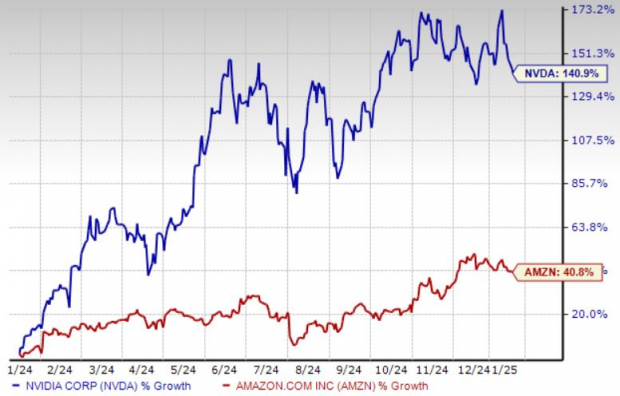

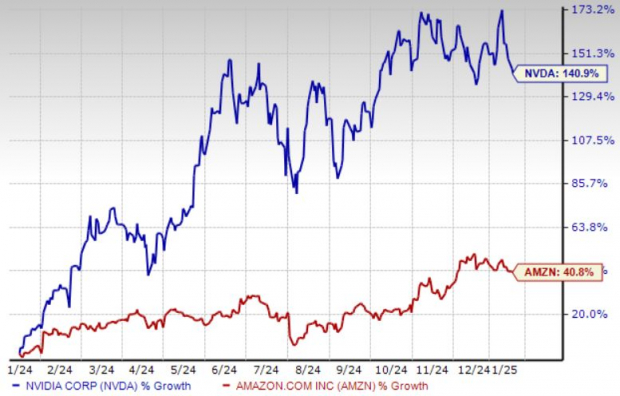

NVIDIA (NVDA) has emerged as a star in the stock market, boasting an impressive gain of 140.9% over the past year, largely fueled by the rise of artificial intelligence (AI).

However, concerns about a potential AI bubble have analysts pondering whether investors might prefer a more stable technology stock. The focus now shifts to Amazon.com, Inc. (AMZN) as a potential alternative that could capture investors’ interest due to its more diversified portfolio.

Let’s explore Amazon’s ability to sustain its growth amidst these concerns, especially with a recent performance indicating a 40.8% increase in stock price over the past year.

One-Year Price Chart

Image Source: Zacks Investment Research

Exploring Revenue Sources: Amazon vs. NVIDIA

Amazon

Revenue Streams Beyond AI: Amazon’s main revenue segments include its cloud computing platform (AWS), advertising, and Prime memberships. In the third quarter of 2024, AWS showed strong performance with a $110 billion annualized run rate, growing 19.1% year-over-year. Additionally, its advertising revenue increased by 18.8% year-over-year, generating $14.3 billion in the same quarter. The rise in Prime memberships has been supported by appealing perks like faster delivery and discounts on groceries.

AI Usage as a Support Function: Though Amazon employs AI to enhance its services, including AWS, customer experience, and operations, AI is not its primary source of growth but rather a tool that boosts efficiency across its varied business operations.

NVIDIA

AI-Centric Growth: NVIDIA’s impressive revenue figures are centered around its leadership in AI markets, with third-quarter 2025 revenues soaring to $35.08 billion, marking a 94% increase year-over-year. Its data center segment, crucial for AI training and tasks, alone brought in $30.8 billion due to the rising demand for AI technology.

AI as the Core Business: NVIDIA’s role in the AI landscape is critical as it provides essential infrastructure for AI model training and inference. Their graphics processing units (GPUs) and software ecosystem greatly support this field, resulting in a growth in both AI workloads and cloud service needs. Furthermore, Microsoft Corp. (MSFT) has also benefited significantly from advancements in AI.

Why Amazon May Be the Better Investment

Many experts suggest that the recent boom in AI stocks could last a few years before facing a downturn. Among hardware companies, NVIDIA’s dependence on AI growth puts it at greater risk of volatility. While NVIDIA has positioned itself as a leader in a high-demand area, its revenue is heavily tied to the AI sector, making it vulnerable if interest in AI applications declines.

Conversely, Amazon’s diversified business strategy could enable it to withstand a potential fall in AI investments. Its earnings are derived from various sectors beyond AI, such as e-commerce and logistics, while AWS supports a broad array of services, reducing reliance on AI performance. This diversified approach positions Amazon to remain resilient if the anticipated AI bubble were to deflate.

AMZN vs. NVDA: Which is the Better Stock?

Thus, Amazon is rated with a Zacks Rank #1 (Strong Buy), reflecting a more balanced investment strategy compared to NVIDIA, which has a Zacks Rank #2 (Buy) but is heavily focused on AI.

For those who prioritize AI and can accept higher risks, NVIDIA remains an enticing option.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing rapidly as we shift away from fossil fuels like oil and natural gas. Nuclear energy offers a viable alternative.

Recently, leaders from the US and 21 other countries pledged to increase global nuclear energy capacity by threefold. Such an ambitious transition could lead to substantial profits for nuclear-related stocks for investors who act early.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, outlines the key players and technologies poised to benefit, including three standout stocks primed for significant opportunities.

Download your free copy of Atomic Opportunity: Nuclear Energy’s Comeback today.

For the latest suggestions from Zacks Investment Research, you can also download 7 Best Stocks for the Next 30 Days free of charge.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.