Explore Oversold Stocks in Consumer Discretionary: A Potential Buying Opportunity

Investors may find a chance to purchase undervalued companies in the consumer discretionary sector, as several stocks are currently considered oversold.

The Relative Strength Index (RSI) is a tool used to assess the momentum of a stock by comparing days of price increases to days of price declines. An RSI below 30 often signals that a stock is oversold, suggesting a potential rebound in price, according to Benzinga Pro.

Below is a list of key players in the consumer discretionary sector, each showing an RSI close to or below 30.

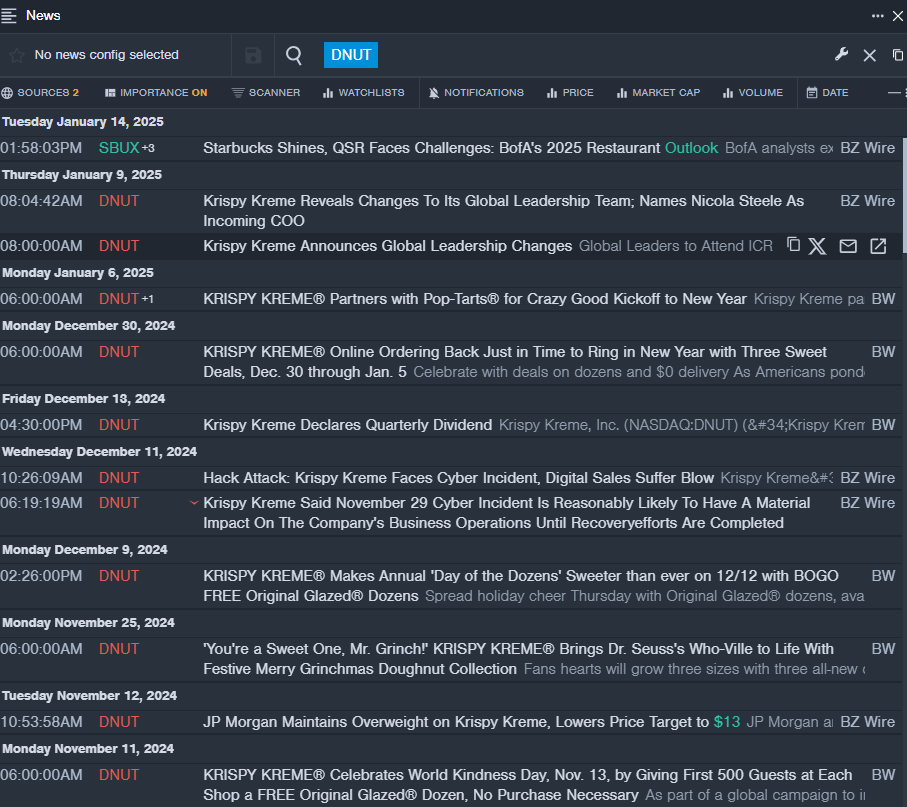

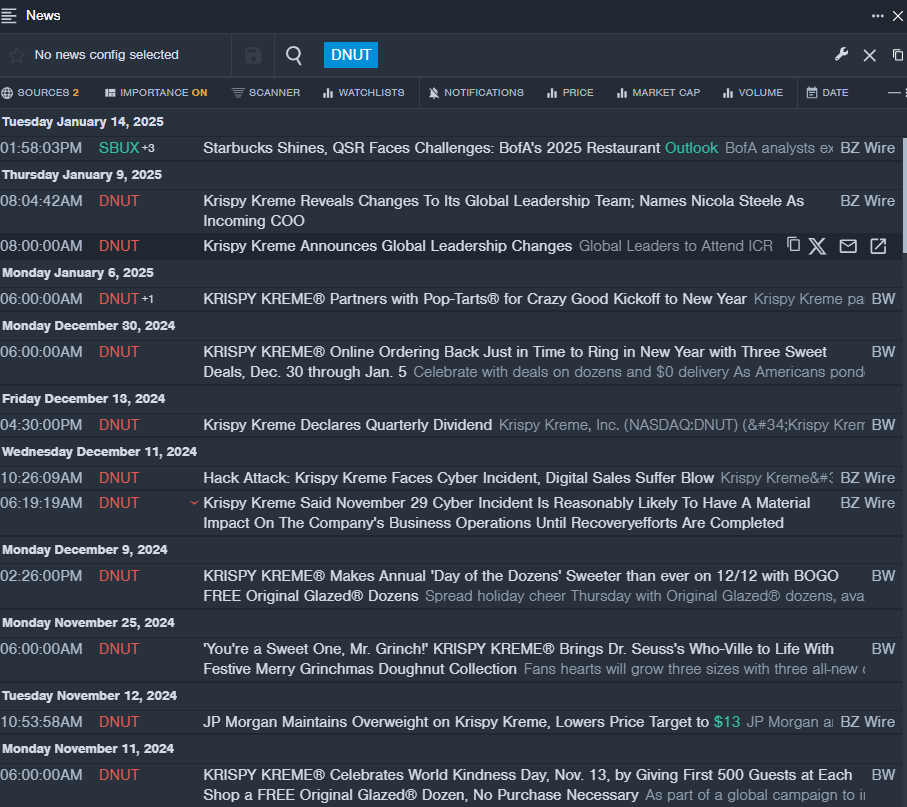

Krispy Kreme Inc DNUT

- Krispy Kreme recently announced new leadership appointments, naming Nicola Steele as the Chief Operating Officer on January 9. CEO Josh Charlesworth emphasized the team’s experience and vision for the brand, stating, “These leadership changes will result in both a bigger and better Krispy Kreme.” Despite the positive outlook, the stock has decreased nearly 7% over the past month, falling to a 52-week low of $8.78.

- RSI Value: 27.3

- DNUT Price Action: Krispy Kreme shares dipped 0.6%, closing at $8.94 on Wednesday.

- Real-time alerts from Benzinga Pro have provided updates on DNUT activities.

Wendy’s Co WEN

- Wendy’s is set to release its fourth quarter and full-year 2024 results on February 13, 2025. The fast-food chain’s stock has recently dropped about 10%, reaching a 52-week low of $14.74.

- RSI Value: 23.9

- WEN Price Action: Shares of Wendy’s closed at $15.13 on Wednesday.

- Benzinga Pro’s charting tools have been instrumental in tracking WEN’s trends.

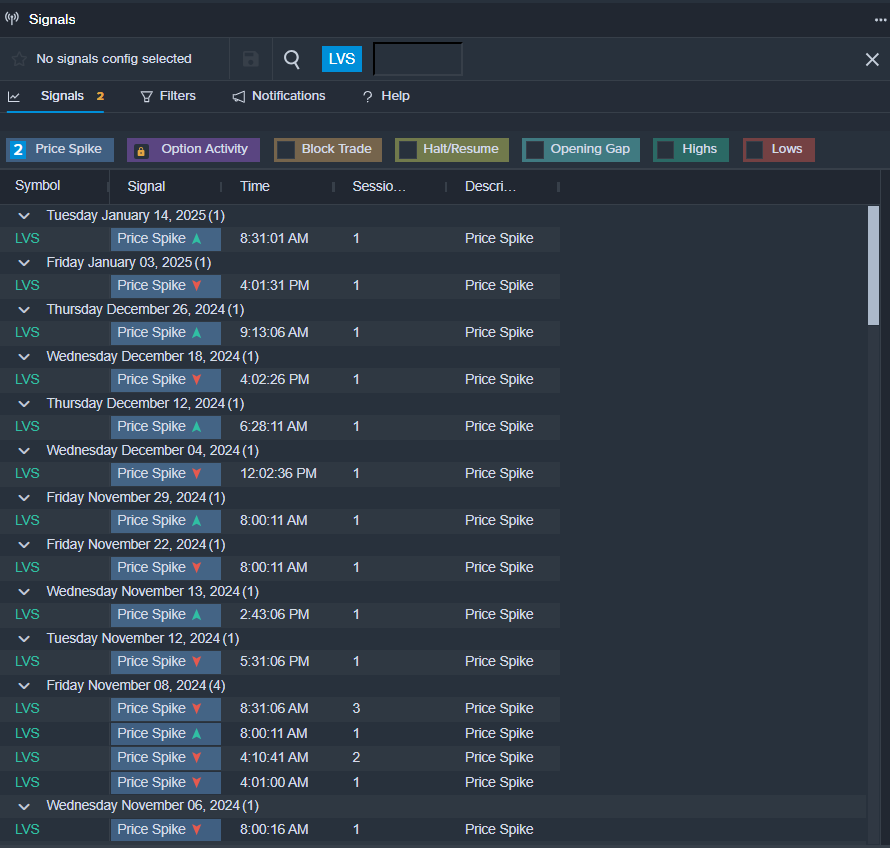

Las Vegas Sands Corp. LVS

- Morgan Stanley downgraded Las Vegas Sands stock on January 14, shifting its rating from Overweight to Equal-Weight and adjusting the price target from $53 to $51. This comes as the stock decreased roughly 16% in the past month, hitting a 52-week low of $36.62.

- RSI Value: 23.5

- LVS Price Action: Shares of Las Vegas Sands ended the day down 1.8%, closing at $44.20 on Wednesday.

- Benzinga Pro also highlighted a potential breakout for LVS shares.

Read This Next:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs