Kratos Defense: A Compelling Investment in the Aerospace Defense Sector

Kratos Defense & Security Solutions, Inc. (KTOS) presents a strong investment opportunity in the Zacks Aerospace Defense Equipment industry, buoyed by rising earnings estimates, low debt levels, ample liquidity, and an expanding backlog.

Here’s a closer look at why this Zacks Rank #2 (Buy) stock is worth considering now.

Growth Projections and Earnings Surprises for KTOS

The Zacks Consensus Estimate for KTOS’ 2025 earnings per share (EPS) recently climbed 3.5% to 59 cents over the last three months, suggesting a 27.9% increase compared to last year’s estimate. Additionally, total revenue forecasts for 2025 stand at $1.28 billion, indicating a 12.2% growth from 2024 projections. Remarkably, Kratos has posted an average earnings surprise of 70.63% in the past four quarters, showcasing its strong performance.

Understanding KTOS’ Debt Position

Kratos Defense maintains a total debt-to-capital ratio of 11.65%, significantly lower than the industry average of 54.03%. Its times interest earned (TIE) ratio stood at 4.9 at the end of the third quarter of 2024, signaling a robust capacity to meet interest payment obligations in the near future.

Evaluating KTOS’ Liquidity

At the conclusion of the third quarter of 2024, Kratos Defense boasted a current ratio of 3.22, well above the industry average of 1.43. This solid ratio affirms the company’s ability to cover its short-term liabilities comfortably.

Rising Backlog of KTOS

As of September 29, 2024, Kratos’ backlog reached an impressive $1.29 billion, marking an 11.1% increase from the same quarter last year. This growth in backlog enhances the company’s revenue potential for upcoming quarters. KTOS anticipates recognizing about 19% of this backlog as revenue in 2024, with an estimated 50% in 2025, and the remainder thereafter.

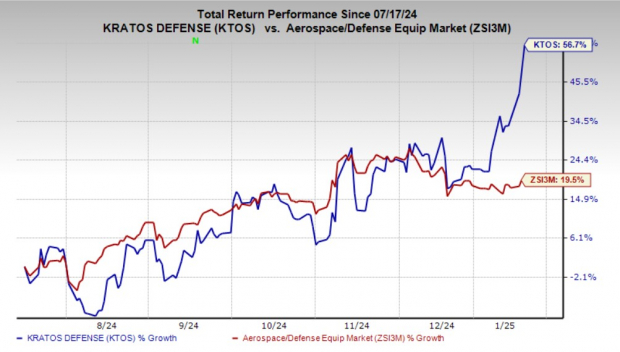

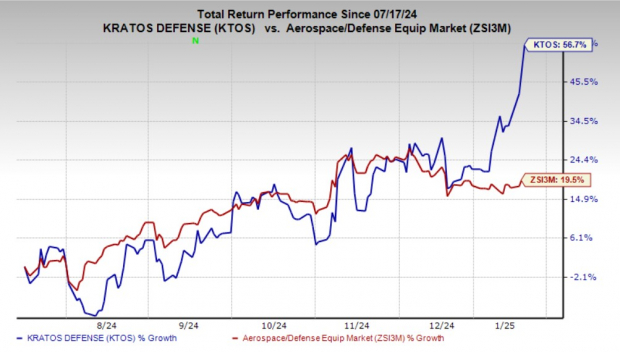

Price Movement of KTOS Stock

Over the past six months, KTOS shares have surged by 56.7%, significantly outpacing the industry growth of 19.5%.

Image Source: Zacks Investment Research

Additional Stocks to Explore

Other noteworthy stocks in the same sector include Mercury Systems (MRCY), AAR Corp. (AIR), and Leonardo DRS, Inc. (DRS). Currently, Mercury Systems boasts a Zacks Rank #1 (Strong Buy), while AAR Corp. and Leonardo hold a Zacks Rank of 2. You can find the full list of Zacks #1 Rank stocks here.

Mercury Systems projects a long-term earnings growth rate of 13.2%. The consensus estimate for MRCY’s fiscal 2025 sales is $848.9 million, reflecting a 1.6% increase year-over-year.

AAR Corp. reported an average earnings surprise of 3.90% over the last four quarters, with the Zacks Consensus Estimate for AIR’s fiscal 2025 sales projected at $2.76 billion, indicating an 18.9% year-over-year growth.

Leonardo DRS also showed strong past performance, with an average earnings surprise of 22.27%. The sales consensus estimate for DRS in 2025 is approximately $3.43 billion, showing a 7.4% increase compared to last year.

The Next Big Semiconductor Stock

Zacks has identified an emerging semiconductor stock that could rival the impressive gains of NVIDIA, which skyrocketed over 800%. This new stock is well-positioned to capitalize on growing demands in Artificial Intelligence, Machine Learning, and the Internet of Things. Forecasts suggest global semiconductor manufacturing could surge from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Today for Free >>

AAR Corp. (AIR): Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS): Free Stock Analysis Report

Mercury Systems Inc (MRCY): Free Stock Analysis Report

Leonardo DRS, Inc. (DRS): Free Stock Analysis Report

Read this article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.