Why Dell Technologies Inc. Is Emerging as a Strong Investment Choice

In today’s fast-evolving technology landscape, Dell Technologies Inc. DELL has often been overshadowed by the rapid developments in quantum computing and artificial intelligence (AI). However, the recent movements in Dell’s stock suggest it’s time for investors to take another look.

While other companies capture headlines, Dell is positioning itself as a key player in the generative AI sector by providing critical infrastructure for AI model development, training, and deployment. CEO Michael Dell has noted that the pace of innovation, particularly in machine intelligence, is accelerating more swiftly than past technological revolutions.

Solid Financial Performance Underpins Growth

Dell’s financial results have shown consistent strength. In recent quarters, the company has frequently surpassed its earnings-per-share targets. Although there have been occasional misses in revenue, the general trend has remained positive, inspiring confidence among long-term investors.

Interestingly, Dell has recently experienced atypical options activity, with a surge in bearish transactions noted in the derivatives market. Nonetheless, most of these trades are set to expire soon, which may clear the way for a more positive stock performance.

Statistical Trends Favor a Positive Outlook

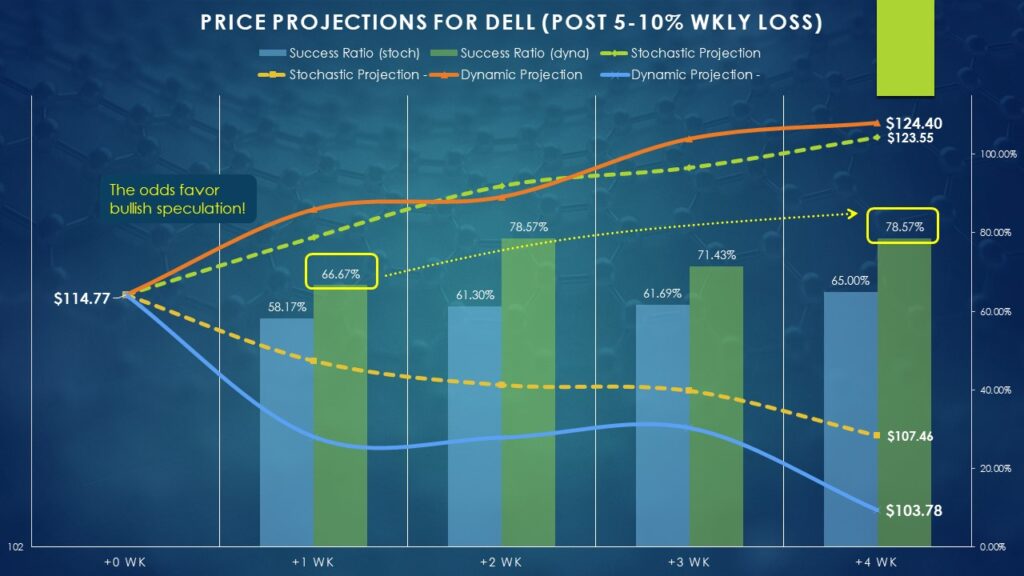

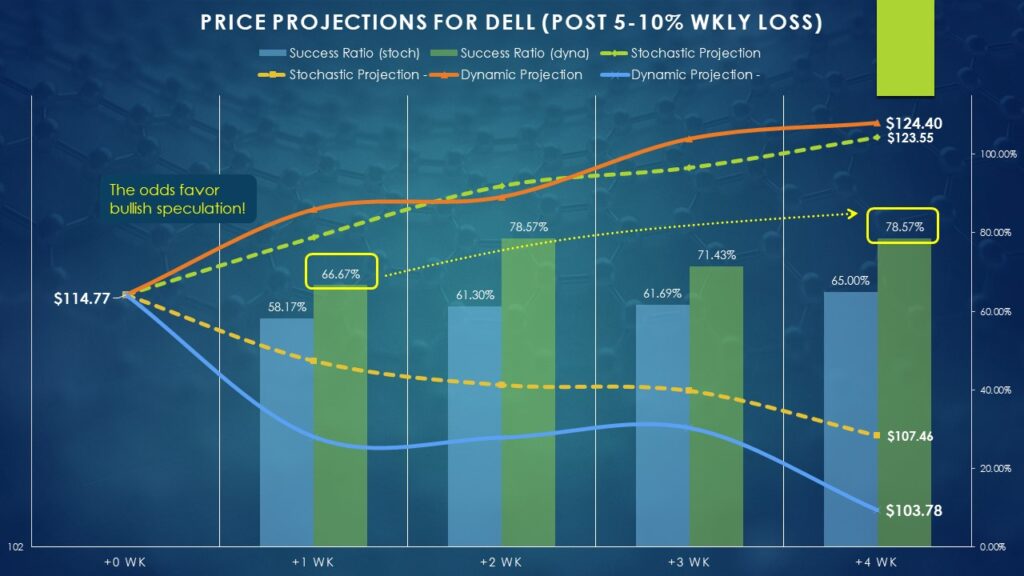

One compelling reason to consider investing in Dell lies in its historical performance. Over the past five years, Dell’s stock has earned profits in 169 out of 260 four-week periods, equating to a 65% chance of profitability if a long position is held for about a month.

Investors can gain more insights by employing dynamic probability assessment methods, which analyze how the stock reacts to significant market movements. For instance, during the week ending January 10, Dell’s stock fell by 5.78%. Yet, historically, such downturns have correlated with recoveries; in 78.57% of similar situations, the stock rebound occurred within four weeks.

Technical analysis further supports the bullish outlook for Dell stock, as it appears to be forming a bullish pennant pattern—a sign of potential upward movement after a period of consolidation.

Investment Strategies for Dell Technologies

Given the robust fundamentals, one straightforward strategy for investing in Dell is to purchase shares directly in the market. Market analysts suggest that generative AI could contribute as much as $1 trillion to the U.S. economy, hinting towards significant growth potential for Dell.

Alternatively, options trading can offer leveraged opportunities for those interested in short-term strategies. Traders might consider executing a bull call spread, which involves buying a call option while simultaneously selling a call at a higher strike price, all with the same expiration date.

This strategic approach aims for the underlying stock to reach or surpass the short strike price. While the sold call caps the potential gains, the funds received offset some costs of the purchased call, creating a net-long position.

Statistically, four weeks following declines between 5% to 10%, positive outcomes occur around 79% of the time, with a median return of 8.39%. With Dell’s last closing price at $114.77, projections suggest it might reach around $124.40 before the expiration of the options chain on February 7.

For more aggressive traders, considering bull call spreads with a short strike of $124 could be advantageous. As of now, the best payout strategy appears to be a 120/124 call spread—buying the $120 call and selling the $124 call simultaneously.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.