“`html

Top 5 Stocks to Watch: Promising Upside and Strong Earnings

Key Highlights

- These stocks are valued at over $35 billion, each with positive earnings per share (EPS) forecasts.

- We anticipate significant price increases, with strong buy ratings for these stocks.

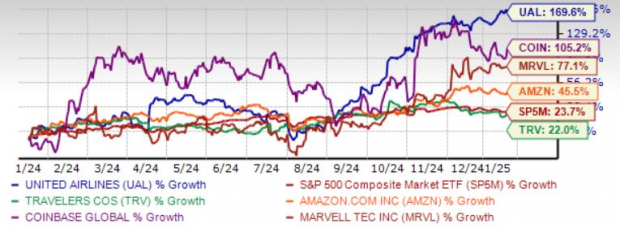

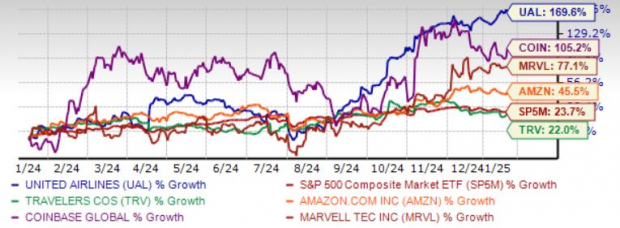

- Last year, shares of Amazon, Marvel, Travelers Companies, and United Airlines surged between 22% and 169%.

Over the past two years, U.S. stock markets have experienced remarkable growth. However, since mid-December, Wall Street has faced renewed volatility. The much-anticipated Santa Claus rally for the 2024-25 fiscal year has not yet occurred, resulting in fluctuating markets as the year unfolds.

A range of U.S. stocks have soared in value over the past two years, with several having seen favorable earnings estimate revisions in the last month. Following this trend, investing in these stocks appears promising, as positive revisions and strong performance indicators suggest continued momentum in the near future.

The five notable stocks include: Amazon.com Inc. AMZN, Coinbase Global Inc. COIN, Marvell Technology Inc. MRVL, The Travelers Companies Inc. TRV, and United Airlines Holdings Inc. UAL.

Investing in Five Major Players with Strong EPS Growth

We have identified these five companies based on four criteria: they possess a market capitalization exceeding $35 billion, indicating strong brand value and financial stability. Furthermore, each stock has seen positive EPS revisions in the last month, along with significant short-term price upside potential. Each of these picks boasts a Zacks Rank of #1 (Strong Buy), noting their investment potential.

Below, you can see the price performance of these five picks over the past year.

Image Source: Zacks Investment Research

Amazon.com Inc.

Amazon.com continues to thrive due to the growth of Prime and AWS services. Projections suggest that net sales will rise by 10.7% in 2024 compared to 2023. A variety of factors, such as the robust AWS services and improved delivery options, contribute positively to its performance.

Additionally, Amazon’s strengthened partnerships with third-party sellers and a successful advertising business bolster its growth. Their expanding presence in sectors like grocery, pharmacy, healthcare, and autonomous driving, along with a focus on generative AI, are also pivotal for future success.

Positive Earnings Estimate Revisions for AMZN

Amazon is expected to see a revenue growth rate of 10.9% and earnings growth of 19.7% in the current fiscal year. The Zacks Consensus Estimate indicates a 0.2% increase in the expected earnings over the past week.

Currently, the average short-term price target from analysts suggests an increase of 14.6% from the last closing price of $223.35, with targets ranging from $197 to $290. This reflects a possible upside of 29.8% and a potential downside of 11.8%.

Coinbase Global Inc.

Coinbase Global provides essential technology and infrastructure for the cryptocurrency economy both in the U.S. and abroad. By offering a primary financial account for consumers, a liquidity pool for institutions, and development tools for crypto-based applications, Coinbase solidifies its position in the market.

Its user-friendly platform appeals to new investors while offering advanced features for seasoned users, including trading and earning mechanisms for holding cryptocurrencies.

Strong Earnings Estimate Revisions for COIN

Coinbase boasts a return on equity (ROE) of 14.81%, outperforming the industry average of 12.92% and the S&P 500’s ROE of 16.84%. The current net margin stands at 29.76%, significantly higher than the industry’s 4.90% and the S&P 500’s 12.45%.

Brokerage firms estimate an average short-term price target that reflects a 15.5% increase from the last closing price of $274.93, with a target range between $185 and $420. This shows a maximum potential upside of 52.7% while indicating a downside risk of 32.7%.

Marvell Technology Inc.

Marvell Technology is leveraging strong demand in the data center market, with revenues in this segment increasing by 98% year-over-year and 25% sequentially. This growth is supported by high demand for AI-driven products and solid-state drives.

As a key player in the storage market, Marvell stands to benefit from rising data volumes and ongoing advancements in enterprise networking and carrier infrastructure.

Promising Earnings Estimate Revisions for MRVL

Marvell Technology anticipates revenue and earnings growth rates of 40.3% and 72.8%, respectively, for the upcoming year ending January 2026. Over the past 30 days, the Zacks Consensus Estimate for the company’s earnings has increased by 0.4%.

The average short-term price target from analysts suggests a 10% increase from the last closing price of $116.

“`

Financial Growth Prospects for Top Companies: Analyzing Travelers and United Airlines

Travelers Companies: Steady Performance Amidst Market Stability

The Travelers Companies Inc. is a strong player in the auto and homeowners’ insurance as well as in the commercial U.S. property-casualty insurance sectors. The company’s growth stems from a high retention rate and an increase in new business, reflecting positively on its renewal premium changes. As market conditions remain stable, TRV’s commercial divisions are expected to thrive.

Optimism surrounds TRV’s personal lines of business, largely thanks to expanding profitable agencies in the auto and homeowners sectors. The company’s growing fixed-income portfolio will likely enhance net investment income, further supporting shareholder value. TRV aims for a mid-teens core return on equity as a long-term goal.

Positive Earnings Outlook for Travelers

Expected revenue and earnings growth rates for The Travelers Companies stand at 7.5% and 8.7%, respectively, this year. Over the past month, the Zacks Consensus Estimate for current-year earnings has risen by 0.2%.

Brokerage firms suggest a short-term price target that reflects a 13.2% increase from the last closing price of $239.98. Current estimates for the target price range from $203 to $310, indicating a maximum potential upside of 29.2% and a downside of 15.4%.

United Airlines: Capitalizing on Travel Demand

United Airlines Holdings Inc. continues to experience growth, driven by increased passenger volumes. The company’s ability to harness strong corporate travel and rising premium leisure demand is central to its success. Benefiting from low fuel costs, UAL’s financial performance is showing signs of improvement. Additionally, the announcement of a $1.5 billion share buyback plan marks UAL’s first buyback since the pandemic, underscoring its commitment to shareholders.

Earnings Prospects for United Airlines Soar

Projected revenue and earnings growth rates for United Airlines reveal figures of 6.5% and 21.5%, respectively, for this year. In the past week, the Zacks Consensus Estimate for current-year earnings has improved by 4.5%.

The average short-term price target designated by brokerage firms indicates a potential increase of 16.6% from UAL’s last closing price of $104.96. The current target price range spans $75 to $150, showcasing the potential for a maximum upside of 42.9% and a downside of 28.6%.

Zacks Highlights a Top Semiconductor Stock

In a competitive market, Zacks has identified a leading semiconductor stock that’s just a fraction of the size of NVIDIA. While NVIDIA has seen remarkable growth since its recommendation, this new stock has significant potential for expansion.

As demand surges for Artificial Intelligence, Machine Learning, and the Internet of Things, this stock is well-positioned to benefit. Projections show global semiconductor manufacturing will rise dramatically from $452 billion in 2021 to an estimated $803 billion by 2028.

Want to see Zacks’ latest stock recommendations? You can download the 7 Best Stocks for the Next 30 Days for free. Click to access this helpful report:

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.