General Motors Strengthens EV Supply Chain: Is it Time to Invest?

General Motors (GM), a leading U.S. automaker, is enhancing its supply chain to support the growing production of electric vehicles (EVs). Recently, GM entered into a partnership with Vianode, a synthetic graphite manufacturer from Norway, to strengthen its battery supply chain.

Building Strategic Partnerships for EV Success

In today’s world, where supply chain challenges can derail production, GM is focused on resilience. Lessons from the COVID-19 pandemic highlighted the necessity of having diverse and reliable supplier relationships; GM has taken this to heart. By fostering long-term partnerships and collaborating directly with suppliers, the automaker is better equipped to handle market fluctuations.

A notable recent move is GM’s multi-billion-dollar agreement with Vianode, which guarantees a consistent supply of anode materials for its battery cells created with LG Energy Solution. This deal, set to begin in 2027, underscores GM’s commitment to a localized and sustainable battery supply chain in North America while working towards its electrification goals.

Additionally, GM’s joint venture with Lithium Americas (LAC) at the Thacker Pass lithium project highlights its dedication to securing key raw materials. With significant lithium reserves in the U.S., GM invested $625 million to hold a 38% stake in this crucial project, aimed at satisfying the increasing demand for EVs.

Long-term agreements with LG Chemical, POSCO Chemical, and Livent guarantee a reliable flow of essential materials like lithium, nickel, cobalt, and cathode active materials for battery production. The longstanding relationship with LG Energy Solution has also progressed to include advanced prismatic cell technology, boosting battery efficiency and variety. Their joint venture has established significant battery manufacturing capacities in Ohio and Tennessee.

To improve the charging experience for consumers, GM has integrated Tesla’s (TSLA) Supercharger network and is collaborating with EVgo (EVGO) to place fast-charging stations in urban areas. These initiatives support GM’s vision of an all-electric future.

GM Maintains Market Leadership

General Motors continues to be the top-selling automaker in the United States. With a strong demand for its quality pickups and SUVs, GM sold 2.7 million vehicles in 2024, marking a 4.3% year-over-year increase, with all four brands — Chevrolet, GMC, Buick, and Cadillac — experiencing growth.

In terms of electric vehicle sales, GM ranked second in U.S. battery electric vehicle sales in 2024, following Tesla, which holds 50% of the market. GM’s EV sales reached 114,000 in 2024, up 50% from 2023. Its diverse lineup, including the Chevy Equinox EV, Cadillac Lyriq, and GMC Hummer EV, anchors its position as the second-largest EV seller in the country.

Cost Discipline and Financial Strength Play a Key Role

GM’s commitment to controlling costs and ensuring financial health is promising for its future. Its $2 billion cost-reduction program aims for completion by the end of 2024.

Further supporting GM’s stability is its balance sheet, showing total automotive liquidity of $40.2 billion as of September 30, 2024, including $23.7 billion in cash. This liquidity positions the company to endure broader economic challenges.

To enhance shareholder value, GM has initiated a share buyback program, repurchasing $1 billion last quarter and planning to retire an additional 25 million shares by year’s end, indicating management’s positive outlook.

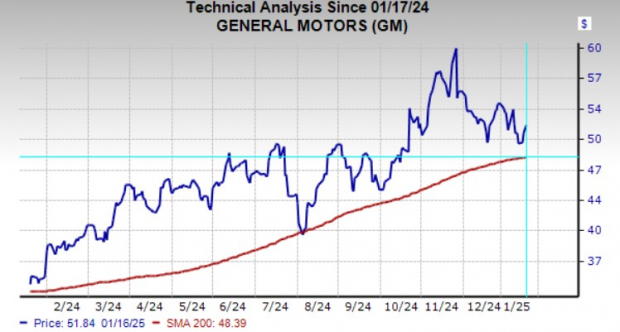

Stock Performance & Valuation Insights

GM’s stock has risen 50% over the past year, outperforming both its industry peers and the overall market.

1 Year Price Performance

Image Source: Zacks Investment Research

Currently, the stock is trading above its 200-day moving average, a sign of strong investor confidence.

Image Source: Zacks Investment Research

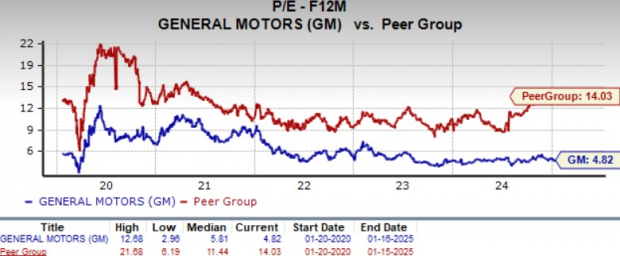

In terms of valuation, GM stands out with a forward price-to-earnings ratio of 4.82, significantly lower than its peers, indicating strong upside potential for value investors. The stock holds a Value Score of A.

Image Source: Zacks Investment Research

Is GM a Strong Buy?

General Motors’ solid presence in the U.S. auto market, strict cost controls, and commitment to EVs position it well for future growth. The company’s initiatives to strengthen its supply chain and broaden its EV offerings signal a promising outlook. Analysts expect a 4% year-over-year growth in GM’s 2025 EPS, with recent estimates rising by 14 cents over the last 60 days, showcasing optimism.

Ultimately, GM stock combines value, growth potential, and resilience. As the automaker accelerates its push into the EV market, now could be a strategic time to consider GM for your investment portfolio.

With a Zacks Rank #1 (Strong Buy), GM represents a noteworthy opportunity for investors. You can view the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been incredibly successful. From inception in 2012 through November 2024, the Zacks Top 10 Stocks gained +2,112.6%, far surpassing the S&P 500’s +475.6%. After reviewing 4,400 companies, Sheraz has selected the 10 best options to buy and hold in 2025. Be among the first to explore these newly released stocks with exceptional potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Lithium Americas Corp. (LAC): Free Stock Analysis Report

EVgo Inc. (EVGO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.