Nvidia: The AI Stock to Watch as Demand Surges

Selecting a single artificial intelligence (AI) stock can be challenging. With numerous investment options available, each has its advantages. Furthermore, concentrating your investments in one company could mean missing out on significant trends like AI if that choice falters. This article delves into my top AI stock pick and its potential for growth, particularly during market downturns.

Why Nvidia Stands Out in the AI Market

If I were limited to one AI stock, it would likely be Nvidia (NASDAQ: NVDA). My top reason is simple: Nvidia is already profiting from the AI trend.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Nvidia’s Continued Growth into 2025

Many leading AI companies have cautioned that substantial profits from their generative AI technologies may take years to materialize. Given the significant investments flowing into this sector, such news is concerning for investors. So, where does this money go?

To Nvidia.

While Nvidia doesn’t capture all investment funds, it commands a significant portion. Nvidia’s GPUs (graphics processing units) are essential for AI companies developing advanced AI models. These GPUs excel at performing multiple calculations simultaneously, allowing faster data processing compared to standard CPUs. They can also be linked together to enhance computing power.

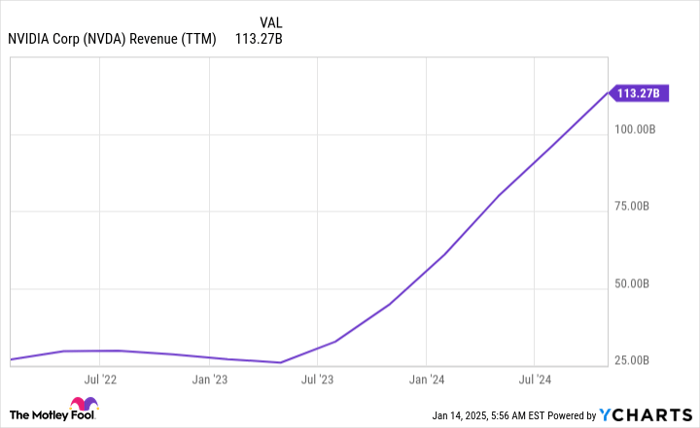

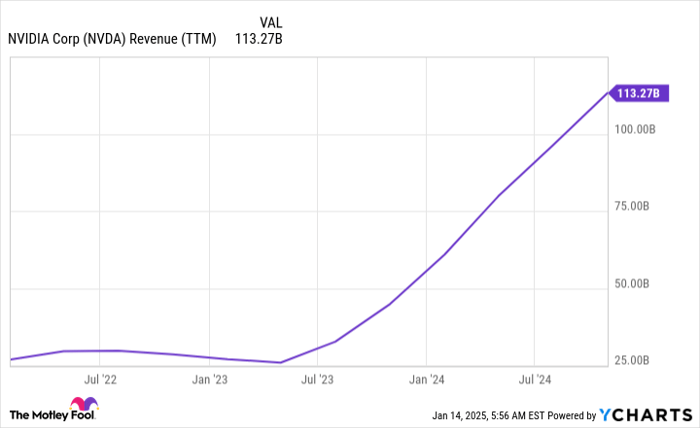

Given Nvidia’s dominance in GPUs and software, it’s not surprising that the company has captured a substantial share of the AI computing market. A quick glance at its revenue growth over the last two years illustrates this point.

NVDA Revenue (TTM) data by YCharts

Despite impressive revenue growth, the demand for AI computing is still rising. AI hyperscalers like Meta Platforms have indicated that their spending on computing infrastructure will see a significant jump by 2025. Cloud providers concur that increasing demand will necessitate further investments in computing capabilities.

These factors suggest that Nvidia’s revenue growth will persist in the coming years, a positive trend for shareholders. However, competition remains a challenge. As AI models become easier to develop, companies may shift toward more affordable CPUs for AI inferencing, a task that demands less computing power than Nvidia’s GPUs.

Moreover, several cloud and AI hyperscaler companies have introduced their proprietary GPU versions, eliminating the need to pay Nvidia. Although these custom GPUs have specific applications, Nvidia’s GPUs are far superior for broader training tasks due to their versatility.

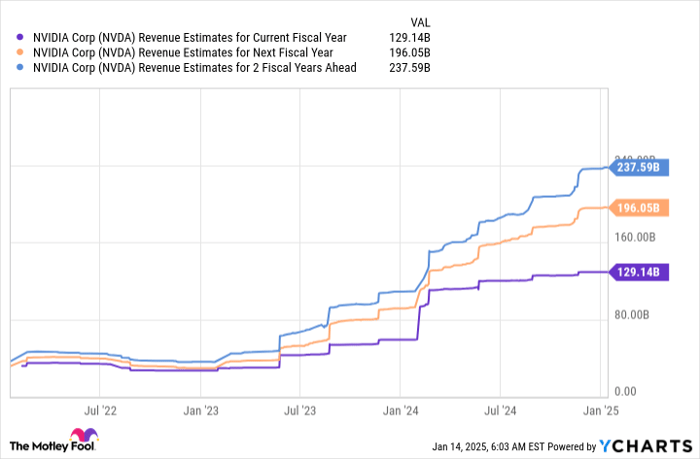

In conclusion, while Nvidia’s growth is not over, the company may face increased challenges going forward. Nevertheless, Wall Street analysts maintain optimistic growth forecasts.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

Revenue is projected to rise by 52% in FY 2026, suggesting ample growth opportunity for Nvidia, as long as investors can purchase it at a reasonable price.

Nvidia’s Stock Valuation Compared to Other Tech Giants

Considering Nvidia’s substantial stock growth, it’s natural to think the stock may be overpriced. However, when growth metrics are included, the valuation appears more reasonable.

Nvidia currently trades at 52 times earnings, a fair price for such rapid growth. When we look at estimates, Nvidia is valued at under 30 times FY 2026 earnings. This makes the stock seem more appealing, especially after a recent price adjustment.

Nvidia has proven to be one of the leading AI stocks over the past two years, with prospects of continued success into 2025. As AI technology matures, the demand for Nvidia’s GPUs is likely to grow significantly, positioning the stock for further appreciation in value.

Is Nvidia a Smart Investment for $1,000 Today?

Before making a decision, consider the following:

The Motley Fool Stock Advisor analyst team has chosen what they recognize as the 10 best stocks to invest in right now, and Nvidia was notably absent from that selection. These 10 stocks are expected to generate impressive returns in the coming years.

Reflect on the fact that Nvidia was included in this list back on April 15, 2005… if you invested $1,000 then, you could have turned it into $818,587!*

Stock Advisor offers investors a clear strategy for success, featuring advice on portfolio building, regular analyst updates, and two new stock recommendations each month. The service has significantly outperformed the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Randi Zuckerberg, a former director of marketing development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Keithen Drury has positions in Nvidia. The Motley Fool has investments in and recommends Meta Platforms and Nvidia. For further details, please refer to The Motley Fool’s disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.