The Uncertain Future of AI Stocks: Evaluating 2024’s Performance

In 2024, artificial intelligence (AI) was predicted to dominate the market. However, while some AI stocks performed well, the results were not as consistent as expected. For investors considering AI-based exchange-traded funds (ETFs), beating market returns proved challenging.

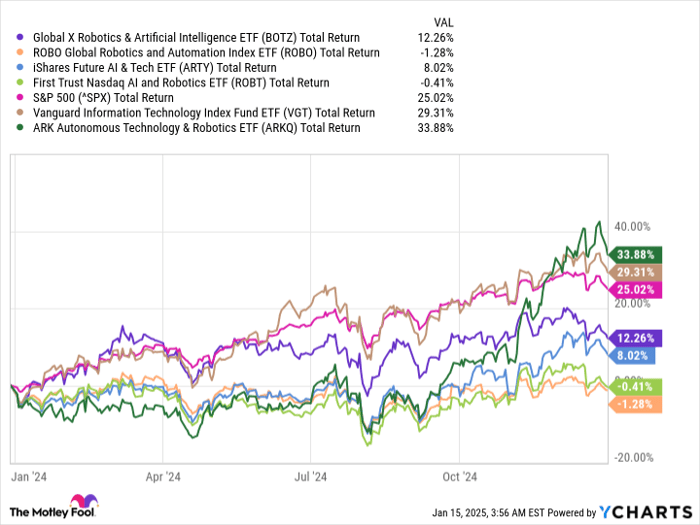

Take a look at the performance of popular AI-based ETFs: the Global X Robotics and AI ETF, the Robo Global Robotics and Automation Index ETF, the iShares Future AI and Tech ETF, the First Trust Nasdaq AI and Robotics ETF, the Vanguard Information Technology ETF, and the ARK Autonomous Technology and Robotics ETF. Comparing these to the S&P 500 gives a clearer picture of their performance:

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. See the 10 stocks »

BOTZ total return level, data by YCharts.

Looking ahead, investors should choose AI stocks with caution. It’s wise to diversify by balancing investments in AI with other kinds of stocks. If ETFs are your preference, select those with broad exposure or combine a few different types to manage risk and increase potential returns.

Some of the top AI picks for 2025 include Nvidia (NASDAQ: NVDA), Palantir Technologies (NASDAQ: PLTR), Taiwan Semiconductor Manufacturing (NYSE: TSM), Amazon (NASDAQ: AMZN), and Broadcom (NASDAQ: AVGO).

1. Nvidia: Beyond Generative AI

Known as the go-to stock for AI, Nvidia holds a significant share of the graphics processing unit (GPU) market essential for generative AI. Some analysts estimate its market share at about 95%, although competition is increasing.

Nvidia remains a strong player. Its market position is stable for the foreseeable future, and the company is also branching into new sectors with innovative technologies.

Even before the rise of generative AI, Nvidia was already well-established for providing chips to the gaming industry, proving its value beyond just one technology.

2. Palantir: AI Solutions for Large Organizations

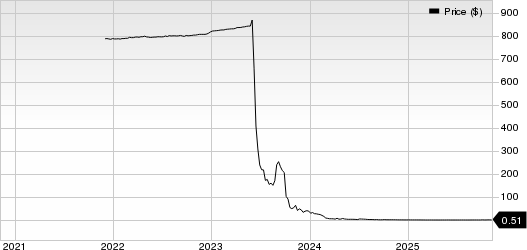

Once a dark horse, Palantir has recently surged in prominence after launching its AI Platform (AIP) in 2023. The company specializes in helping large entities, including governments, manage and analyze vast datasets to uncover insights.

Sales have skyrocketed, rising 44% in the third quarter of 2024 as Palantir secured 104 new contracts. Despite its stock climbing 340% last year and becoming pricey, its growth opportunities in 2025 remain promising.

3. Taiwan Semiconductor: The Chipmaker for AI

Taiwan Semiconductor is a leading manufacturer of various semiconductors and GPUs, working with major chip designers like Nvidia who depend on these foundries for production.

While its chips serve various industries, the current demand for AI provides an impressive opportunity. Even as new competitors arise, the need for semiconductor production will persist, ensuring Taiwan Semiconductor’s relevance in the tech space.

As generative AI demand continues to grow, Taiwan Semiconductor is poised for excellent performance in 2025.

4. Amazon: Practical AI for Businesses

Amazon is developing generative AI tools for a variety of businesses. Through Amazon Web Services (AWS), the company has introduced a suite of services tailored for cloud clients, featuring different programming layers for developers.

This multi-tier structure includes tools for creating custom large-language models (LLMs) and pre-built solutions for small enterprises. Management believes the potential for growth in Amazon’s generative AI services is just beginning.

5. Broadcom: The Glue for AI Components

Broadcom is transforming its business to capitalize on AI opportunities. By providing the necessary semiconductors and infrastructure, it enables the connection between software and hardware, crucial for AI performance.

Broadcom is attractive not only for its potential in AI but also for its diversified business that remains robust even if AI trends shift.

Take Advantage of a Second Chance to Invest

Feeling like you missed out on major stock opportunities? Now could be your chance.

Our team occasionally issues “Double Down” stock recommendations for companies expected to experience significant growth. If you worry about missing your chance, consider investing now. Here are some historical returns:

- Nvidia: Invested $1,000 in 2009 would now be worth $357,084!

- Apple: Invested $1,000 in 2008 would now be worth $43,554!

- Netflix: Invested $1,000 in 2004 would now be worth $462,766!

Currently, we’re issuing “Double Down” alerts for three promising companies, potentially presenting a rare investment opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, Palantir Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.