Nu Holdings: Disrupting Banking in Brazil and Beyond

Nu Holdings (NYSE: NU) is a digital bank that is changing the banking landscape in Brazil. Traditionally, banking options were limited and fees were high, making it difficult for many residents to access financial services. With its fresh approach, Nu has emerged as a leader in the sector and has even attracted investments from Berkshire Hathaway.

Now, Nu is expanding into other important markets in Latin America, such as Mexico and Colombia. Despite its growth, the company faces challenges, particularly with rising credit concerns. Recently, Berkshire Hathaway reduced its stake in the company, leading to a 29% drop from its 52-week high.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy today. See the 10 stocks »

With shares trading below $14, is it time to consider investing in Nu Holdings?

Revolutionizing Banking for Millions in Brazil

For years, many Brazilians lacked access to any banking services due to the concentration of power among five major banks, which controlled 80% of the country’s financial assets. This oligopoly charged high fees, with credit card interest rates reaching an astonishing 160% and personal loans at 100% just five years ago.

Recognizing this issue, Nu Holdings co-founder and CEO David Vélez aimed to provide a solution. Roadblocks were lifted by regulatory changes that allowed Nu to shake up the traditional banking environment.

The company created a digital-only banking model that eliminates physical branches. With lower operational costs, Nu offers free accounts and credit cards without annual fees, making banking affordable for millions.

Since its inception, Nubank’s customer base skyrocketed from 24 million in 2020 to nearly 99 million, encompassing more than 56% of Brazil’s adult population. Over the past years, the number of unbanked Brazilians fell from 16.3 million to 4.6 million, representing about 3% of the adult population.

Image source: Getty Images.

Growing Across Latin America

Nu is poised for further growth as it targets expansion in Latin America. By moving into Mexico and Colombia, it taps into two of the region’s largest economies.

In the third quarter, Nu’s customer count reached 2 million in Colombia and 8.9 million in Mexico, marking significant growth of 150% and 106% from the previous year, respectively. Recent figures from Susquehanna Financial Group indicate that 51% of Mexico’s population, about 66 million people, remains unbanked, presenting a major opportunity for Nu.

The company has seen impressive financial results, achieving seven consecutive quarters of net income growth. In Q3 alone, profits hit $553 million, an impressive 82% increase compared to the previous year and a 13.5% rise from the last quarter.

Investor Anxiety Over Credit

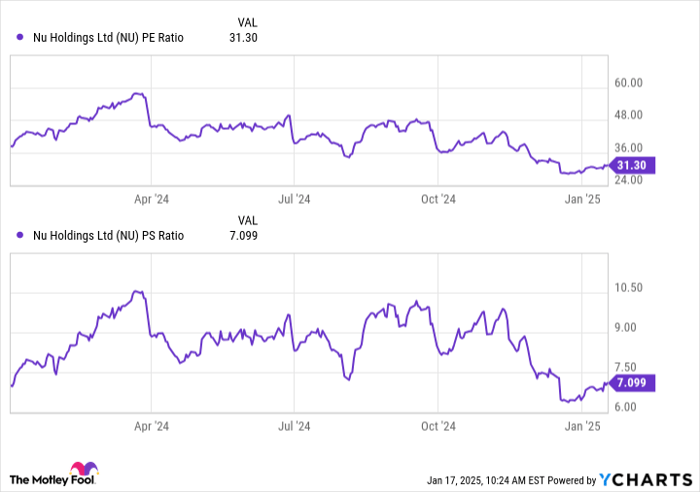

Despite soaring growth, Nu Holdings has seen its stock drop 29% recently. Although the company is succeeding, some investors worry that its stock had soared too quickly. As of late October 2024, prior to the downturn, Nu was trading at around 48 times earnings and over 10 times sales. The current price now stands around 31 times earnings and 7 times sales.

NU PE Ratio data by YCharts. PE = price-to-earnings. PS = price to sales.

Concerns are rising regarding the slowdown in credit card and personal loan activity in Brazil. Notably, the rate of delinquent non-performing loans over 90 days increased to 7.2% from 6.1% a year earlier. Additionally, write-offs surged to $1.6 billion, up from approximately $957.6 million last year.

After a period of strong growth, credit card receivables have also plateaued. Currently, they sit at $15.2 billion, just marginally up from $14.5 billion reported by the end of 2023. In Q3, Berkshire Hathaway trimmed its stake in Nu by 19%, now holding 86.4 million shares.

Future Prospects for Nu

Nu Holdings is exploring new avenues to enhance its market reach. In recent years, it launched services like NuPay, NuTravel, and NuMarketplace. Recently, the company introduced NuCel, a mobile phone service, to diversify its offerings beyond financial services.

This diversified strategy allows Nu to tap into its large customer base in Brazil, building a digital ecosystem that encourages cross-selling. Vélez emphasized: “The opportunity to expand beyond financial services through various verticals is significant.” Ultimately, the goal is to stabilize revenue by minimizing dependency on credit for growth.

Should You Buy This Stock?

Investors should closely monitor Nu’s loan growth and portfolio health. While recent delinquency rates have aligned with management’s expectations, further increases could impact the company financially.

Nu’s rapid growth is compelling, and its potential in untapped markets makes it worth considering. However, its elevated valuation leaves it open to volatility, which may not suit conservative investors. Despite recent declines, for long-term growth investors, Nu could be an attractive buy at this moment.

Is Now the Time to Invest $1,000 in Nu Holdings?

Before investing in Nu Holdings, it’s important to think critically:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to buy now… and Nu Holdings isn’t included. The picks that made the list have the potential for substantial returns in the years ahead.

Consider that when Nvidia was listed on April 15, 2005… if you had invested $1,000 then, you’d be sitting on $843,960!*

Stock Advisor provides a user-friendly strategy for success, featuring guidance on building a portfolio, regular updates from analysts, and monthly stock picks. Since 2002, Stock Advisor has outperformed the S&P 500 by more than four times.*

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Courtney Carlsen currently holds no positions in the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Nu Holdings. Please see our disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.